Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 14, 2016

May's move to No 10 sparks corporate bond rally

GBP denominated investment grade corporate bonds have rallied in the wake of Theresa May's speedy ascension to the UK prime ministerial job, but the rally has yet to be fully felt by financial bonds.

- iBoxx " Corporates spread now at 174bps, 6bp tighter than on the eve of referendum

- Rally has driven a large wedge between financial and non-financial sterling IG bonds

- ETF investors not returning to GBP corporate bonds after strong outflows leading up to vote

The scepticism seen in pound denominated investment grade corporate bonds has melted away in the wake of Theresa May's ascension to prime minister with the spread over benchmark rates priced into the asset class is now less than the levels seen on the eve of the referendum. The benchmark spread of the Markit iBoxx " Corporates now stands at 174 bps, over five bps tighter than the levels seen prior to the brexit vote.

The market's initial reaction to the referendum, and the political and economic uncertainty it brought, was to demand a greater yield over risk free gilts in order to hold investment grade pound denominated corporate bonds. The resulting surge in spread over benchmark rates proved to be transitory with the latest spread now over 30bps tighter than the post brexit highs seen three days after the referendum.

The spread compression, combined with massive fall in gilts yields which underpin the UK bond market means that the yield offered by investment grade pound denominated corporate bonds now stands at an all-time low of 2.84% after having dipped below the 3% mark for the first time ever on Monday.

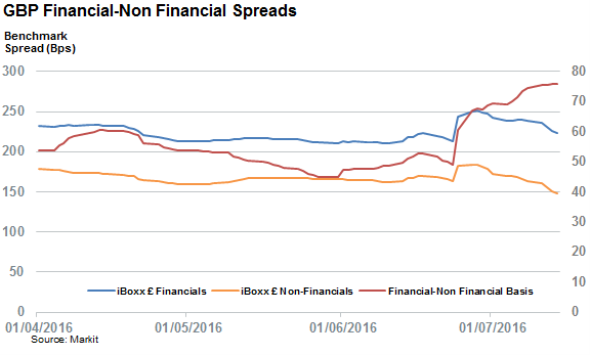

Financial basis grows

It's worth noting that the spread compression seen in the Markit iBoxx " Corporates index has not affected all its constituent bonds evenly as bonds issued by financial institutions still trade at a higher spread to gilts than on the eve of the brexit vote. The spread carried by the Markit iBoxx " Financials, which makes up 38% of the parent iBoxx " corporates index, now stands at 13.2bps wider than that seen on the 23rd of June. Thiswidening spread speaks to the uncertainty that is shrouding the sector which has the potential to suffer from any domestic slowdown or wider uncertainty of banking regulation post brexit.

Bonds issued by non-financial institutions, which have proven much more resilient to the recent volatility have driven the post referendum spread tightening. The iBoxx " Non-Financials index is now 14bps tighter than on the eve of the vote.

These diverging paths between the two broadest classes of pound denominated corporate bonds means that the spread difference between the iBoxx " Financials and its non-financial peer has jumped by more than 50% in the three weeks since the referendum to 76bps.

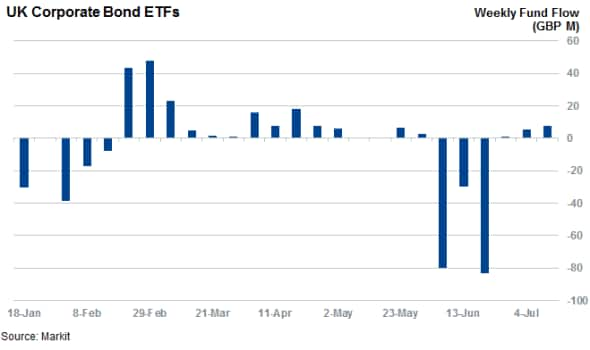

ETF investors yet to return

ETF investors have shown little willingness to return to loading up on pound denominated corporate bond market, despite the healthy 5% returns delivered by the asset class since the referendum. ETF investors had withdrawn "193m of funds from the six pound denominated bond ETFs in the three weeks leading up to the referendum.

While these ETFs have seen inflows in the three weeks since the vote the aggregate fund flows over that period of time of "14m, are less than a tenth of the amount withdrawn ahead of the vote.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072016-Credit-May-s-move-to-No-10-sparks-corporate-bond-rally.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072016-Credit-May-s-move-to-No-10-sparks-corporate-bond-rally.html&text=May%27s+move+to+No+10+sparks+corporate+bond+rally","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072016-Credit-May-s-move-to-No-10-sparks-corporate-bond-rally.html","enabled":true},{"name":"email","url":"?subject=May's move to No 10 sparks corporate bond rally&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072016-Credit-May-s-move-to-No-10-sparks-corporate-bond-rally.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=May%27s+move+to+No+10+sparks+corporate+bond+rally http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14072016-Credit-May-s-move-to-No-10-sparks-corporate-bond-rally.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}