Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 16, 2017

Stocks to watch out for this week

We reveal the stocks that are heavily targeted by short sellers ahead of earnings announcements

- Greenhill borrow demand surges since its shareholder buyout offer

- Scandinavian tech firms feature high on short sellers' agenda this week

- Asian short sellers circle round Metaps as its value surges to new highs

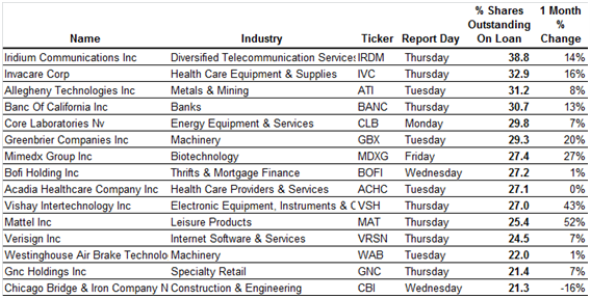

North America

The top short target among North American firms announcing earnings this week is boutique investment bank Greenhill. The company is used to advising short targets - as opposed to being on the one targeted - but the hypercompetitive nature of M&A advising has turned the tables after a series of disappointing earnings updates.

It's worth noting that not all the borrowing activity in Greenhill is likely to be directional - the company is in the midst of a tender offer which will see it buy back the majority of its publically traded shares. The announcement of this tender offer prompted a rush to borrow Greenhill shares; the proportion of the company's shares outstanding on loan has increased by more than a third in the last month.

Industrial distributor W W Grainger sits in runner-up position among this week's list of top short targets. Grainger is arguably the latest firm to join the long and growing list of companies that have seen their business model disrupted by Amazon's quest for growth. Short sellers were late to spot Amazon's disruptive impact on Grainger's business, but the surge in demand to borrow Grainger shares over the last few weeks indicates that bears anticipate more bad news for the company's investors.

Iconic motorcycle firm Harley Davidson continues to experience its fair share of upheaval. Its most recent earnings update proved it is increasingly hard for the company to replace its aging customer base. These struggles prompted shorts to triple their positions over the last six months, and 18% of HOG shares are now out on loan.

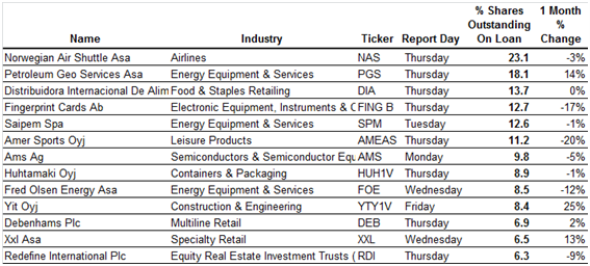

Europe

The top short amongst European companies announcing earnings this week is Swedish electronics equipment manufacturing firm Mycronic. Although 11% of its shares are now on loan, short sellers are starting to have second thoughts, and the demand to borrow Mycronic shares fell by over a tenth in the last month.

Mycronic isn't the only Scandinavian tech short announcing earnings this week - communication equipment firm Ericsson and Nordic Semiconductor also have more than 5% of their shares out on loan to short sellers.

Outside of the Nordics, recently spun off Philips Lighting has come under increased scrutiny in the weeks leading up to Thursday's earnings announcement.. Philips Lighting shares attracted more than their fair share of skeptics over the last few months due in part to the company's inability to grow revenues. This skepticism has yet to pay off though, as Philips Lighting shares rallied by more than 40% year to date.

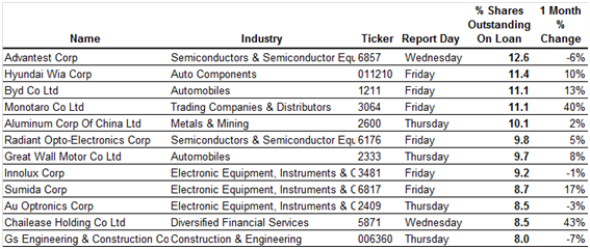

Asia

By quite a wide margin, Metaps is the most shorted Asian company announcing results this week. Short sellers started seriously targeting the software company in the third quarter of last year, and demand to borrow has increased to the current all-time high of 19% of shares outstanding. Much of this increase was spurred on by a willingness to double down on losing positions following new surges in Metaps share price.

Short sellers' desire to strike appears to be driven by fundamentals. After the recent rally, Metaps trades at a very rich 115 forward P/E ratio - seven times the Japanese IT service average. Short sellers will find it almost impossible to double down from now on as more than 90% of Metaps shares which can be borrowed have been spoken for.

Simon Colvin | Research Analyst, IHS Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102017-Equities-Stocks-to-watch-out-for-this-week.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102017-Equities-Stocks-to-watch-out-for-this-week.html&text=Stocks+to+watch+out+for+this+week","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102017-Equities-Stocks-to-watch-out-for-this-week.html","enabled":true},{"name":"email","url":"?subject=Stocks to watch out for this week&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102017-Equities-Stocks-to-watch-out-for-this-week.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Stocks+to+watch+out+for+this+week http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102017-Equities-Stocks-to-watch-out-for-this-week.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}