Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 17, 2016

Crude oil woes impact municipal bond spreads

Major oil producing US states are suffering the negative impact of crude oil price volatility on their municipal debt.

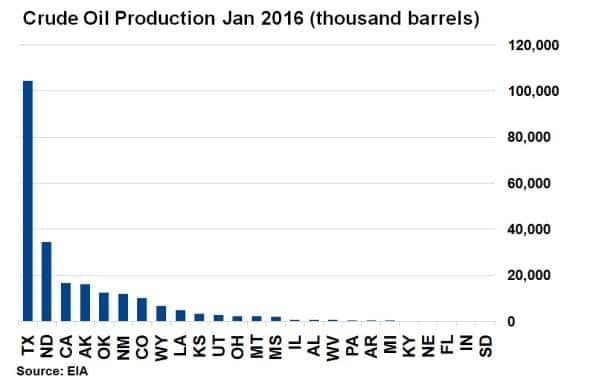

- Texas, North Dakota, California and Alaska are the biggest oil producing states in the US

- Oil price-sensitive states have seen their municipal debt underperform the wider market

- The spread difference peaked at 20bps in January, after a low of 6bps in July last year

The volatility experienced in crude oil prices over the past two years has influenced the credit landscape across a number of fixed income assets. US treasury yields have been dampened by falling inflation expectations, oil dependent sovereigns have seen their credit ratings hit, and shale oil producers have had their solvency scrutinised.

US municipal bonds are no exception, with bonds issued by oil price-sensitive states underperforming the wider market.

Oil states underperform

In term of crude oil production, the biggest state producers in January were Texas, North Dakota, California and Alaska. Texas produced more than double its nearest rivals but due to its diversified economy, has lesser reliance on crude oil for revenue. Alaska and North Dakota, which between them produced around 50 million barrels, are more exposed from a budgetary standpoint and therefore saw their municipal bond spreads react in tandem with the recent crude oil price fluctuations.

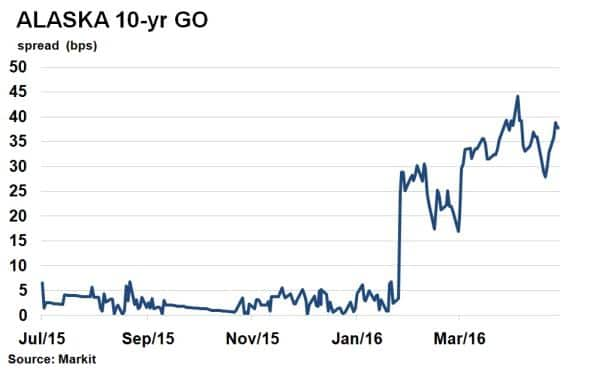

Alaska has seen the spread on its 10-yr General Obligation bond widen significantly so far this year, which was compounded by a ratings downgrade from S&P in January. The agency citing the long term effects of low oil prices on the economy.

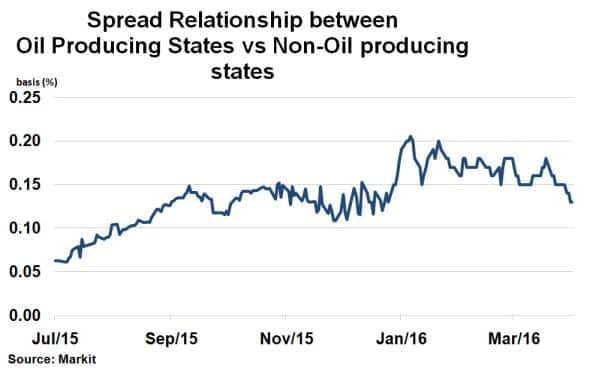

To showcase the impact of crude oil prices on municipal bond spreads, a comparison can be made between the average municipal bond spread (5% coupon, 10-yr maturity, AAA-AA rated) for the top ten oil producing states versus non-oil producing states.

According to analysis from Markit's Municipal bond pricing service, there has been a correlation between fluctuating oil prices and the risk associated with the municipal bonds of oil producing states over the past year. Prior to the collapse in crude oil prices at the end of 2014, this relationship was negligible, suggesting that the relationship developed only when downside price risk in crude oil came to the fore.

The municipal bond spread difference between oil producing states and non-oil producing states peaked at around 20bps as WTI crude oil prices fell below $30/barrel in January. The spread difference was as low as 6bps last July when oil prices were above $50/barrel. Crude oil prices have recovered since January and consequently the spread difference has started to tighten again as downside risk in oil prices has started dissipate. The spread difference was 13bps by the end of the first quarter, the level seen at similar crude oil prices last November, further evidence of the relationship.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17052016-Credit-Crude-oil-woes-impact-municipal-bond-spreads.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17052016-Credit-Crude-oil-woes-impact-municipal-bond-spreads.html&text=Crude+oil+woes+impact+municipal+bond+spreads","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17052016-Credit-Crude-oil-woes-impact-municipal-bond-spreads.html","enabled":true},{"name":"email","url":"?subject=Crude oil woes impact municipal bond spreads&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17052016-Credit-Crude-oil-woes-impact-municipal-bond-spreads.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Crude+oil+woes+impact+municipal+bond+spreads http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17052016-Credit-Crude-oil-woes-impact-municipal-bond-spreads.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}