Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 16, 2016

Week Ahead Economic Overview

In a week that sees the UK vote on whether or not to remain in the European Union, PMI data will give guidance on global economic trends in June. US durable goods orders and consumer sentiment figures will add insight into whether the Fed will hike interest rates again in 2016, and the Bank of Japan publishes minutes from its latest monetary policy meeting, which will be scoured for clues as to whether policymakers will chose to add more stimulus next month.

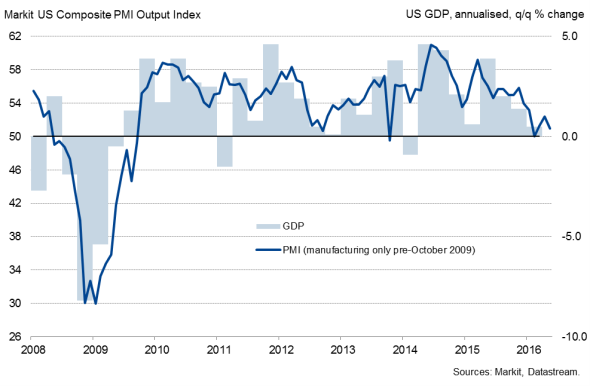

A slowing US labour market paired with uncertainties arising from the EU referendum on 23rd June resulted in the Federal Reserve keeping interest rates unchanged at its June meeting. However, the bank kept the door open for further rate hikes as early as July, stating that "growth in economic activity appears to have picked up". Policy makers will therefore keep an eye on the data flow in coming weeks, with flash PMI results for June providing the first insight into economic trends over the second quarter as a whole. Analysts will want to see an uptick in the pace of growth after May's survey results pointed to a disappointingly weak expansion.

US GDP and the PMI

The release of the Reuters/Michigan Consumer Sentiment Index and the Johnson Redbook Index will also provide more information on how households are faring in the second quarter, while durable goods orders numbers are viewed for signs of manufacturing performance. Durable goods orders rose 3.4% in April and are expected to have fallen 0.8% in May.

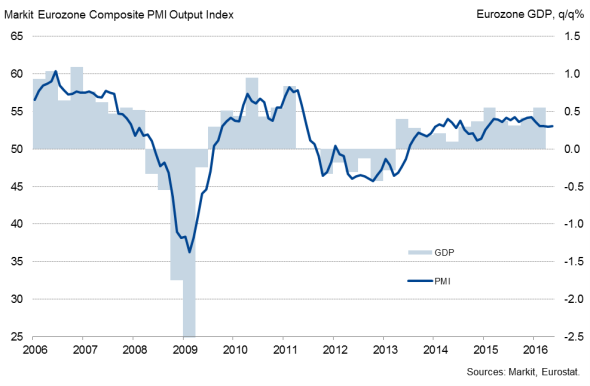

The release of flash PMI results for June will meanwhile provide analysts with the first complete picture of eurozone growth trends in the second quarter. The May survey pointed to the region's economy remaining on a subdued growth path, with GDP growth likely to have slowed from the impressive start to the year. Meanwhile, the European Commission updates its Consumer Confidence Index. May data signalled the highest level of confidence for four months, thereby highlighting that, despite uncertainty stemming from the EU referendum, consumers were more optimistic about the next few months than they were before.

Eurozone GDP and the PMI

Other important releases in the currency union include Ifo's Business Climate Index for Germany, retail sales and industrial orders numbers in Italy and INSEE business climate data in France.

Over in Japan, flash PMI results are released alongside minutes from the Bank of Japan's June meeting. The bank decided to hold rates steady amid uncertainty due to Brexit, but there is still a strong likelihood that monetary policy will be loosened at some point this year. Core consumer prices fell 0.3% in April and survey data suggest that the Japanese economy slid back into decline in the second quarter, thereby adding to signs that more stimulus is needed. Flash manufacturing PMI results are released on Thursday and will provide analysts with important information on industry trends in June.

Monday 20 June

Japan's Ministry of Finance publishes trade data for May.

Russia sees the release of retail sales, unemployment and real wages data alongside monthly GDP numbers.

Eurostat publishes construction output numbers for the euro area.

Producer price figures are issued in Germany.

In Canada, wholesale trade data are out.

Tuesday 21 June

House price data are released by the Australian Bureau of Statistics.

The Bank of Japan publishes minutes from its last monetary policy meeting.

ZEW issues latest economic sentiment numbers for Germany.

Public sector net borrowing data are meanwhile out in the UK.

The Johnson Redbook Index is published in the US.

Wednesday 22 June

India sees the release of M3 money supply information.

Inflation numbers are issued in South Africa.

The European Commission publishes preliminary June consumer confidence data for the eurozone.

The Office for National Statistics releases public sector finances data in the UK.

Retail sales figures are meanwhile updated in Canada.

In the US, mortgage and FHFA home price data are issued.

Thursday 23 June

Flash PMI results are published in Japan, the eurozone and the US.

French business climate data are updated by INSEE.

Industrial orders and trade numbers are released in Italy.

Initial jobless claims figures are issued in the US.

Friday 24 June

Bank lending data are issued in India.

Germany sees the release of import price and Ifo business climate numbers, while retail sales and wage inflation figures are out in Italy.

In the UK, BBA mortgage approval data are published.

Current account numbers are meanwhile updated in Brazil.

The US sees the release of building permit and durable goods orders figures and the latest Reuters/Michigan Consumer Sentiment Index.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}