Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 17, 2017

Week Ahead Economic Overview

Flash PMI data for Japan, the eurozone and the US will be released, providing fresh evidence on the health of these economies at the end of the first quarter. Official data highlights include UK retail sales and inflation as well as US durable goods orders.

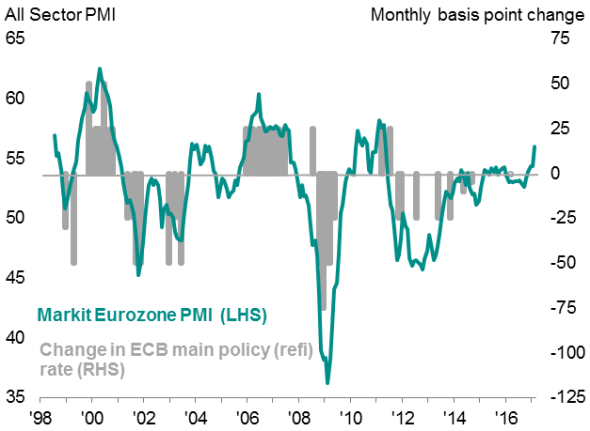

The eurozone economy comes into focus with the flash PMI providing fresh insight into ECB policy. February's PMI signalled a renewed growth spurt in the region, accompanied by rising prices and hiring at a near decade high. The surprisingly strong start to the year has raised questions as to whether ECB rhetoric will turn increasingly hawkish if the trend continues. PMI data have already moved into territory that is historically consistent with a tightening bias at the ECB.

Eurozone PMI and ECB policy

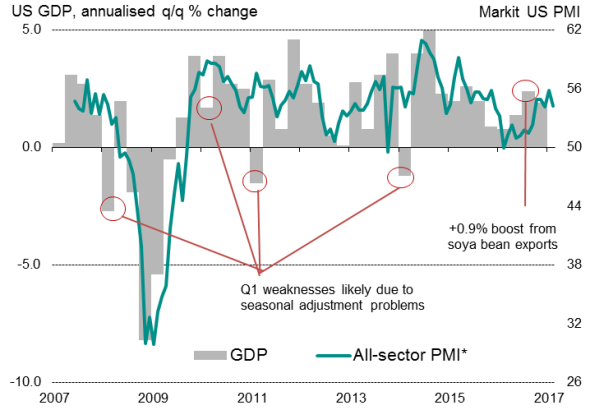

The US economic data will meanwhile be watched for signals as to how many Fed rate hikes are likely this year. The economy has shown signs of strength waning slightly, albeit with the latest survey data pointing to a solid annualised rate of growth of 2-2.5%. Importantly, the labour market also remains in rude health as a further 235k non-farm payrolls were added in February. It therefore came as no shock when the Fed increased its benchmark interest rate again at its March meeting, but the markets showed surprise that only two further hikes were being signalled for 2017.

The release of US durable goods orders data, which rose by 1.8% in January, and Flash PMI results will further help guide expectations of how aggressive policy tightening may need to be.

Markit US PMI and GDP

With signs of renewed hawkishness at the Bank of England, traders will also focus on updated inflation and retail sales data for the UK. Inflation is expected to rise further from the annual rate of 1.8% seen in January, its highest since June 2014 . However, more important will be the extent to which household spending is showing resilience in the face of higher prices. Retail sales fell throughout the three months to January, a downturn which if sustained could shift policymakers back into a dovish stance.

Weak consumer data would add to slowdown fears after latest PMI data pointed to a slowdown in GDP growth to 0.4% during the first quarter and UK pay growth waned.

UK Inflation and producer prices

Japan's trade balance figures are updated next week, which will be scoured for signs of export strength, as are flash PMI results. The latter offer an early insight to the performance of the economy at the conclusion of the first quarter. Recent data showed the Japaneseeconomy maintained a solid pace of growth during February, driven by a strong performance at manufacturing companies, where output rose to the greatest extent in nearly three years. Sharper production was fuelled by an uptick in export growth.

Meanwhile, the Bank of Russia will meet to set its latest key lending rate, which currently stands at 10%. Forecasters are anticipating a 0.5% cut after signs of inflation falling faster than anticipated. Recent data also show economic growth picking up and business optimism in Russia's private sector reaching its highest since June 2013

Monday 20 March

Russian producer prices, retail sales figures, unemployment rates and wages data are released.

Germany's latest producer prices index is issued.

Labour costs data for the eurozone are updated.

In the US, the Chicago Fed National Activity Index is published.

Tuesday 21 March

Balance of trade data is released in Japan, while the BoJ releases minutes from its latest monetary policy meeting.

Public sector borrowing data is available in the UK, alongside the latest inflation figures.

Canadian retail sales figures are made available.

Wednesday 22 March

Preliminary inflation data is out in Brazil along with an update on foreign exchange flows.

South Africa's inflation figures are updated.

In the euro area, a non-monetary policy ECB meeting is scheduled.

The Bank of England's Financial Policy Committee holds its first quarterly meeting of the year.

US mortgage applications and existing home sales data are out.

Thursday 23 March

Singapore's consumer price index is updated.

In Germany, the GfK releases its latest consumer confidence indicator.

Preliminary estimates on the Netherlands GDP numbers for the first quarter are announced.

Poland's unemployment rate is issued.

The Office for National Statistics publishes latest retail sales numbers for the UK.

Friday 24 March

Flash PMI data are released in Japan, France, Germany, the eurozone and the US.

Industrial production numbers are updated in Singapore.

Indian foreign reserve data is published.

The Bank of Russia announces its latest key lending rate.

Final French Q4 GDP figures are made available.

In Canada, the latest consumer price index is released.

US durable goods orders are published.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032017-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032017-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}