Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 16, 2016

ASEAN government bonds outperform amid fears

Asian credit hasn't been immune from the heightened market volatility experienced so far this year, but local currency government bonds in the ASEAN region have so far proved rewarding.

- Markit iBoxx AHBI Index's spread is now 521bps over US treasuries; the widest since inception

- Markit iBoxx ALBI Indonesia index has outperformed US treasuries by 2.4% so far this year

- ASEAN local currency bonds have also outperformed developed market IG corporate bonds

A waning outlook for the US economy, further commodity related credit pressures and turmoil among European banks has seen global market volatility continue into 2016.

Heightened credit risk

Despite a somewhat brighter outlook following last week's Chinese New Year celebrations, Asian credit markets have not been immune to the heightened level of credit risk seen in global markets this year.

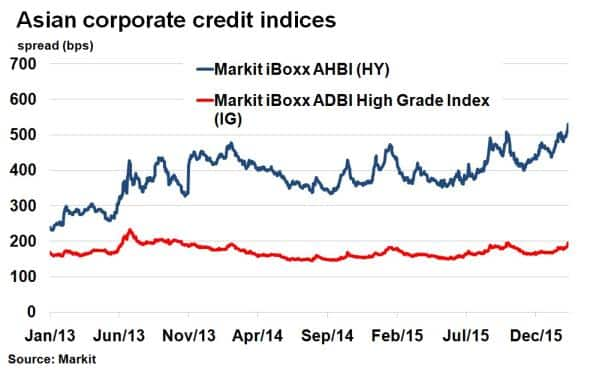

The Markit iBoxx AHBI Index, made up of US dollar denominated high yield (HY) bonds in the Asian region, has seen its spread over US treasuries widen to 521bps; the widest since the index's inception. Investment grade (IG) corporate bonds bond have also shared a similar fate, with the Markit iBoxx ADBI High Grade Index touching its widest levels since last summer's China and emerging market induced market volatility.

Asia stands tall

Despite the rise in Asian corporate credit risk, one of the bright spots in global fixed income markets has been ASEAN region sovereign bonds. The recent bounce in macroeconomic sentiment, the potential for more global monetary stimulus, relatively depressed valuations (stemming from mid-2015's de-risking) and a shift in fears towards developed markets has seen the ASEAN region lead bond returns.

Certain parts of the region have even outperformed perceived "safe haven", risk-free assets such as US treasuries and German bunds, on a total return basis so far this year.

According to Markit iBoxx Asian Local Bond Indices (iBoxx ALBI), the Markit iBoxx ALBI Indonesia index has outperformed the Markit iBoxx $ Treasuries index by 2.4% so far this year on a total return basis. Even German bunds, which have seen their 10-yr yields plummet, have not managed to outperform Indonesian government bonds, which are currently rated BBB (on the cusp of investment grade).

Eliminating currency differences, the Markit iBoxx USD Asia ex-Japan Indonesia Sovereigns index has returned 1.5% so far this year. But currency fluctuations have however benefitted other ASEAN countries such Malaysia and the Philippines, whose US dollar denominated sovereign debt has outperformed US treasuries by

The ASEAN region has also had strong returns versus similar rated developed region investment grade corporate bonds. According to Markit's iBoxx indices, IG US dollar (iBoxx $ Corporates and Euro (iBoxx " Corporates) denominated bonds have returned negative this year.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022016-credit-asean-government-bonds-outperform-amid-fears.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022016-credit-asean-government-bonds-outperform-amid-fears.html&text=ASEAN+government+bonds+outperform+amid+fears","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022016-credit-asean-government-bonds-outperform-amid-fears.html","enabled":true},{"name":"email","url":"?subject=ASEAN government bonds outperform amid fears&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022016-credit-asean-government-bonds-outperform-amid-fears.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ASEAN+government+bonds+outperform+amid+fears http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022016-credit-asean-government-bonds-outperform-amid-fears.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}