Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 18, 2015

Large caps underperform as dollar advances

The recent US dollar strength has negatively impacted US companies which have large overseas revenue exposure; a trend that has impacted larger firms more than their small cap participants.

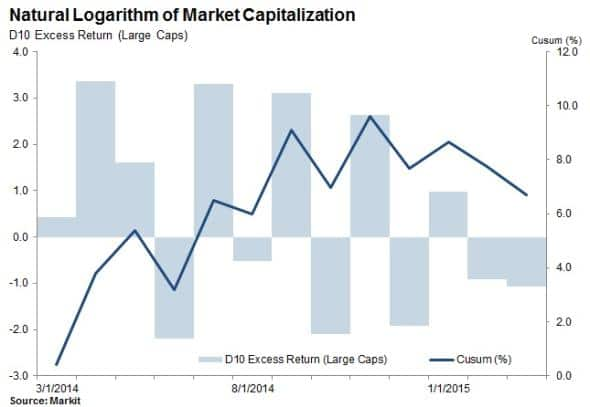

- US Large caps rallied strongly the first half of 2014 outperforming the market by 7.1%

- The last six months have seen large caps lose ground to their smaller peers

- ETF investors have pared back large cap exposure while increasing small cap holdings

Large stocks losing momentum

In the last 12 months the S&P500 has rallied by 12.4%, outperforming the Russell 2000 whose constituents are much smaller. However, a deeper dive into the returns data shows that most of this outperformance was delivered in the six months leading up to September. Analysing the largest 10% of company returns versus the smallest 10%, reveals that over the last six months, the largest companies have underperformed the smallest by 1.7%.

The relative retreat seen in the 10% of largest firms is in stark contrast to prior the six months leading up to September 2014, when the largest companies outperformed by an impressive 15.8%.

Markit's Research Signals Natural Logarithm factor provides insights into return distribution characteristics of companies based purely on the value of their public traded equity. The factor ranks firms by market cap and statistical inferences can be made on the return profiles of the different decile groupings of companies.

The large cap slowdown was clearly visible in February when the largest companies in the US fell by 0.9%. This was reflected in index returns as the S&P 500 underperformed the smaller cap Russell 2000 by nearly half a per cent.

Dollar exposures revealed

One explanatory factor of the recent large cap underperformance is that these firms derive a higher proportion of their earnings overseas. Compared to global peers such as Amazon and Apple, smaller firms have benefited from single currency exposure and a larger focus on the resurgent US economy.

Most of the outperformance provided by large cap firms occurred prior to the recent surge in the Dollar index, a trend which accelerated over March. During this time the Russell 2000 advanced by 0.6% while the S&P 500 retreated by over 2%. This resurgence in small cap names also coincided with the US Dollar's advance to new multi-year highs.

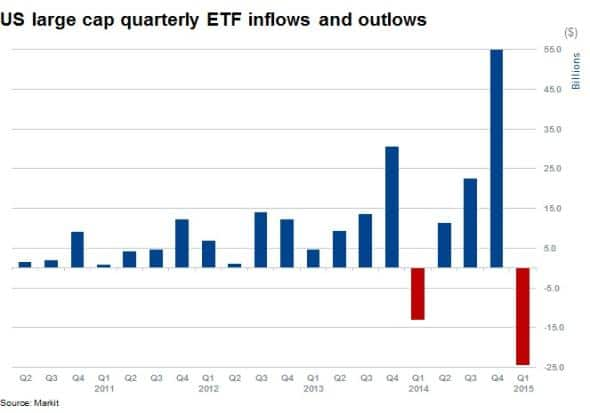

Small cap ETFs in favour

ETFs focused towards large cap stocks are on track to see their largest quarterly outflows in over five years, after investors withdrew $24.4bn in the opening two months of the year. These outflows represent a significant 3.9% of current AUM. They reverse the trend which saw large cap ETFs record their best quarterly inflows in the closing moths of last year, when investors added over $50bn in large cap exposure.

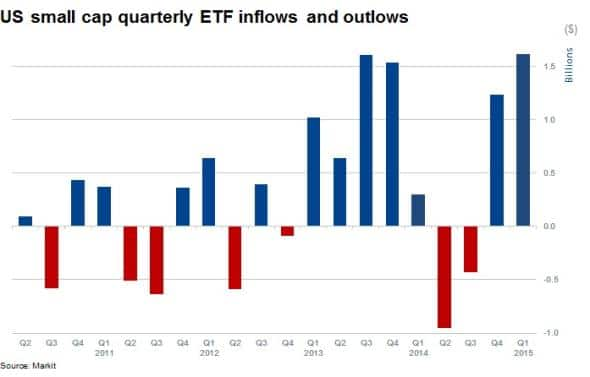

In contrast to the large cap outflows, small cap focused ETFs are on track for their largest quarterly inflow in over five years. These funds represent a much smaller piece of the ETF pie, with $27.5bn of total AUM. Inflows for the first quarter of 2015 total $1.6bn, representing 6.3% of AUM. Interestingly, investors withdrew funds over the second and third quarters of last year when larger companies outperformed their smaller peers.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-equities-large-caps-underperform-as-dollar-advances.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-equities-large-caps-underperform-as-dollar-advances.html&text=Large+caps+underperform+as+dollar+advances","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-equities-large-caps-underperform-as-dollar-advances.html","enabled":true},{"name":"email","url":"?subject=Large caps underperform as dollar advances&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-equities-large-caps-underperform-as-dollar-advances.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Large+caps+underperform+as+dollar+advances http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032015-equities-large-caps-underperform-as-dollar-advances.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}