Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 17, 2017

Weak consumer spending creates drag on Japan’s third quarter performance

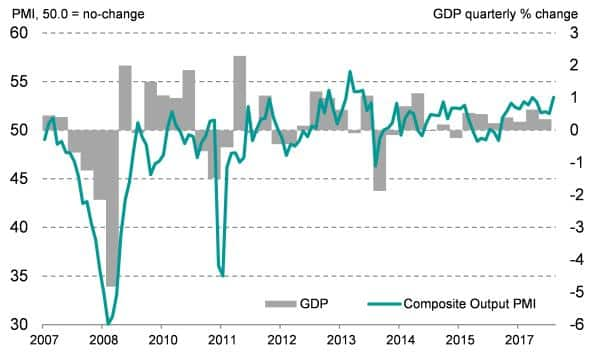

Latest official data indicated a slowdown in Japanese economic growth, with the initial estimate of third quarter GDP showing a 0.3% increase, down from 0.6% in the second quarter. The weaker pace of expansion is in line with the signal from the Nikkei PMI surveys.

The softer expansion coincided with the first contraction in private consumption expenditure (a 0.5% decline) since the fourth quarter of 2015. That said, the third quarter GDP reading extends the current sequence of growth to the longest since 2001.

Survey data had accurately foretold of the upturn in GDP growth in the second quarter and the subsequent slowing in the third quarter, but also suggest that the pace of growth has picked up again at the start of the fourth quarter. The October Nikkei Composite PMI signalled the joint-fastest pace of expansion since January 2014, buoyed by strong growth in the service sector. The strength of the October PMI contrasts with the prior three months' readings, which were the lowest seen in 2017.

GDP growth eases in line with PMI data in Q3

Source: IHS Markit, Nikkei, Japan Cabinet Office

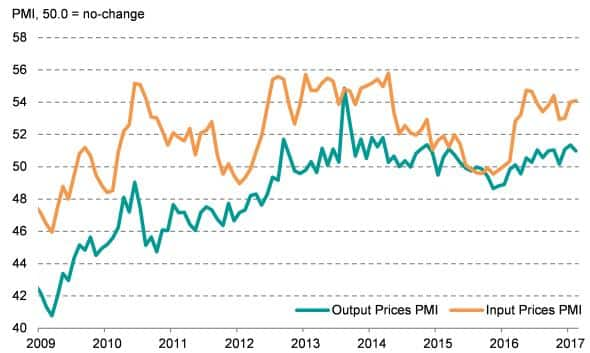

In contrast to lacklustre domestic spending, foreign demand has increased, with the PMI Export Orders Index registering in expansionary territory for a fourteenth successive month in October. There has been limited rebound in the yen following its sharp depreciation against the US dollar during the final few months of 2016. As a result, businesses are continuing to attract new orders from abroad. While the terms of trade rebalance, this trend is likely to endure, to the benefit of Japanese exporters.

To the downside, a weak yen has generated cost-push inflationary pressures for producers. Combined with rising global raw material costs, this will generate an unwelcome tightening of businesses' profit margins.

Input price inflation accelerates

Source: IHS Markit, Nikkei

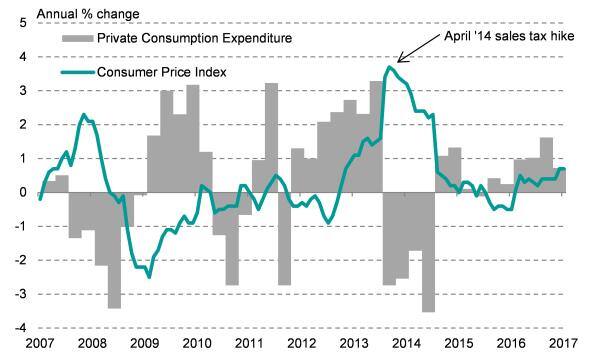

Furthermore, weak consumer spending data will ring more alarm bells for Japanese companies. The chart below indicates the sensitivity of Japanese consumers to changes in aggregate prices, illustrating how rising inflation in the past has often rapidly constrained private sector consumption.

Bank of Japan Governor Haruhiko Kuroda recently commented on the difficulty that policymakers face to dispel the deflationary mind-set which has plagued Japan for so many years: consumers have tended to defer purchases in the expectation that prices will fall in the future. Consequently, firms may act cautiously before deciding to pass on higher costs to consumers, in order to avoid squeezing household spending even further in the fourth quarter.

Deflationary mind-set discourages spending when prices rise

Source: Japan Cabinet Office

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112017-Economics-Weak-consumer-spending-creates-drag-on-Japan-s-third-quarter-performance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112017-Economics-Weak-consumer-spending-creates-drag-on-Japan-s-third-quarter-performance.html&text=Weak+consumer+spending+creates+drag+on+Japan%e2%80%99s+third+quarter+performance","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112017-Economics-Weak-consumer-spending-creates-drag-on-Japan-s-third-quarter-performance.html","enabled":true},{"name":"email","url":"?subject=Weak consumer spending creates drag on Japan’s third quarter performance&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112017-Economics-Weak-consumer-spending-creates-drag-on-Japan-s-third-quarter-performance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weak+consumer+spending+creates+drag+on+Japan%e2%80%99s+third+quarter+performance http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112017-Economics-Weak-consumer-spending-creates-drag-on-Japan-s-third-quarter-performance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}