Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 06, 2014

Russian ETPs see outflows

Despite holding steady in the opening months of the Ukraine crisis, investors are now turning away from Russian assets in the wake of the recent wave of sanctions.

- Russian focused ETFs have seen ten straight weeks of net outflows

- Short sellers are congregating on mining firms Petropavlosk and Evraz

- Yandex so far appears untroubled by the recent political unrest

The mounting tension in Ukraine has seen harsh measures imposed on high ranking Russian officials and the institutions they control. This, along with far ranging sanctions forbidding the import of technology into the country and blocking their financial institutions from capital markets both in the US and Europe, has seen a dramatic shift in investor sentiment. With no sign of any swift resolution to the situation, we reveal the details of the recent bout of negativity in the country's assets.

ETF outflows

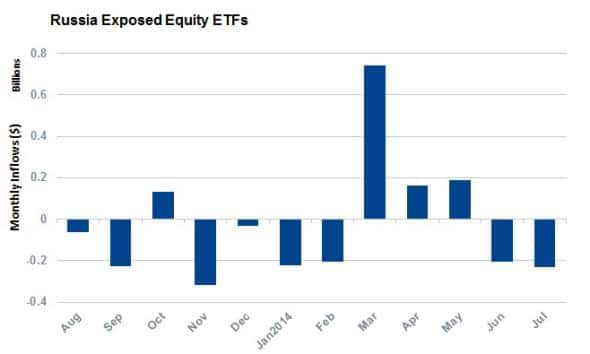

The continuing civil unrest in Eastern Ukraine looks to be lessening the appetite for Russian assets. Russian focused ETPs have seen ten straight weeks of net outflows as the conflict looks increasingly entrenched. These outflows have only intensified with the attack on Malaysian Airlines flight MH17, whose downing marked the largest weekly outflow out of Russian ETFs in over six months.

While the previous chapter in the Ukrainian saga actually saw investors increase their holdings in Russian ETFs, it seems that the country's continuing role in the crisis has started to test investors' patience.

The large outflows out of Russian assets over the last two months have now topped $400m, wiping out the inflows seen in April and May when investors saw the falling value of Russian assets as a buying opportunity.

Leading the way in outflows over the last few weeks has been the Source RDX UCIT which has lost over $100m of assets in July, essentially halving the fund's aggregate AUM in the last eight weeks.

US based investors are also wasting little time unloading Russian assets as the Market Vectors Russia ETF Trust, the largest Russian focused ETF, saw $90m of outflows in July.

Shares also targeted

On the individual share side, the recent sanctions and potential new ones could see a further breakdown in business relationships between the west and Russia. This looks set to put companies domiciled in the UK with large operations in Russia in an uncomfortable situation. As a result, we've seen large jumps in shorting activity in Petropavlovsk and Evraz over the last few days.

Petropavlovsk saw the largest amount of shorting as demand to borrow shares more than doubled to 16% of shares outstanding, up from 6% a week ago.

Steel firm Evraz has also seen a resurgence in demand to borrow with the percentage of its shares out on loan jumping by 50% in the last week, reaching its highest level since the start of the conflict.

Shorts steer clear of Yandex

Interestingly, the recent developments do not appear to have affected the country's largest internet search provider, as Yandex shares have actually seen a decline in short interest over the last couple of weeks. Demand to borrow shares in the firm is down by nearly two thirds in the last week to less than 1% of shares outstanding.

Andrew Laird | Securities Finance Analyst, Markit

Tel: +1 646-312-8990

andrew.laird@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082014Russian-ETPs-see-outflows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082014Russian-ETPs-see-outflows.html&text=Russian+ETPs+see+outflows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082014Russian-ETPs-see-outflows.html","enabled":true},{"name":"email","url":"?subject=Russian ETPs see outflows&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082014Russian-ETPs-see-outflows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russian+ETPs+see+outflows http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15082014Russian-ETPs-see-outflows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}