Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 14, 2015

Greek bonds rally; Chesapeake spreads widen

With a third bailout close, Greek government bonds have begun to rally, while in North America the price of oil is sending Chesapeake's credit spread sky high.

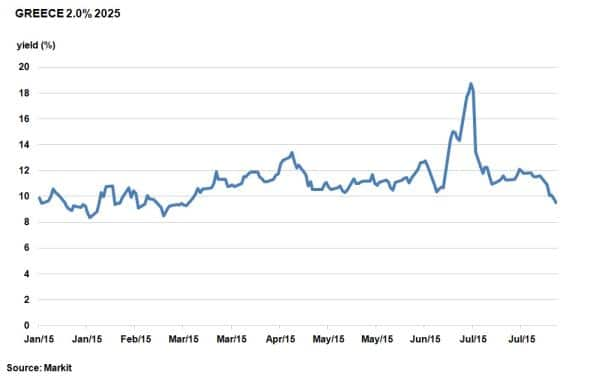

- Greece's ten year government bond yield dropped below 10% for the first time since March

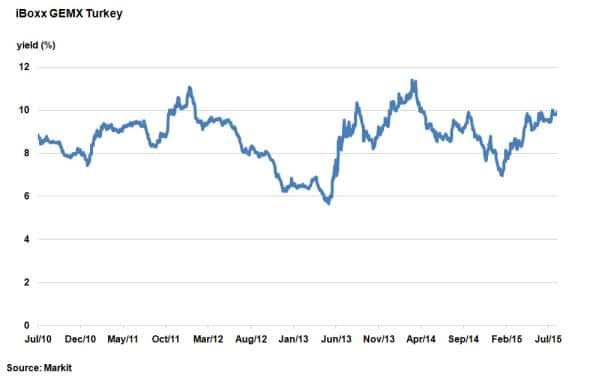

- Markit iBoxx GEMX Turkey index yield has risen 3% since mid-January

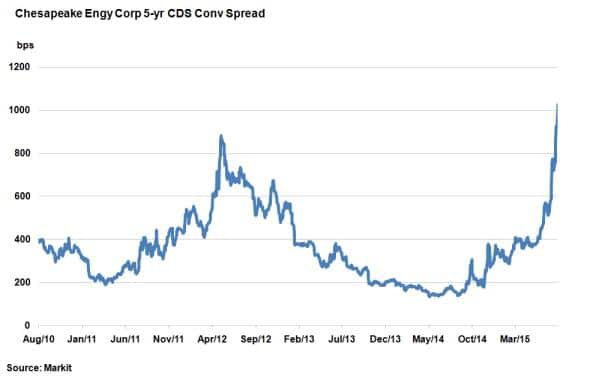

- Chesapeake's 5-yr CDS spread has widened above 1,000bps; a new five year high

Greece bailout

Greece's ruling party Syriza has passed (not without stern opposition) a vote to win parliamentary approval for a new bailout agreement with its creditors. European finance ministers will now meet today to discuss the terms, the mood between ministers is optimistic.

With the $96bn bailout imminent, bond markets have reacted positively with credit spreads tightening. Greece's government bond due 2025 has rallied, with its yield falling 200bps over the past week to 9.53%, according to Markit's bond pricing service. This fall marked the first time Greece's ten year bond yield has dropped below 10% since mid-March, but the number remains around 100bps shy of levels seen pre-Syriza.

Greek bond investors will now turn their attention to Greece's ability to implement the agreed reforms; something Greece have been guilty of not doing in the past. Added to the mix is possible political upheaval, meaning that credit markets have remain cautioned with CDS spreads still implying a 57% chance of a Greek default over the three year bailout period. The Greek economy did however have something to cheer about this week, with data showing the economy had surprisingly grown by 0.8% in Q2.

Turkey

Political squabbling, public unrest and military action abroad have sent the lira to record lows against the US dollar.

Bond investors have remained wary of Turkey's political situation, with the yield on the Markit iBoxx GEMX Turkey index, comprising Turkish government bonds, approaching 10%. Yields were just 7% in mid-January but an indecisive election result and further political turmoil have combined to push yields up.

The biggest credit widener over the past week has been ChesapeakeEnergyCorp which has seen its 5-yr CDS spread rocket past 1,000bps for the first time in five years. The oil and natural gas producer's credit spread was trading at half the current level just one and a half months ago. But with the price of oil taking another downturn, fears of further oil price deterioration straining operations further has sent investors rushing for cover.

Other major credit wideners over the past week included Bombardier, a Canadian aerospace and transportation firm. The firm has seen its 5-yr CDS spread widen over 100bps after delays in its new CSeries jet as the company struggles with performance and cash flow. Fitch has downgraded the firm further into junk territory.

On the credit improvers' front, Barrick Gold Corp, the largest gold mining company in the world saw its CDS spread tighten to 308bps from recent highs of 353bps. China's recent currency devaluation acted as a catalyst for the recent turnaround in the price of gold.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-credit-greek-bonds-rally-chesapeake-spreads-widen.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-credit-greek-bonds-rally-chesapeake-spreads-widen.html&text=Greek+bonds+rally%3b+Chesapeake+spreads+widen","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-credit-greek-bonds-rally-chesapeake-spreads-widen.html","enabled":true},{"name":"email","url":"?subject=Greek bonds rally; Chesapeake spreads widen&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-credit-greek-bonds-rally-chesapeake-spreads-widen.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greek+bonds+rally%3b+Chesapeake+spreads+widen http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082015-credit-greek-bonds-rally-chesapeake-spreads-widen.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}