Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 18, 2015

Low prices help consumers drive global economic growth

Business survey data show the global economic upturn being powered by rising spending by consumers on food and drink, as well as a range of services, while industry generally lags behind. The data therefore provide encouraging signs that subdued inflation and lower oil prices are boosting consumer spending power and sustaining economic recoveries in many countries. However, the data are also a reminder that governments cannot afford to be complacent, as global growth could weaken if inflation or oil prices pick up significantly.

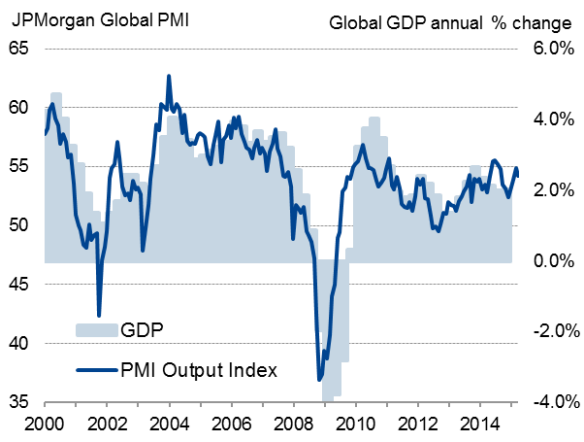

Global economic growth

Food and drink lead global growth rankings

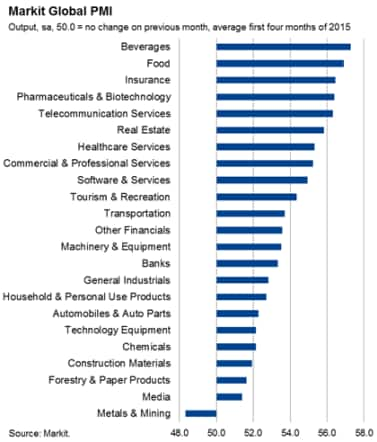

Detailed sector PMI data compiled by Markit show that the global food and drink industries have enjoyed the strongest expansion of output on average so far this year, holding first and second spots out of 23 sectors in the growth rankings.

Other consumer-oriented sectors such as healthcare, real estate, pharmaceuticals, tourism & recreation and certain financial sectors have also fared well.

In contrast, heavy engineering, production of construction materials, basic manufacturing and 'primary' industries such have fared relatively badly. Metals & mining has in fact been in decline on average so far this year, highlighting the ongoing weak state of global industry.

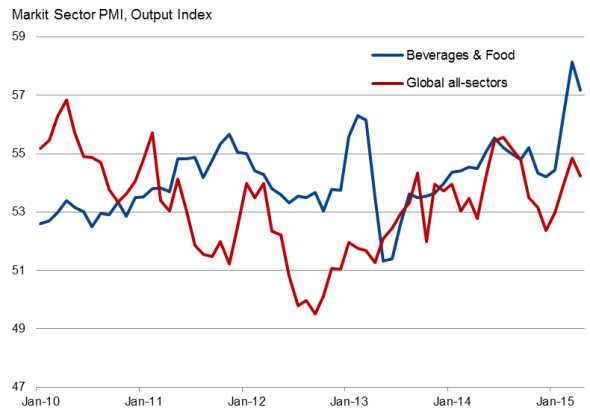

Global food & drink outperforms

Source: Markit. Chart uses three-month average of beverages and food output index to better illustrate data trend.

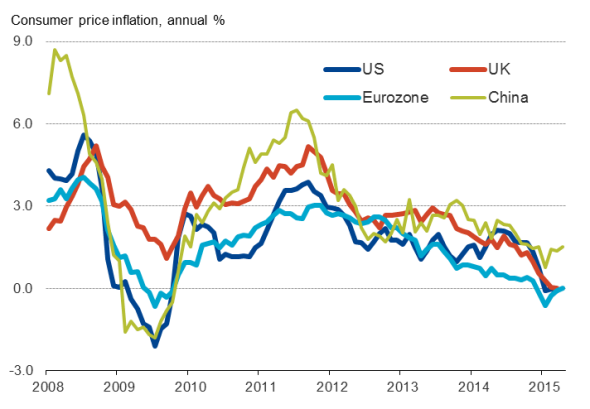

Low prices make up for lack of wage growth

The survey findings add weight to the belief that low inflation is helping boost global growth. Lower oil prices in particular have led to reduced fuel and utility bills, freeing up more household income to spend on other items. With inflation at or near zero in many major economies such as the UK, US and eurozone, real incomes are rising, despite still-weak nominal wage growth.

Low agricultural commodity prices, combined with intense competition among retailers in many countries, have led to an especially steep rise in demand for food products.

The consumer upturn is not limited to the West but also evident in Asia. Markit's newly-launched detailed PMI data for Asia showed consumer services to have been the strongest-growing broad sector in April.

Consumer price indices

Source: Ecowin.

Risks to inflation outlook

Institutions such as the International Monetary Fund have welcomed the stimulus from low inflation as a boon to the global economy as rates of industrial expansion slow in many emerging markets, notably China. Global economic growth is consequently expected to remain resilient in 2015 as consumers act as an important source of demand growth.

There is an inherent danger, however, that the forces currently simulating economic growth could fade or even move into reverse in coming months. Oil prices are showing signs of bottoming out, with Brent Crude prices up from lows of $45 per barrel earlier in the year to close to $70 in recent days, still well below last year's peaks but nevertheless moving upwards and serving as a reminder that low oil prices cannot be relied upon.

The inflationary impact of high oil prices may also be exacerbated by the threat of a new El Ni"o cycle pushing up soft commodity prices later in the year, meaning international food prices could soon start to accelerate in the face of supply concerns.

Although by no means a certainty, the possibility that rising prices could start to subdue consumer spending across the globe later in 2015 means that investors will be keen for policymakers and governments to remain firmly focused on boosting other growth drivers, notably investment, in order to sustain recoveries.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-Economics-Low-prices-help-consumers-drive-global-economic-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-Economics-Low-prices-help-consumers-drive-global-economic-growth.html&text=Low+prices+help+consumers+drive+global+economic+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-Economics-Low-prices-help-consumers-drive-global-economic-growth.html","enabled":true},{"name":"email","url":"?subject=Low prices help consumers drive global economic growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-Economics-Low-prices-help-consumers-drive-global-economic-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Low+prices+help+consumers+drive+global+economic+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-Economics-Low-prices-help-consumers-drive-global-economic-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}