Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 15, 2014

Industrial production growth in China weakens to post-crisis low

Official data showed growth of industrial production slowing sharply in August, dropping to the lowest for almost six years. The data raise the likelihood of the Chinese authorities taking further action to prevent a further cooling in the pace of economic growth.

Factory output was just 6.9% higher than a year ago in August, according to the National Bureau of Statistics, the weakest annual rate of growth seen since December 2008 and down sharply from 9.0% in July.

Alarm bells about the possibility of a sharper than previously expected slowdown in China's factories were also rung by official data showing electricity production falling for the first time in four years, dropping 2.2% in August.

The NBS blamed the weakness on subdued demand from emerging markets and the recent downturn of the domestic housing market. Property sales were down 8.9% on a year ago in August.

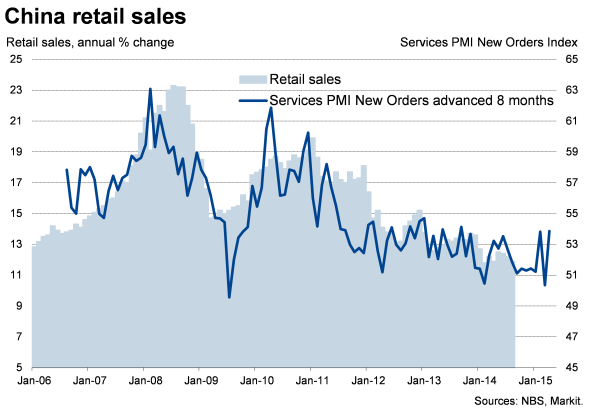

The disappointing data add to other signs of a slowing in the pace of economic growth. Retail sales were just 11.9% higher than a year ago in August, representing one of the weakest annual growth rates seen over the past decade.

Inflationary pressures have also cooled alongside the slowing economy, which at least provides policymakers with leeway to implement more stimulus measures to revive the economy. Consumer prices rose at an annual rate of just 2.0% in August, down from 2.3% in July, while factory prices fell 1.2% compared to a year ago.

The data add to fears that the government may miss its 7.5% growth target for this year. However, Markit's PMI data, produced for HSBC, provide some reassurance that the slowdown is perhaps not as marked as the latest industrial production numbers suggest.

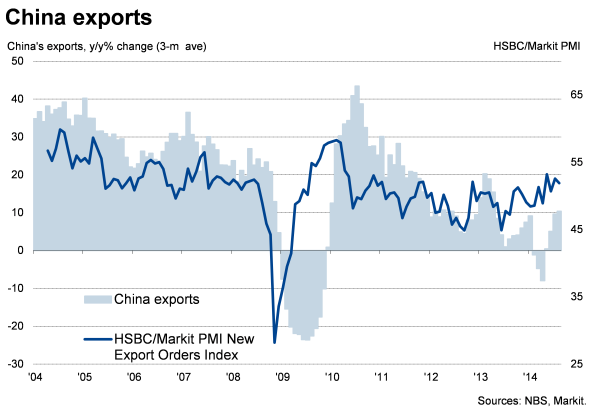

PMI data on exports, for example, have signalled a relatively robust pace of increase so far this year, an upturn that is now being confirmed by official data. Official exports rose 9.4% on a year ago in August, with data showing the strongest trend since April of last year.

PMI data on new orders in the domestically-focused service sector, which tend to lead annual growth of retail sales, also rebounded markedly in August from a near post-crisis low in July.

However, although signalling an improvement on the particularly tepid growth seen earlier in the year, the PMI surveys suggest the overall pace of economic growth will be modest in the third quarter. Alongside the disappointing official data, the weak surveys add to the likelihood of the Chinese authorities taking further action to boost economic growth following the mini stimulus announced earlier in the year. Possible measures are a cut to interest rates and further action to boost bank lending.

On the other hand, the authorities may see the current situation as a short-term symptom of the planned rebalancing of the economy away from domestic investment and factory production, and that such stimulus measures may merely exacerbate the current problems facing the Chinese economy.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-Industrial-production-growth-in-China-weakens-to-post-crisis-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-Industrial-production-growth-in-China-weakens-to-post-crisis-low.html&text=Industrial+production+growth+in+China+weakens+to+post-crisis+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-Industrial-production-growth-in-China-weakens-to-post-crisis-low.html","enabled":true},{"name":"email","url":"?subject=Industrial production growth in China weakens to post-crisis low&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-Industrial-production-growth-in-China-weakens-to-post-crisis-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Industrial+production+growth+in+China+weakens+to+post-crisis+low http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-Industrial-production-growth-in-China-weakens-to-post-crisis-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}