Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 16, 2015

European HY outperforms global bond market

European high yield bonds have outperformed global bond sectors in 2015 so far with UK high yield leading the way, but investors are beginning to return to the US market.

- GBP high yield bonds have returned 3.7% in 2015, led by Odeon, Aston Martin bonds

- Euro single B has been the best performing rating group; returning double that of BB

- US high yield investor sentiment has reversed; biggest ETF weekly inflow since February

European high yield markets have been one of the bright spots in global bond markets this year. The European high yield market is much smaller and less developed than its US counterpart, in part due to borrowers' greater reliance on bank funding. But this gap is beginning to close as more corporations take advantage of accommodative European monetary policy.

With QE set to continue till at least September 2016, investors have been flocking towards the asset class, with the iShares Euro High Yield Corporate Bond ETF (IHYG) seeing net inflows this year and $4.1bn of AUM at the latest count. However it's worth noting that this figure only represents 8% of the high yield ETF market, which remains dominated by US listed products.

Performance

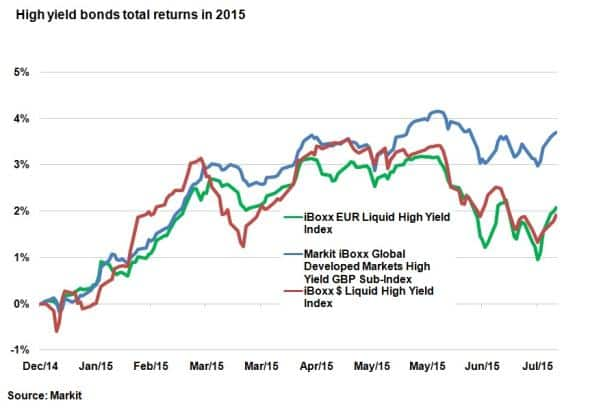

Very few bond sectors have outperformed European high yield on a total return basis so far this year. In Europe, while sovereigns and investment grade corporates have slipped into negative territory, high yield bonds have managed to hang onto gains made at the start of the year.

The iBoxx EUR Liquid High Yield Index has returned 2.08% so far this year, 16bps more than US high yield, as represented by the iBoxx $ Liquid High Yield Index.

But the best performing high yield market in Europe has been in the UK, with the Markit iBoxx Global Developed Markets High Yield GBP Sub-Index returning 3.7% in so far this year. There currently isn't an ETF that tracks UK high yield.

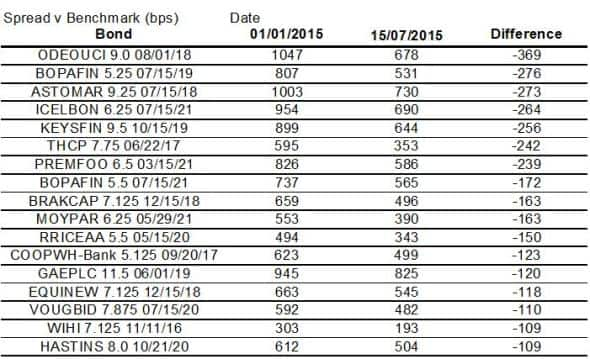

18 bonds in the 46 constituent Markit iBoxx Global Developed Markets High Yield GBP Sub-Index have seen a 100bps decline in benchmark spreads so far this year. Led by names such as Odeon, whose 9% 2018 bond saw a 369bps decline, Boparian finance

(-275bps), and car maker Aston Martin's 9.25% 2018 bond (-272bps.)

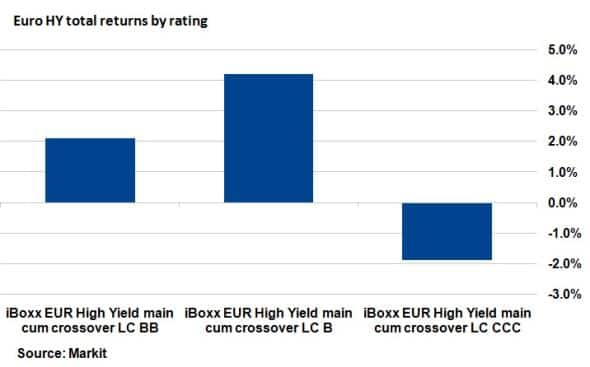

Within the larger euro denominated high yield universe, one rating group stands out above the rest: bonds rated single B. Interestingly, This rating grade has returned double than that of bonds rated one notch higher, while CCC rated bonds have seen negative total returns.

US comeback

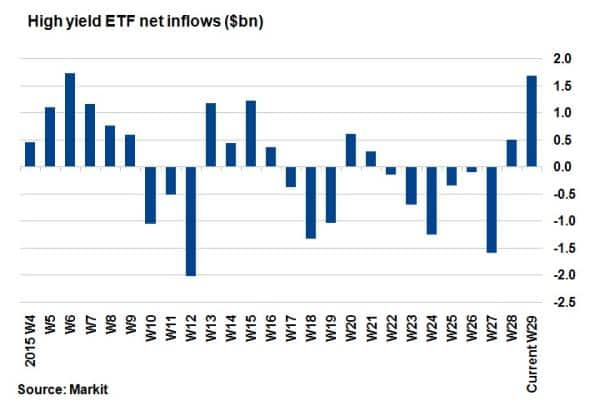

While European high yield has outshone the US so far this year, if investor sentiment is anything to go by, the second half of this year may provide a new trend.

After experiencing six consecutive weeks of net outflows, US high yield ETFs are back in favour with inflows totalling $1.7bn; the biggest inflow in a single week since February. For income investors, US high yield still provides an annual yield of 6.36%, according the Markit iBoxx $ Liquid High Yield Index, which is greater than sterling (5.46%) and euro (4.25%) high yield.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16072015-Credit-European-HY-outperforms-global-bond-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16072015-Credit-European-HY-outperforms-global-bond-market.html&text=European+HY+outperforms+global+bond+market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16072015-Credit-European-HY-outperforms-global-bond-market.html","enabled":true},{"name":"email","url":"?subject=European HY outperforms global bond market&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16072015-Credit-European-HY-outperforms-global-bond-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+HY+outperforms+global+bond+market http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16072015-Credit-European-HY-outperforms-global-bond-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}