Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

INDICES COMMENTARY

Apr 17, 2015

European bonds tighten after Draghi comments

Mario Draghi reasserted his commitment to ECB QE this week, sending European bond yields tighter.

- Markit iBoxx € Sovereigns index now yielding 70bps

- Tightening occurs despite increasing bearish news coming out of Greece

- Alcatel Lucent CDS spreads tightened by 80bps after Nokia announcements

Bonds tighten after ECB comments

While much of the media coverage of the recent ECB press conference focused on the confetti showered on president Mario Draghi, the market chose instead to focus on the bank's continuing commitment to QE. The central bank was bullish on the impact of the program so far and pledged to continue its €60bn monthly asset purchase program for as long as eurozone inflation remains low.

The news sent eurozone sovereign bond yields falling to new lows, with the Markit iBoxx € Sovereigns index yield hitting the 70bps mark for the first time ever on Wednesday; a tightening of 4bps from the close of last week.

Corporate bonds also reacted positively with the Markit iBoxx € Corporates index tightening by 2bps. Interestingly, the yields on the region's corporate bonds are still off their all-time lows registered at the closing weeks of last year, indicating that the recent tightening is driven by falling reference sovereign credit and not improving outlook on the region's corporate bonds.

Market discounting Greek trouble

Not all the sovereign news flow was positive however. Greek bonds fell to new recent lows as the country's ongoing negotiations with international creditors hit another impasse. This news sent Greek CDS spreads to new highs with the market now implying a 77% change of default for the country in the coming five years.

Despite this latest chapter in the protracted Greek saga, the CDS market has tightened in line with bonds over the last few weeks, with the iTraxx index recently reaching its lowest level in over five years.

Corporates tighten

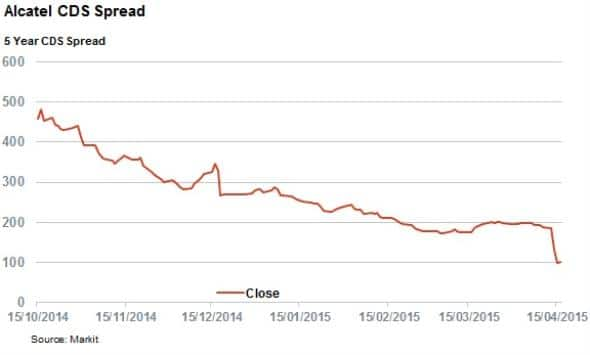

Another development moving the CDS market this week was the announced tie-up between Finnish telecommunication equipment maker Nokia and its French rival Alcatel Lucent in a €15.6bn all-stock deal. Both firms are hoping to save around €900m through synergies, something which the market has well received as evident by the tightening in Alcatel's CDS spread. The firm's 5 year CDS fell by over 80bps in the two days after the deal came to light, reaching their lowest level in over 7 years.

Alcatel bonds also rallied in line with the CDS spreads.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-Credit-European-bonds-tighten-after-Draghi-comments.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-Credit-European-bonds-tighten-after-Draghi-comments.html&text=European+bonds+tighten+after+Draghi+comments","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-Credit-European-bonds-tighten-after-Draghi-comments.html","enabled":true},{"name":"email","url":"?subject=European bonds tighten after Draghi comments&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-Credit-European-bonds-tighten-after-Draghi-comments.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+bonds+tighten+after+Draghi+comments http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-Credit-European-bonds-tighten-after-Draghi-comments.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}