Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 17, 2015

Mining dividends looking like fools gold

Investor demand for gold has hit a six year low as the price of the commodity retreats in earnest, forcing precious metal mining firms to drastically cut their dividend payments.

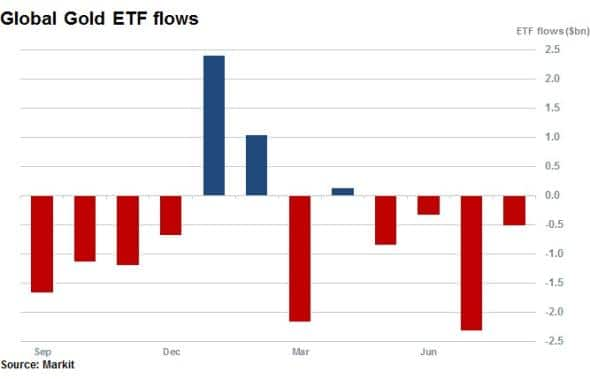

- More than $2.5bn has flowed out of ETFs tracking gold in this year so far

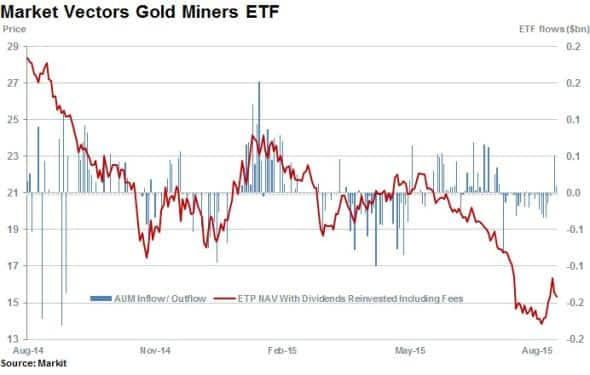

- The Market Gold Mining ETF has fallen 46% year to date

- Precious metals miners' aggregate dividends have plummeted to a five year low

Gold bugs rush out of ETFs

Over $2.5bn has flowed out of global gold ETFs in 2015 so far as the metal hovers at the lowest prices seen in five years. The more than 40% fall in the price of gold from the highs a couple years ago is still fresh and investors have remained cautious despite the recent increased market volatility.

Miners in trouble

Managing $4.7bn in AUM, the Market Vectors Gold Miners ETF tracks the world's largest gold miners. NAV of the ETF is currently down 46% year to date but the fund has seen volatile fund flows during this precipitous.

Prior to large outflows seen during July and August 2015, the fund saw two months of strong inflows occurring in May and June totalling $0.5bn. Additionally strong combined inflows of $1.2bn were seen in January and February 2015.

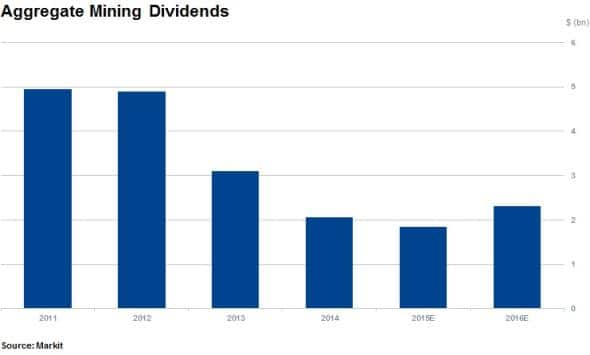

Dividends expected to fall

While some miners currently offer enticing trailing dividend yields basis due to suppressed prices, some names are expected to see further cuts to dividends going forward as operations are rationalised to cope with falling prices and lower demand.

Markit Dividend Forecasting data reveals that across large precious metals miners, aggregate dividends are expected to fall to $1.8bn; more than 60% below the $4.9bn seen in 2011.

But aggregate dividends are expected to recover in 2016 however, growing by 25% to $2.3bn as cost cutting, capital expenditure and restructuring efforts start to impact firms cash flows after four years of sustained lower metal prices.

Markit's dividend forecasts expect dividends for Barrick Gold to fall by 30%, compounding previous dividends cuts which saw payments fall by a third on previous levels. The stock is down by over 50% in the last 12 months.

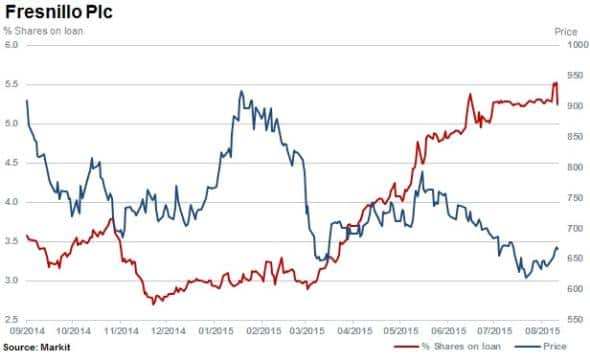

Short sellers have recently been attracted to large silver and gold miner Fresnillo with the stock falling by 20% over the last six months.

After three years of large dividend cuts in the regular dividend, total dividends from Mexican based Fresnillo are expected to fall by a further 20% this year to $0.065. This leaves the annual regular dividend payment some 94% off its 2011 figure.

Precious platinum miner

Lonmin has not paid a dividend since February 2012, six months before the Marikana tragedy took place. Since then, the platinum price has fallen more than 50%, and Lonmin's stock by 94%.

Dividends are currently not forecast for the miner through to 2017 and short sellers have circled the stock once again, with shares outstanding on loan increasing to 10.5 %.

Lonmin's shares have come under significant pressure in the last three months; falling by 73% as the company struggles with plans to refinance its debt burden.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082015-Equities-Mining-dividends-looking-like-fools-gold.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082015-Equities-Mining-dividends-looking-like-fools-gold.html&text=Mining+dividends+looking+like+fools+gold","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082015-Equities-Mining-dividends-looking-like-fools-gold.html","enabled":true},{"name":"email","url":"?subject=Mining dividends looking like fools gold&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082015-Equities-Mining-dividends-looking-like-fools-gold.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mining+dividends+looking+like+fools+gold http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082015-Equities-Mining-dividends-looking-like-fools-gold.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}