Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 16, 2015

Fed delay boosts Barrick and emerging markets

As the prospect of a 2015 rate hike fades, the weaker US dollar has boosted credit tied to gold and emerging markets.

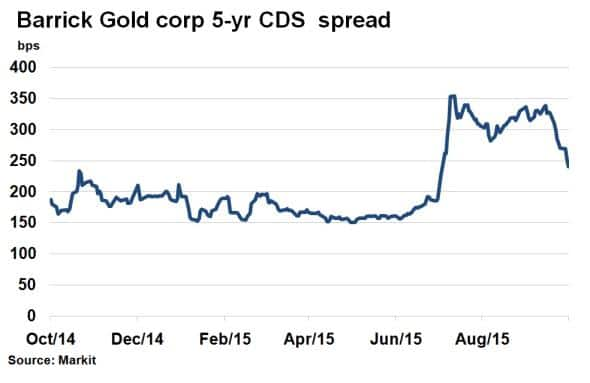

- Barrick's 5-yr CDS has tightened by a quarter in the last month

- European insurance sector bonds have returned 2.33% in October; inflation bonds rally

- Markit iBoxx GEMX Russia has returned 27.2% in 2015, the best performing bond market this year

Barrick Gold

The price of gold rallied to three month highs this week, much to the relief of the world's largest producer, Barrick Gold. Its share price has rallied 30% over the past month but provides only a glimmer of what has been a challenging year for gold miners.

Barrick, which describes itself as "disciplined, profitable production", has been anything but recently if credit markets are anything to go by. Dragged down by the wider commodities slump which saw the cost of credit protection soar among miners, Barrick's 5-yr CDS spread topped 325bps last month, tantalisingly in implied junk territory. It was, however, wider a few months back, reaching 354bps on July 24th, the day the price of gold hit a six year low.

With operations heavily linked to the price of gold, last month's decision from the Fed to keep interest rates on hold was an important credit risk factor for Barrick. Its CDS has tightened 25% since, as the prospect of higher interest rates and a stronger US dollar faded. A strong US dollar is seen as a negative for gold, which is widely traded in US dollars. Markets now expect a 2016 lift off, and this has boded well for gold and Barrick's credit position.

Russian bonds gain in price and liquidity

The prospect of a weakening dollar has also provided a tailwind for oil prices. Russian government bonds have continued their advance with the best performing bond market this year, delivering total returns of 2.57% so far this month, according to the Markit iBoxx GEMX Russia index. This index has returned a jaw dropping 27.2% this year, led by a cooling in tensions in Ukraine. Russia has been by far the best performing BRIC nation with Brazil (0.1%), China (4.2%) and India (7.5%) all trailing.

Corporates bonds have also fared well, providing a 21% total return according to the Markit iBoxx USD Corporates Russian Federation index. This has led to issuers (non-sanctioned) re-entering the capital markets after a near one year hiatus.

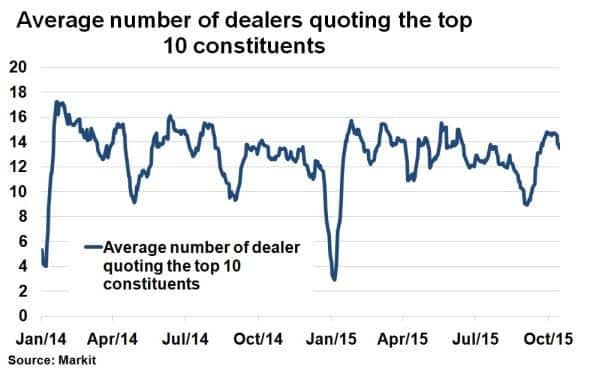

According to Markit's bond pricing liquidity analytics, average dealer quote counts have picked up over the last month to levels seen earlier this year, a period when corporate bond returns were fruitful. Seasonality coupled with volatility during the summer stemming from Greece and then China forced dealers to restrict trading of such instruments. Level are now higher than this time last year, with approximately 14-15 dealer quotes as opposed to 12-13, which could indicate dealer sentiment.

Growth in Russia, however, remains mundane, as lower export revenues from oil continue to bite. Any further downside has the threat of reversing fortunes.

Investors return to FI ETF flows

As a US rate rise becomes ever more distant, investors have been returning to emerging markets through ETFs. The iShares Emerging Markets Local Government Bond UCITS ETF saw $144m of inflow yesterday, according to Markit's ETP analytics service.

Insurance shines

Midway through October, European bonds have enjoyed stellar returns this month with the Insurance sector proving most rewarding.

The Markit iBoxx € Insurance index has returned 2.33% so far this month on a total return basis, 53bps more than its nearest contemporary, € High Yield. Even the energy and mining based sectors, € Oil & Gas and € Basic Materials, have failed to match Insurance returns, led by names such as French insurer CNP Assurances and the Spanish name Mapfre.

Also performing well are German and French inflation linked bonds. With Europe struggling to spark inflation, rumours of further monetary stimulus have been rife over the past few months. This was reignited yesterday when ECB's Ewald Nowotny suggested that the ECB needed to do more to boost growth and inflation.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Credit-Fed-delay-boosts-Barrick-and-emerging-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Credit-Fed-delay-boosts-Barrick-and-emerging-markets.html&text=Fed+delay+boosts+Barrick+and+emerging+markets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Credit-Fed-delay-boosts-Barrick-and-emerging-markets.html","enabled":true},{"name":"email","url":"?subject=Fed delay boosts Barrick and emerging markets&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Credit-Fed-delay-boosts-Barrick-and-emerging-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fed+delay+boosts+Barrick+and+emerging+markets http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Credit-Fed-delay-boosts-Barrick-and-emerging-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}