Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 15, 2015

Green investments pay off

Green or socially responsible investments have slowly attracted investors once again but declining energy prices and mixed results are clouding conclusions on the strategy's merits.

- Green ETFs have clawed back AUM in recent years, but still well off pre-crisis peaks

- Wind energy firm Vestas has continued to outperform despite the fall in energy prices

- US stocks with higher environmental, social and governance ratings have outperformed

Going long the environment

Socially responsible investment (SRI) and green strategies that hinge purely on providing exposure to clean energy sources have been dealt a blow over the last six months. Lower oil and associated energy prices have decreased the competitiveness of renewables as energy cost savings decrease, bringing feasibility concerns into focus.

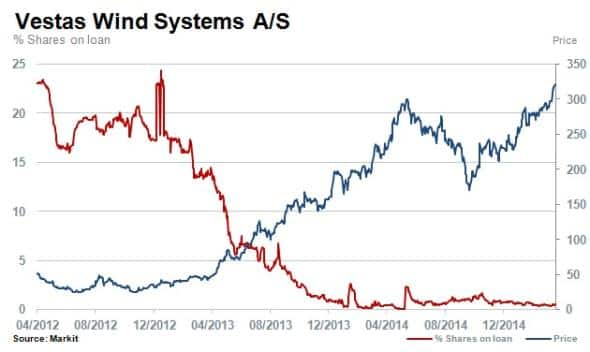

Despite these apparent setbacks, some environmental shares such as Vestas Wind systems have proven doubters wrong in recent months. Vestas shares are up over 76% in the last six months. Short sellers have also been largely mute as the percentage of Vestas shares outstanding on loan has decreased dramatically from 23% only two years ago to negligible levels of under 1% at present. Additionally, the recent rally has not seen increased appetite among short sellers.

Vestas has managed to produce annualised three year revenue growth of 11% per year. This is laudable given that more than half of these revenues were generated inside of Europe during 2014. The company posted positive earnings in 2014 and analysts are forecasting profits to grow by more than a quarter in the coming financial year.

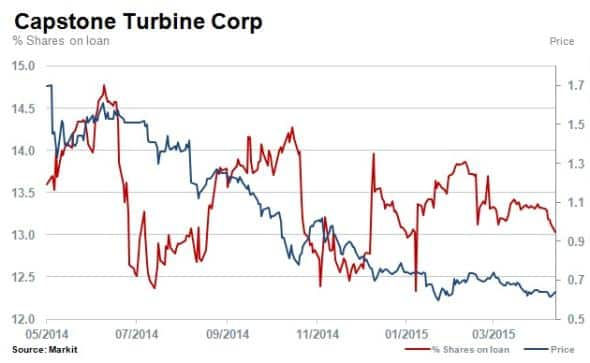

Vestas' results contrast with Capstone Turbines, which supplies low emission micro turbines for renewable and remote energy applications but ironically has a large exposure to the US and shale oil operations. The company's shares have lost 70% of their value in the last 12 months while shares outstanding on loan remain high at 13%.

Green labels

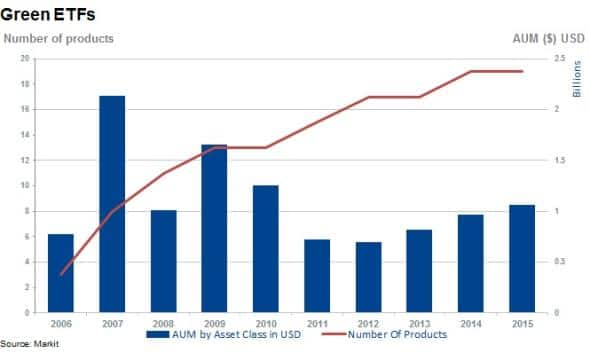

AUM for green ETFs peaked prior to the financial crisis when these funds managed just above $2bn. This niche ETF category did not exist prior to 2006 and the current 19 products now manage just over $1bn; half of the AUM registered at its record high in 2008.

ESG ratings

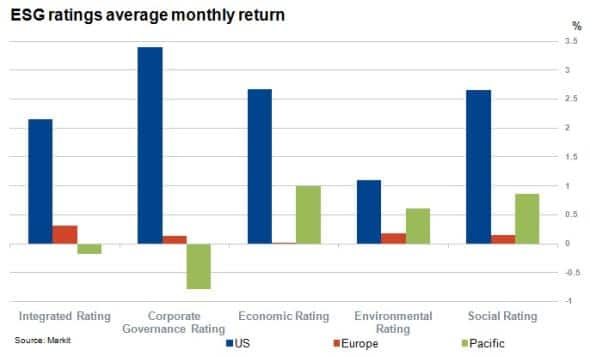

Another way to play the recent wave of green investments has been to invest in companies with good environmental, social and governance (ESG) policies, both in their business models and wider corporate philosophies. Although still early in terms of impact in financial markets as a substantial category, ESG responsible policies are starting to gain momentum particularly among investors with activist stakeholders such as university endowments.

ESG investment strategies need not come at the expense of returns, as highlighted by the ESG factor suite on the Markit Research Signal platform. This suite is comprised of factors that relate to the Principles for Responsible Investment (PRI), backed by the UN, and identifies and ranks companies based on a range of ESG criteria.

Average monthly returns among the 10% of US shares which score the highest across a range of ESG metrics have consistently outperformed those that score badly over the last three years. This outperformance holds up well across the spectrum of ESG suites which include: corporate governance, economic responsibility, environmental and social rating.

This return spread has been significant in the last three years and cumulates to over 70% for the last three years; showing that a clear investment conscience need not come at the expense of profits.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-Equities-Green-investments-pay-off.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-Equities-Green-investments-pay-off.html&text=Green+investments+pay+off","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-Equities-Green-investments-pay-off.html","enabled":true},{"name":"email","url":"?subject=Green investments pay off&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-Equities-Green-investments-pay-off.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Green+investments+pay+off http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-Equities-Green-investments-pay-off.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}