Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 16, 2016

UK retailers enjoy spring surge in sales

UK retail sales surged higher in May in a sign that consumer spending continues to boost the economy.

Sales surge

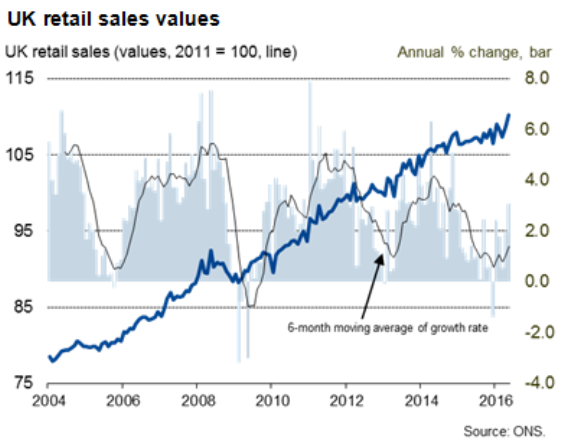

Sales in volume terms rose 0.9% during the month, up some 6.0% compared with a year ago, according to the Office for National Statistics. Excluding petrol, sales were 5.7% higher than a year ago, the best performance seen since last September. April's data were also revised higher to show 5.2% annual growth, rising 1.9% compared to March.

Sales growth is being helped by falling prices. The 6.0% leap in sales volumes assumes a 2.8% drop in average prices compared to last year, which suggests that sales are being fuelled by aggressive price discounting.

This continues a trend that has been clearly visible over recent years as consumers have enjoyed widespread discounting and low inflation. Over the past three years, sales in value terms have risen by just 7.8%, but once falling prices have been taken into account, the ONS estimates that sales volumes have risen 14.5% over this period.

However, this is not just about discounting: there was strong growth also seen in sales values, up 3.1% on a year ago. This can be linked to better weather but also labour market improvements and of course low interest rates.

Better weather certainly played a clear role in May, encouraging shoppers to buy summer clothing. Clothing sales rose 4.3% compared to April. The sales upturn also follows yesterday's good news on the labour market, which showed unemployment dropping to a near eleven-year low in April, suggesting that rising employment and wage growth are also feeding through to increased sales.

The boon to retailers from the improving labour market, reviving income growth, low inflation and record low interest rates is something that Markit's Household Finance Index survey indicates persisted into June, suggesting that consumers will make a strong contribution to economic growth in the second quarter.

Excluding fuel, retail sales are running 2.0% higher than the first quarter. However, retail sales are a poor indicator of economic growth. The worry remains that other aspects of the economy, notably business spending and investment, will have acted as a drag, not least due to rising worries about Brexit.

Data worries

We do also have concerns relating to the data. Note that the total value of online sales was reported up an eye-opening 21.5% on a year ago, rising 6.4% compared to April. Such growth, even if correct, looks unsustainable.

Data from Visa, which cover total consumer spending rather than just retail sales, showed spending growth slowing to an annual rate of 0.8% in May, its weakest rise since February 2014, despite seeing a similar jump in clothing sales to that recorded by the ONS. Visa e-commerce data showed a mere 2.3% annual increase, with face-to-face spending falling 0.8% compared to last year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-UK-retailers-enjoy-spring-surge-in-sales.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-UK-retailers-enjoy-spring-surge-in-sales.html&text=UK+retailers+enjoy+spring+surge+in+sales","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-UK-retailers-enjoy-spring-surge-in-sales.html","enabled":true},{"name":"email","url":"?subject=UK retailers enjoy spring surge in sales&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-UK-retailers-enjoy-spring-surge-in-sales.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+retailers+enjoy+spring+surge+in+sales http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Economics-UK-retailers-enjoy-spring-surge-in-sales.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}