Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 17, 2017

US manufacturing rebounds in October, in line with PMI

US manufacturing production rebounded in October from hurricane-related disruptions in prior months, confirming earlier signals from IHS Markit's PMI data.

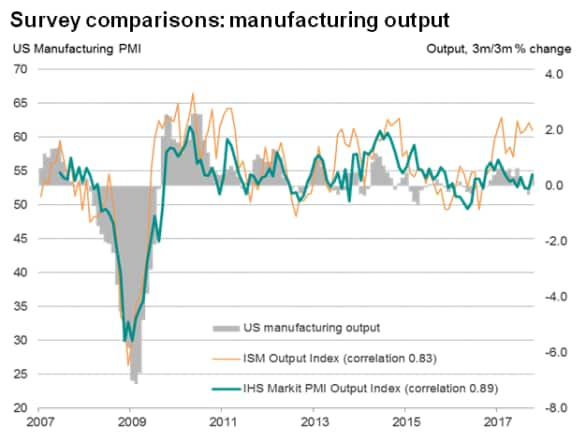

While the hurricane impact and subsequent recovery in production was widely anticipated, not all surveys had signalled such a growth pattern. The ISM manufacturing survey, for example, had shown output growth easing slightly in October, remaining close to near post-recession highs in prior months.

The official data from the Federal Reserve showed factory output climbing 1.3% in October as production returned to normal in areas affected by the recent hurricanes. Production had fallen 0.3% in the three month to September, the steepest such decline in over two years. The rebound in output meant the three-month growth rate consequently improved to 0.4% in October.

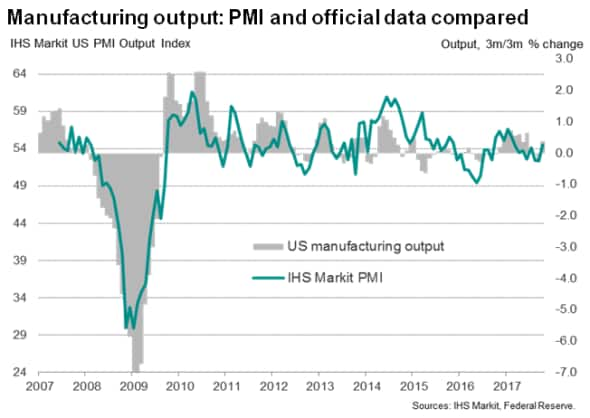

The output trend almost exactly matches that indicated by IHS Markit's PMI survey. The PMI showed factory production growth slipping in August and September to the lowest for over a year, primarily driven by supply chain disruptions. Both months saw output index readings of 52.4, the lowest since the second quarter of 2016. A rise in the output index to 54.6 in October signalled the largest increase in production since February.

The comparable ISM index which measures manufacturing output fell to 61.0 in October from 62.2 in September.

IHS Markit's manufacturing PMI output index exhibits an 89% correlation with the Fed's official measure of production but is available almost a month ahead of the official numbers. The November flash PMI is published on November 24th andwill provide a clearer picture of the health of the US economy in terms of underlying output growth, employment and inflationary pressures.

Converting PMI numbers into official data

We use a simple regression analysis to determine the three-month-on-three month rate of change in the official data implied by the PMI. September's PMI reading signalled a 0.3% decline while the October reading was consistent with a 0.3% increase, which are very similar to the respective -0.3% and +0.4% rates in the official measure.

The regression has an adjusted r-square of 0.80 with SE of 0.83.

Manufacturing output 3m/3m % change

= -14.53 + (PMI Output Index x 0.271)

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112017-Economics-US-manufacturing-rebounds-in-October-in-line-with-PMI.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112017-Economics-US-manufacturing-rebounds-in-October-in-line-with-PMI.html&text=US+manufacturing+rebounds+in+October%2c+in+line+with+PMI","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112017-Economics-US-manufacturing-rebounds-in-October-in-line-with-PMI.html","enabled":true},{"name":"email","url":"?subject=US manufacturing rebounds in October, in line with PMI&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112017-Economics-US-manufacturing-rebounds-in-October-in-line-with-PMI.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+manufacturing+rebounds+in+October%2c+in+line+with+PMI http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112017-Economics-US-manufacturing-rebounds-in-October-in-line-with-PMI.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}