Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 17, 2015

US investors double down on inflation

TIPS returns since the start of the year have been particularly disappointing; but this has not precluded investors from piling into ETFs tracking the asset class.

- The iBoxx TIPS index has lagged its conventional Treasury peer by 2.4% ytd as inflation fell

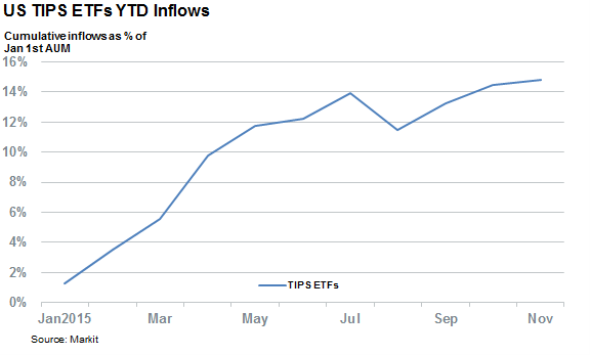

- US TIPS ETFs have seen net inflows ytd that equal to 14% of their starting AUM

- Inflation linked US ETFs on track for their largest yearly inflows since 2009

Today's US Consumer Price Index (CPI) number brought some relief for long suffering TIPS investors. The latest release from the US Bureau of Labour Statistics showed that yearly inflation edged 0.2% higher for October after a flat year on year reading in the previous month. While inflation is still way off the 2% pace seen in the middle of last year, the result was enough to give inflation linked bond ETFs a leg up over their conventional peers this morning. The iShares TIPS Bond ETF was flat in early trading while its conventional iShares US Treasury Bond ETF traded 24bps off the previous day's close.

Despite the most recent rally, these US government inflation linked bonds have proved to be largely disappointing so far this year as the iBoxx TIPS Inflation-Linked index has delivered negative total returns of 1.7% ytd. This is over 2.4% less than the conventional Markit iBoxx $ Treasuries index, which has returned 70bps of total returns so far this year.

Inflation expectations behind slump

Not surprisingly, the recent commodities dip has been a large driver of the recent slump as core inflation has remained relatively healthy. The reading, which strips out volatile energy and food prices, grew at an annualised rate of 1.9% over October. This relatively healthier core reading will be of little help for TIPS investors given that the benchmark inflation used to adjust the asset class is the wider, less buoyant, CPI.

This trend looks set to continue if the cash bond market is anything to go by. The breakeven inflation priced into five year inflation linked treasury bonds is now 1.2%, a full 50bps off the levels seen just prior to the commodities collapse seen this summer.

ETF investors double down

Despite the vast underperformance delivered by US inflation linked bonds year to date, ETFs that track the asset class have continued to see steady inflows. Investors have added to their TIPS ETF holdings for ten of the past 11 months, and the $2.8bn of assets that have flowed into the asset class represent 15% of the AUM managed by these funds at the start of the year. Should this trend hold for the next six weeks, 2015 would mark the best year for inflation linked bonds since 2009.

These steady inflows indicate that investors are viewing the current inflationary environment as a one way bet for TIPS, and their willingness to add exposure to the asset class shows that they are willing to take some short term pain in order to profit from a lift in inflation from the current doldrums.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-Credit-US-investors-double-down-on-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-Credit-US-investors-double-down-on-inflation.html&text=US+investors+double+down+on+inflation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-Credit-US-investors-double-down-on-inflation.html","enabled":true},{"name":"email","url":"?subject=US investors double down on inflation&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-Credit-US-investors-double-down-on-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+investors+double+down+on+inflation http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112015-Credit-US-investors-double-down-on-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}