Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 15, 2016

Finding outperforming European sectors in an inflationary environment

Survey data highlight how a strengthening European economic recovery in the fourth quarter is being accompanied by rising price pressures, something which may well intensify as oil prices rise. The EU Manufacturing PMI Input Prices Index has already risen to 61.2 in November, its highest since June 2011. In this note we look at how investors can use PMI data to seek outperforming sectors in this environment.

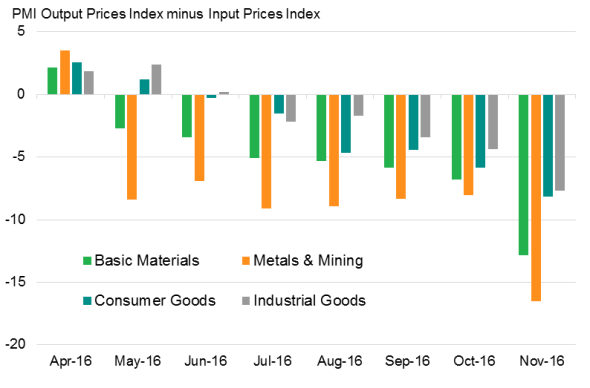

Metals & Mining facing toughest squeeze

Looking at more details for the sectors, it appears that some sectors are more exposed than others. With a difference of -12.8 between the PMI Output Prices Index and Input Prices Index in November, the Basic Materials sector reported the most severe squeeze on its margins. The main reason indicated by companies for the inflationary environment is rising raw material costs, notably metals and oil. Logically, within the Basic Materials sector, Metals & Mining companies suffered the biggest squeeze (-16.5).

Margin squeeze

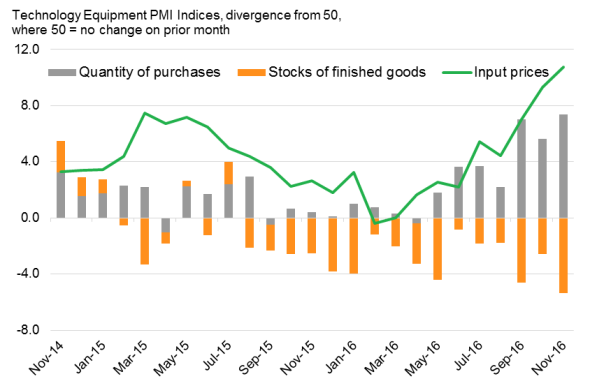

Technology Equipment well prepared

Despite this negative influence for the manufacturing sector overall, some of the sub-sectors remain very positive on fundamentals. The best case-study this month is the Technology Equipment sub-sector. With a positive change for the Quantity of Purchases Index and negative for the Stock of Finished Goods Index, coupled with increased inflows of new orders (suggesting purchasing activity is picking up to boost production and replenish deleted warehouse inventories), the sub-sector is suggesting a promising outlook in the short-term. Therefore, it appears that the Technology Equipment sub-sector is currently well positioned to face the inflationary risks and compensate for the margin reduction by potentially selling more goods.

Tech sector

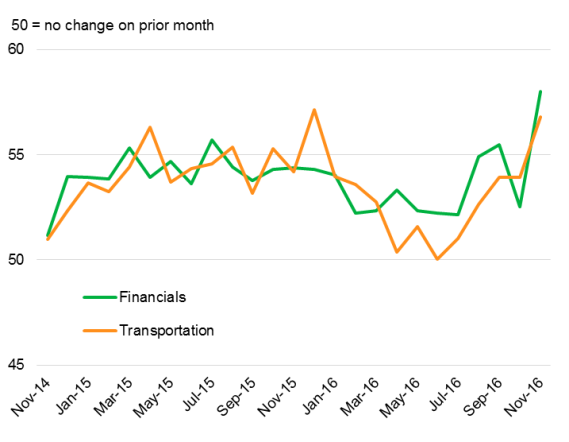

Service sector alternatives

Another way for the investors to hedge the rise in cost-push inflation led by commodity prices would be to diversify exposure towards the service sector. Less sensitive to raw materials fluctuations by nature, service providers can provide exposure to the global growth recovery without a significant risk of surging input prices. The Financials and Transportation sectors are showing particularly encouraging signs in terms of potential growth. The PMI Incoming New Business Indices are respectively at 58.0 and 56.8, which represents a nine-year high for Financials and the second-best reading in over nine years for Transportation. While the Transportation sub-sector is experiencing positive potential, the sector does suffer from its exposure to oil prices.

PMI inflows of new business for selected sectors

Subscribe to Sector PMI data

The current PMI indices overall show positive signs across the majority of sectors in terms of quantity of purchases and new orders for companies. However, inflationary pressure continue to build and the risk of companies seeing their margins reduced is accelerating every month. It is therefore critical to diversify the growing inflation exposure with industries less exposed or with a strong sales outlook. PMI Sector data provide priceless metrics for the Europe area and will allow you to compare over 30 different broad and detailed sectors.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Finding-outperforming-European-sectors-in-an-inflationary-environment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Finding-outperforming-European-sectors-in-an-inflationary-environment.html&text=Finding+outperforming+European+sectors+in+an+inflationary+environment","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Finding-outperforming-European-sectors-in-an-inflationary-environment.html","enabled":true},{"name":"email","url":"?subject=Finding outperforming European sectors in an inflationary environment&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Finding-outperforming-European-sectors-in-an-inflationary-environment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Finding+outperforming+European+sectors+in+an+inflationary+environment http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15122016-Economics-Finding-outperforming-European-sectors-in-an-inflationary-environment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}