Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 15, 2015

M&A helps HY bonds; long dated bonds selloff

The recent bond market volatility continued this week, but high yield bonds have continued to avoid the worse of the slump as assisted by M&A activity.

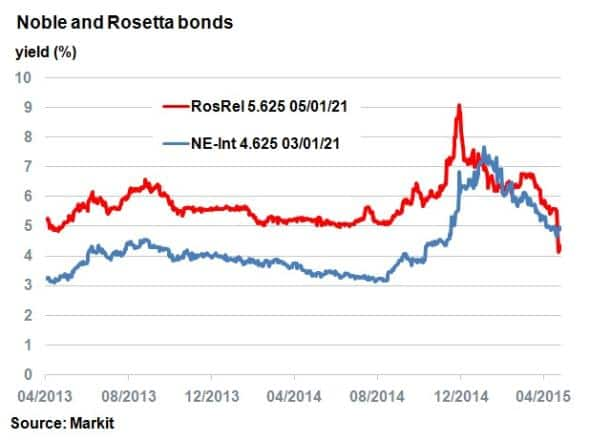

- Shale driller Rosetta saw its bonds surge as Noble Energy announced acquisition

- Oracle bond liquidity boosted by its recent ratings upgrade

- Long maturity fixed income ETFs experienced $1.36bn in outflows, wiping out 2015 inflows

Shale industry consolidates

This week saw the first major M&A transaction in the US shale oil industry, with Noble Energy buying Rosetta Resources in a $3.7bn deal. The move comes after consolidation in the wider oil & gas sector, with Royal Dutch Shell’s acquisition of BG Group last month. Further M&A activity in the shale industry is expected as small highly leveraged players struggle to maintain operations amid the global oil price slump. The recent $15 pop in WTI crude oil prices has certainly boosted confidence.

Unsurprisingly, Rosetta’s bonds rallied in the wake of the deal; the 5.625% maturing in 2021 jumped 7pts to 107.875 (cash basis), according to Markit’s bond pricing service. Yields in Rosetta’s bonds have now converged with Noble Holding’s comparable 4.625% 2021 bond. Liquidity in Rosetta’s bonds also spiked with the number of dealers quoting the Rosetta bond recently reaching a high of 19, compared to the ten day average of 15.

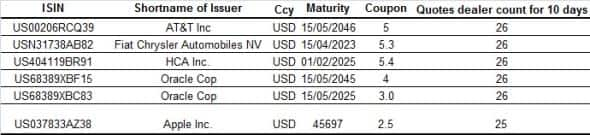

Most quoted

In the US, Technology and Telecoms bonds continue to feature heavily on the list of most highly quoted corporate bonds (ex sovereign and financials) by dealers.

Oracle Corp’s bond rating was boosted by rating agency S&P last month; this has in turn increased its bond liquidity, implied by thenumber of dealers quoting their bonds. AT&T and Apple also make the list, as investor demand for recent high quality corporate issuers remains robust.

In Europe, French cable operator Numericable is the most quoted on average over the last ten business days, with 20 dealers. Others near the top of the list are Altice and retailer Carrefour 3.875% 2021 bond.

The data, compiled by Markit’s bond pricing service, shows that the US remains the deepest market in terms of number of dealers quoting bonds. In stark contrast, Asia’s most quoted bond (China Power 4.5% 2017) has an average of 11 dealers quoting over the last ten days. This metric seems to match sentiment around Asia’s lack of corporate bond liquidity in comparison to Europe and the US.

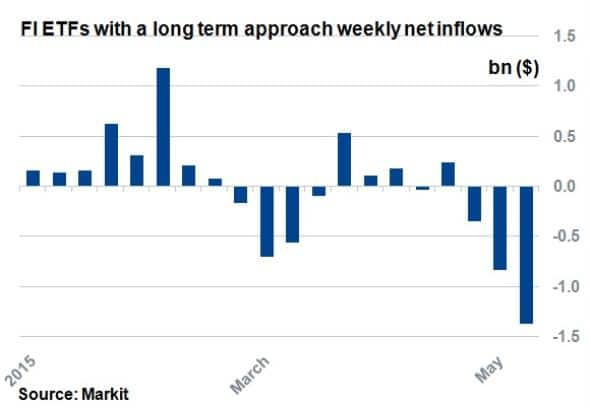

Investors back off from duration

It appears that fixed income ETFs with a long term investment approach are rapidly falling out of favour with investors. This week saw $1.36bn of outflows as investors continued to react to the global sovereign bond selloff, which had the greatest impact on long term rates. Net inflows are now negative for the first time this year. It was also the third consecutive week of outflows, with each of greater magnitude than the previous weekly selloff.

The only other period this year that experienced outflows of a similar nature was at the start of March, when investors dumped the broader fixed income market. Next week will indicate whether the selloff has curtailed or whether investors have started to rotate out of long term bonds.

Neil Mehta, Analyst, Fixed Income at Markit

Tel: +44 207 260 2298

neil.mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052015-credit-m-a-helps-hy-bonds-long-dated-bonds-selloff.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052015-credit-m-a-helps-hy-bonds-long-dated-bonds-selloff.html&text=M%26A+helps+HY+bonds%3b+long+dated+bonds+selloff","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052015-credit-m-a-helps-hy-bonds-long-dated-bonds-selloff.html","enabled":true},{"name":"email","url":"?subject=M&A helps HY bonds; long dated bonds selloff&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052015-credit-m-a-helps-hy-bonds-long-dated-bonds-selloff.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=M%26A+helps+HY+bonds%3b+long+dated+bonds+selloff http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15052015-credit-m-a-helps-hy-bonds-long-dated-bonds-selloff.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}