Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 18, 2016

Cocos remain liquid despite recent volatility

Coco bonds were at the heart of last week's market volatility, but recent price swings can't be attributed to liquidity constrains as liquidity metrics for the asset class have held steady.

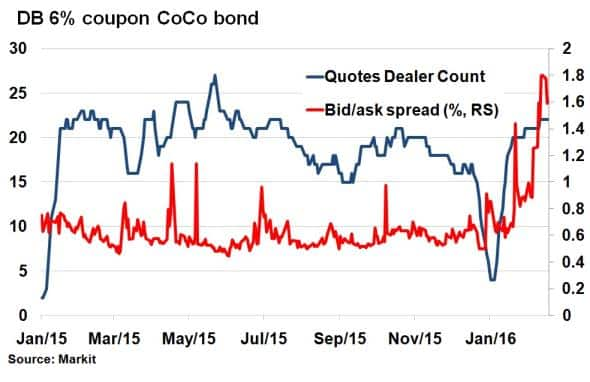

- DB's 6% Coco bond has seen its bid/ask spread triple amid the market turmoil

- Despite this, the number of dealers quoting the bond has remained above 20

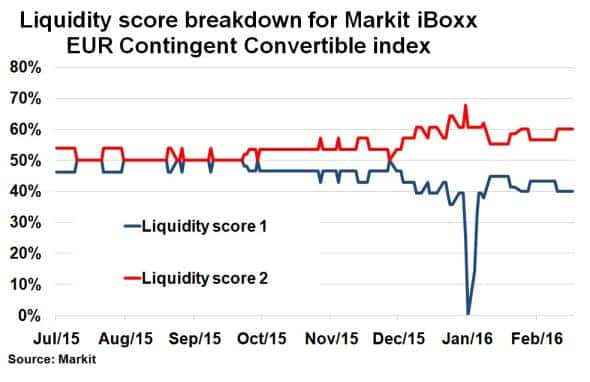

- Markit iBoxx EUR Contingent Convertible index has 40% of its constitutes ranked with the highest liquidity score, down from 50%

European Contingent Convertible (Coco) bonds suffered their worst week on record last week as the market re-priced the asset class. The current low yield, low growth environment encouraged the view that some banks could struggle to meet coupon payments on their Coco bonds. The resulting selloff saw the yield in the Markit iBoxx EUR Contingent Convertible index lose over 6% of its value on a total return basis over the course of the week. While the index has rebounded somewhat over the course of this week, this index yield is still 2.3% higher than at the start of the year.

The Coco bond under particular scrutiny last week was Deutsche Bank's 6% coupon "1.75bn issue, which saw its price tumble to 70.63 (cash basis to par) on February 11th, from a recent high of 93 in January, according to Markit's bond pricing service. The price has since recovered to 80 as Deutsche announced a bond buyback programme, a signal of confidence, and macro fears abated.

The sharp fall in price did however bring up concerns around liquidity. Such volatile price movements are typically more reminiscent of equity prices, which coupled with the lack of understanding around the asset class and a push towards higher quality debt as investors take caution; all had the potential to effect the market liquidity transmission.

Measuring liquidity

As ever in periods of sharp volatility, liquidity, or the lack thereof, was singled out as a contributing factor to the asset class' collapse. However a closer look at Markit Bond pricing's liquidity metrics across the constituents of the Markit iBoxx EUR Contingent Convertible index shows that these fears are largely overblown as liquidity metrics across the asset class remained robust and stable over the worst of last week's volatility.

One metric to measure liquidity is the bid/ask spread which captures the difference between the highest price a buyer is willing to pay (bid) for a bond and the lowest price that a seller is willing to accept. DB's 6% Coco bond saw its bid/ask spread triple amid the market turmoil and remains elevated at 1.5%. It had been hovering around 0.6% for much of 2015, the tighter spread suggesting a more liquid market.

However, despite the widening bid/ask spread, the number of dealers quoting the DB 6% CoCo has remained above 20 over the past few weeks. While this number represents a fall from the average seen in mid-2015, it's well above the 15 seen during last September's China and emerging markets induced global market volatility. If anything, the number of dealers has remained surprisingly resilient.

Looking at the broader Coco market, the Markit iBoxx EUR Contingent Convertible index saw only a slight change in Liquidity score composition. Markit's liquidity score encapsulates a wide range of metrics such as market depth, bid/ask spreads and maturity merits. The percentage of bonds ranked Liquidity Score 1, the highest rank, dipped from around 50% last year to 40% currently; a marked deterioration but suggesting that the last few weeks' impact on liquidity was marginal.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022016-Credit-Cocos-remain-liquid-despite-recent-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022016-Credit-Cocos-remain-liquid-despite-recent-volatility.html&text=Cocos+remain+liquid+despite+recent+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022016-Credit-Cocos-remain-liquid-despite-recent-volatility.html","enabled":true},{"name":"email","url":"?subject=Cocos remain liquid despite recent volatility&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022016-Credit-Cocos-remain-liquid-despite-recent-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Cocos+remain+liquid+despite+recent+volatility http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022016-Credit-Cocos-remain-liquid-despite-recent-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}