Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 16, 2017

UK labour market strength generates only meagre wage growth

The second quarter saw strong growth of employment and falling unemployment, but a persistent lack of any significant upturn wage growth in the UK economy further dents the prospect of interest rates rising, especially given the steadying of inflation in July.

Although the unemployment rate fell to 4.4% in the second quarter, its lowest since 1975, the tightness of the labour market is still not translating into the sort of wage growth that we would normally be seeing with such few people out of work. It's therefore hard to make the case that wage growth will spike higher, warranting higher interest rates, any time soon.

Modest uptick in earnings

Data from the Office for National Statistics showed regular employee earnings rising 2.1% in the three months to June compared to 2.0% in the three months to May. Earnings growth was a similar 2.1% if bonuses are included, up from 1.9%. Inflation is running at 2.6%, meaning wages continue to fall 0.5% in real terms, but the uptick in earnings growth at least means real wages are falling at a reduced rate compared to earlier in the year. Our suspicion is, however, that inflation will pick up again in coming months, further squeezing household budgets.

Strong job gains

The good news is that employers continue to take on extra staff in encouraging numbers, suggesting firms remain in expansion mode despite heightened uncertainty surrounding Brexit. Employment rose by a solid 125,000 in the second quarter.

REC recruitment survey

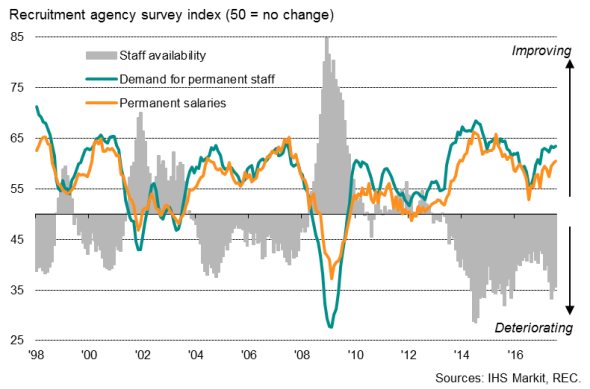

The REC recruitment industry survey also shows the labour market's strength persisted into July. Agencies reported that the number of people placed in permanent jobs rose at the fastest rate since April 2015, and temporary employment showed the largest monthly rise since February 2015. Demand for staff from employers was reportedly growing at one of the strongest rates seen over the past two years.

Limited scope for rate hike

The survey also found salaries awarded to new staff rising at the steepest rate for over one-and-a-half years as employers competed to attract candidates in the face of widespread skill shortages. The availability of suitable staff continued to deteriorate at one of the steepest rates seen in the survey's twenty-year history.

The lack of wage growth in the economy as a whole suggests, however, that it's only new staff that are able to negotiate higher pay. Staff not changing jobs appear to be generally settling for below-inflation pay reviews, most likely as employers seek to keep wage costs down to offset rising input prices, which can in turn be at least partly blamed on the weakened exchange rate continuing to drive up the cost of imported materials. As long as this situation persists, the chance of the Bank of England raising interest rates remains low.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16082017-Economics-UK-labour-market-strength-generates-only-meagre-wage-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16082017-Economics-UK-labour-market-strength-generates-only-meagre-wage-growth.html&text=UK+labour+market+strength+generates+only+meagre+wage+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16082017-Economics-UK-labour-market-strength-generates-only-meagre-wage-growth.html","enabled":true},{"name":"email","url":"?subject=UK labour market strength generates only meagre wage growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16082017-Economics-UK-labour-market-strength-generates-only-meagre-wage-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+labour+market+strength+generates+only+meagre+wage+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16082017-Economics-UK-labour-market-strength-generates-only-meagre-wage-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}