Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 16, 2015

Australia and its falling dollar

The Australian dollar has devalued against the US dollar, sending short sellers covering mining and materials positions as the currency movement improves cost structures and revenues for local operators.

Australian currency ETF bets pay off as AUD depreciates 13% in second half of 2014 and 4.3% year to date Currency movements positive for smaller non-iron ore firms, with a 28% decline in average short interest Decline in short interest driven by gold miners benefiting from a weaker currency and recent gold price rally Red Australian soil

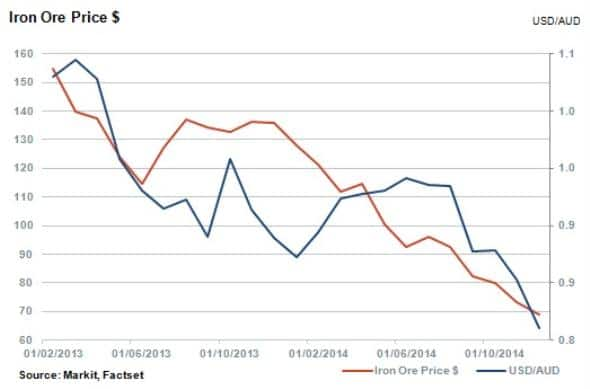

Australia has been battling slumping commodity markets as declining prices fetched for the nation’s most prolific exports; iron ore, coal and liquefied natural gas, put the brakes on the country’s economic engine. The more than 50% price collapse in iron ore occurred as demand from the country’s largest customer, China, cools amid a global excess in supply.

Australian miners are partly responsible for iron ore price movements, as production continues to ramp up. Analysts expect lower price levels to persist for another four years during the global supply glut, which could reach a 300 million ton surplus by 2017.

The Reserve Bank of Australia lowered interest rates by 25bps in February 2015 to 2.25%, an all-time low. It was the first rate movement for the country in 18 months as the central bank attempts to support the economy by providing further weakness to the Australian dollar to support the mining sector.

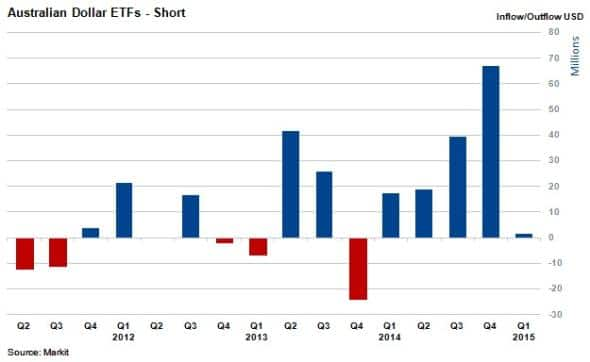

Investors who were betting that the Australian dollar would in fact weaken have hit pay dirt in recent months. Evidence of this was the strong inflows into ETFs which provide short exposure to the Australian dollar through long positions in other currencies. This group of ETFs saw material inflows occur in the last two quarters of 2014

.Materials sectors sees sharp decline in short interest

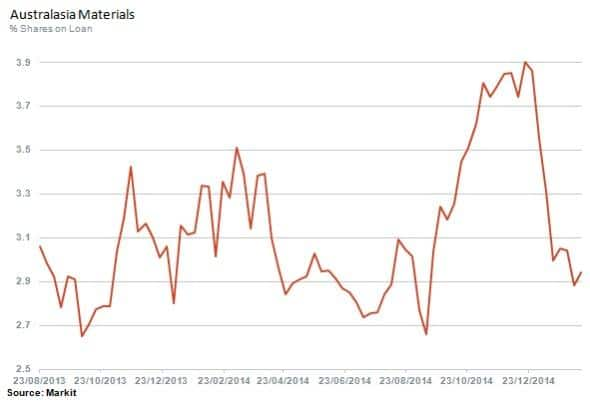

Average short interest for the Australian materials sector has declined by 28% since December 2014.

With drastically lower prices being realised on output compared to six months prior, short interest for the sector peaked at 3.9% in December 2014, and currently sits at 2.8%.

Smaller companies operating in the sector represent the majority of movements in average short interest. The majors, namely BHP Billiton and Rio Tinto, represent roughly 80% of the listed market in Australia and have actually seen short interest increase in the last month. These two companies currently have 0.7% and 0.3% of shares outstanding on loan respectively compared to the much higher average among smaller companies.

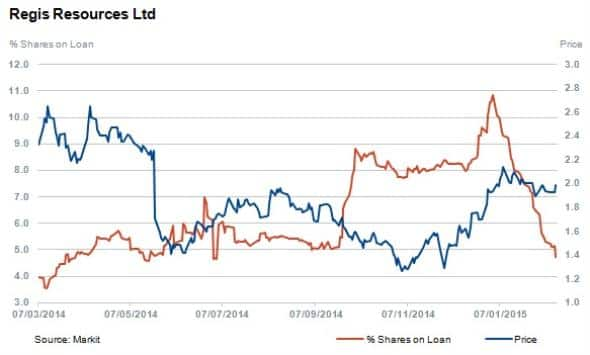

One smaller company in the sector that has seen the largest decrease in shares outstanding on loan is Regis Resources. The firm has seen a decline of 41% in short interest in the last month to hit 4.7% at present.

The Australian based gold producer, due to release earnings next month, has seen consensus forecasts raised and is benefiting from both a weak Australian dollar and a recent rally in the gold price.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-equities-australia-and-its-falling-dollar.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-equities-australia-and-its-falling-dollar.html&text=Australia+and+its+falling+dollar","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-equities-australia-and-its-falling-dollar.html","enabled":true},{"name":"email","url":"?subject=Australia and its falling dollar&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-equities-australia-and-its-falling-dollar.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australia+and+its+falling+dollar http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-equities-australia-and-its-falling-dollar.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}