Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 14, 2014

Euro area economy stagnates in second quarter

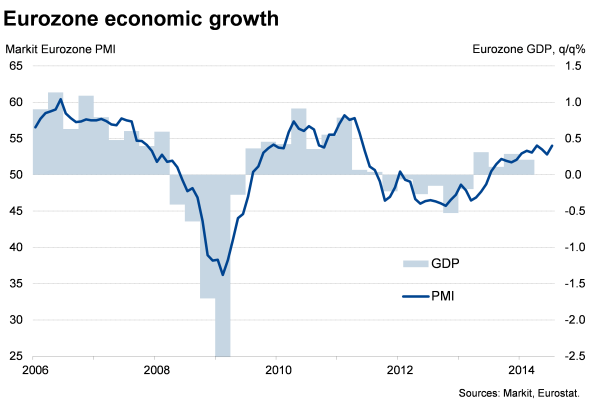

A stalling of economic growth in the second quarter raises concerns that the euro area is sliding back into a triple dip recession. Many, including the European Central Bank, point to survey data suggesting such fears are overplayed, and that growth will revive as previously-announced stimulus takes effect. But the renewed weakness will certainly fuel louder calls for the ECB to do more to reinvigorate economic growth across the single currency area.

GDP stalls

Data from Eurostat showed gross domestic product in the eurozone was unchanged in the three months to June. The second quarter disappointment follows only modest growth of 0.2% in the first quarter and leaves the economy some 2.5% smaller than its pre-crisis peak reached in the first quarter of 2008.

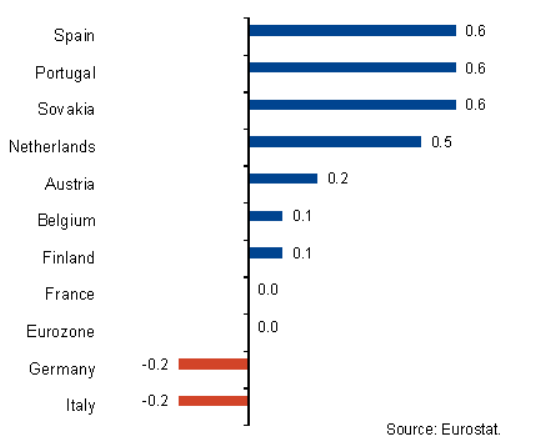

There was a curious variance of growth across the region. Germany and Italy both contracted by 0.2% and France stagnated. However, Spain, Portugal and Slovakia enjoyed robust growth of 0.6% while the Netherlands reported growth of 0.5%. Austria grew 0.2% and Belgium and Finland both eked out growth of 0.1%.

Contrast with robust PMI

Looking at the largest member states, the biggest surprises were the downturns seen in Germany and Italy. PMI survey data had signalled robust growth in Spain and the Netherlands and a stagnation in France, but had also indicated a strong second quarter expansion in Germany and modest growth in Italy.

The Eurozone PMI had consequently signalled a reasonable expansion of the region's economy in the second quarter of approximately 0.3-0.4%.

At least some of the weakness in the official data, especially in Germany, is likely to have been due to an unusually high number of holidays, linked to workers taking Friday off as public holidays fell on a Thursday. Such working day related factors tend not to be seen in the survey data, where reporting companies often take into effect the number of working days when comparing business activity with the prior month.

The strong variance in growth rates across the region adds to the suggestion that the weakness in some countries may be linked to statistical issues.

All eyes are therefore on the third quarter to see if the region is facing the genuine threat of a triple-dip recession.

ECB to act in absence of Q3 rebound

So far the survey data have pointed to faster but still modest growth in July, representing a reasonable start to the third quarter. However, there are also signs that business confidence has been dented by worries over the situation in Ukraine. Not only will an escalating crisis hit risk appetite, but sanctions are also likely to have some impact on Europe's economies in coming months. At the moment, there is little hard data to indicate that the eurozone economy has been affected to any significant extent, but the crisis poses a major threat to the euro area's fragile recovery.

Any further substantial weakening of the economic data in the third quarter will therefore heighten expectations that the ECB will embark on further stimulus, most likely taking the form of asset purchases. However, the ECB has also made it clear that it wishes to give time to allow previously announced stimulus to take effect, and notably the TLTROs, which should start to have an impact in September.

It would therefore be surprising to see any further action from the central bank until the fourth quarter, unless the data disappoint significantly in coming months.

Flash PMI data for August are published on 21st August.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014euro-area-economy-stagnates-in-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014euro-area-economy-stagnates-in-second-quarter.html&text=Euro+area+economy+stagnates+in+second+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014euro-area-economy-stagnates-in-second-quarter.html","enabled":true},{"name":"email","url":"?subject=Euro area economy stagnates in second quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014euro-area-economy-stagnates-in-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Euro+area+economy+stagnates+in+second+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014euro-area-economy-stagnates-in-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}