Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 17, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week, plus names identified at risk of experiencing a short squeeze.

- World Acceptance is the most shorted in the US, with 36% short interest

- Charter Communications joins Neustar and Exact Sciences as highest risk of short squeeze

- Air France KLM short sold ahead of earnings in Europe post union agreement in July

North America

Most shorted in North America ahead of earnings is small consumer lender World Acceptance Corporation. The company has 36% of shares outstanding on loan with shares dropping by a third over the last 12 months.

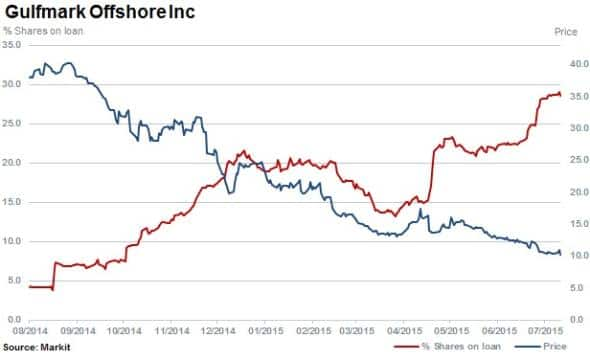

Gulfmark Offshore is the third most shorted with 28% of shares outstanding on loan. The company provides offshore marine transportation services, supporting the oil and gas industry in developing new resources. The stock is down over 70% over the last 12 months.

High risk of squeezing

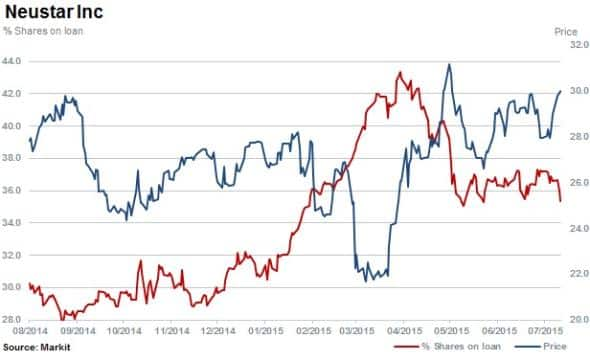

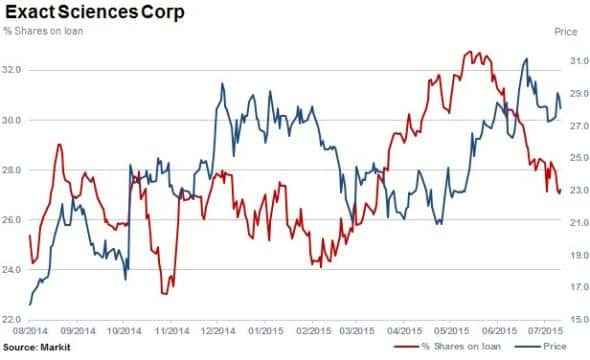

Among the top shorted firms about to report earnings, Neustar and Exact Sciences Corp also rank in the top decile of stocks in Markit's Short Squeeze model*.

Neustar is the second most shorted ahead of earnings with 35% of shares outstanding on loan. The information services and analytics firm has kept short sellers steady however with shares rallying by 40% since March 2015.

Cancer screening test provider Exact Sciences has 27% of shares outstanding on loan. Short sellers have covered positions in the stock since the end of May while shares have rallied by a third.

Charter Communications is currently ranked in the top percentile in the Short Squeeze model, indicating that a squeeze is highly likely. The stock has a high concentration of short sellers near breakeven level with the majority losing money.

Europe

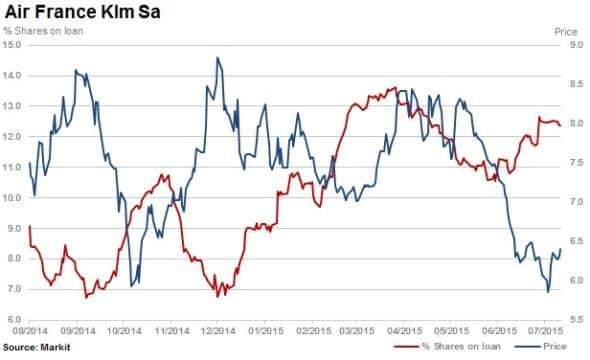

Most shorted in Europe ahead of earnings is Air France KLM whose shares have slumped 21% since the beginning of April as the airline continued to cut costs amid a slow European economy and tense labour negotiations. However the company announced that it had signed an agreement with unions on July 8th.

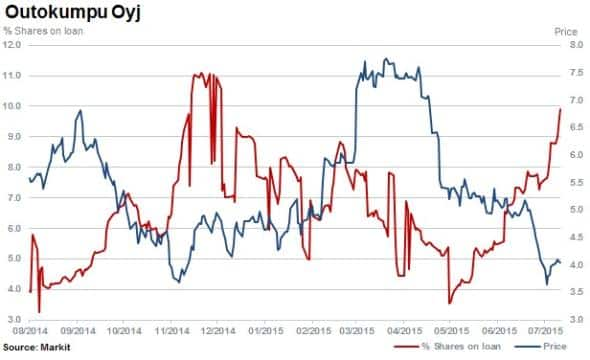

Second most shorted in Europe ahead of earnings is stainless steel manufacturer Outokumpu. Short sellers have added 75% to their positions in the last 12 months, while the share price has fallen by a third.

Apac

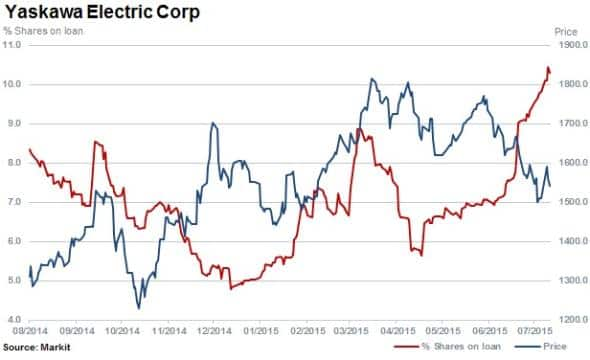

Most shorted in Apac is Yaskawa Electric which has seen short interest jump 77% in the last three months to hit 10% as the share price fell 11%. Based in Japan the company provides industrial systems robotics and electronics, predominantly into the manufacturing sector.

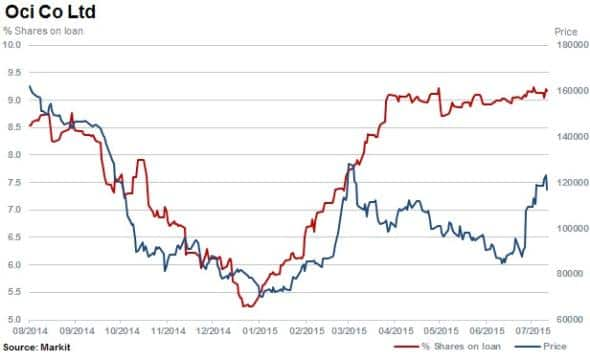

Second most shorted in Apac ahead of earnings is Oci Co, a Korean manufacturer of a wide variety of industrial chemical products.

Since Oci last featured in the most shorted, shares have increased by 21% while short sellers have increased positions by 5%, with shares outstanding on loan increasing to 9.2%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}