Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 15, 2017

Japan second-quarter GDP at strongest for over two years

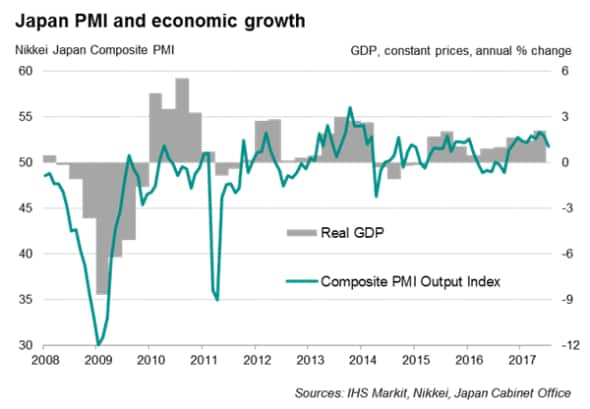

Japan's economy expanded at the fastest rate for over two years during the second quarter, marking a sixth successive quarter of growth, thanks to improving domestic demand. Further growth is signalled at the start of the third quarter, according to the latest PMI surveys, albeit with signs of some loss of momentum.

Data from the Cabinet Office of Japan showed that an annualised growth rate of 4.0% was recorded for the three months ending June, far exceeding the consensus forecast (2.5%) and representing the quickest pace since the opening quarter of 2015. The latest data also indicated a significant pick up from the 1.5% rate of expansion seen in the first quarter. On an annual basis, Q2 GDP growth was at 2.1%, up from 1.4% in the previous quarter.

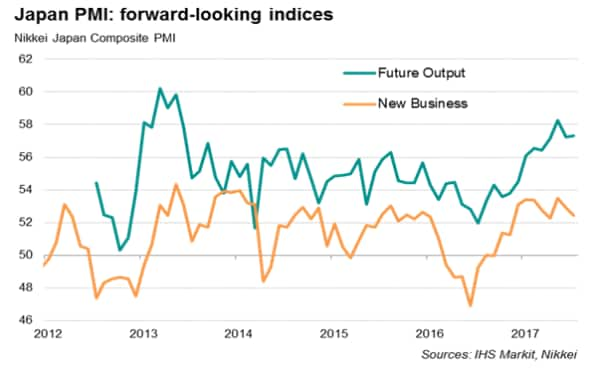

Although above consensus, the robust expansion in the second quarter had been signalled well in advance by the Nikkei PMI surveys, which had also accurately foretold of the broadening out of the upturn towards domestic consumption. Alongside an expanding manufacturing base, the PMI surveys have indicated the fastest growth of service sector activity for around four years in recent months, the latter buoyed by rising consumer and corporate demand for services.

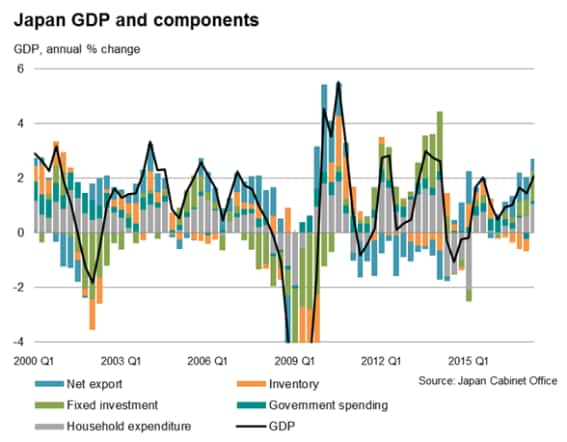

Like the surveys, the GDP data indicated a shift in growth engines in the latest upturn: the external economy played a smaller role as domestic demand took off. Private consumption and business investment provided greater support to overall GDP growth compared with the past few quarters. That said, the smaller contribution from net exports to GDP was linked to a faster annual rise in imports (which accompanied increased domestic consumption), which in turn led to the largest trade deficit for three quarters.

Stronger domestic demand

Encouragingly, a 4.8% annual rise in business investment " the strongest in just over three years " indicated greater risk taking amid growing business optimism; something that the PMI surveys have also been showing.

While a loss of growth momentum is being signalled at the start of the third quarter, Japanese firms believed the slowdown is temporary; expectations about future output, especially in the manufacturing sector, were among the best for four years. There is further evidence of rising optimism from firms' intentions to increase capital spending over the next 12 months, according to the IHS Markit Japan Business Outlook.

Overall, the official and survey data paint a picture of a strengthening economy that is seeing a broadening growth base. Economic activity is being increasingly supported by domestic demand, including rising household consumption, which is clearly good for raising inflationary pressures. But a recent easing in growth momentum, particularly in manufacturing, could weigh on GDP expansion if the slowing persists in coming months. We'll know more about how Japan's manufacturing sector fares this month with next week's flash PMI numbers, out on 23 August.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082017-economics-japan-second-quarter-gdp-at-strongest-for-over-two-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082017-economics-japan-second-quarter-gdp-at-strongest-for-over-two-years.html&text=Japan+second-quarter+GDP+at+strongest+for+over+two+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082017-economics-japan-second-quarter-gdp-at-strongest-for-over-two-years.html","enabled":true},{"name":"email","url":"?subject=Japan second-quarter GDP at strongest for over two years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082017-economics-japan-second-quarter-gdp-at-strongest-for-over-two-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+second-quarter+GDP+at+strongest+for+over+two+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082017-economics-japan-second-quarter-gdp-at-strongest-for-over-two-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}