Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 14, 2017

Weak pay growth adds to doubts on UK economic outlook

News of slowing pay growth alongside rising inflation adds to growing worries about the UK's economic outlook. Households are being squeezed by falling real pay at the same time that business uncertainty is likely to have escalated in the aftermath of the election, posing a double-whammy of downside risks to the economy.

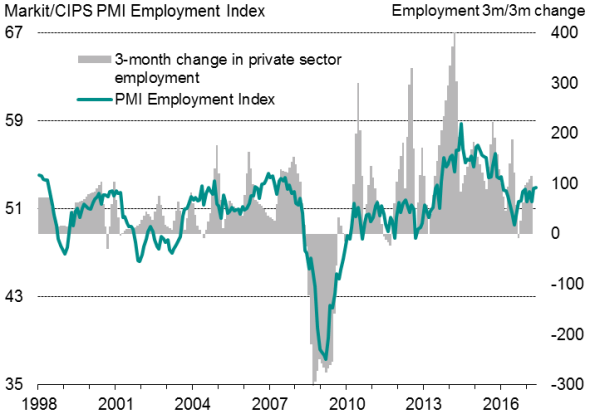

First the good news: the official data showed a further solid rise in employment in the three month to April, adding to survey evidence that companies had been expanding capacity and shrugging off uncertainty caused by Brexit in the lead up to the general election.

Employment indicators

Employment rose 109,000 in the three months to April, according to the ONS. That took the employment rate to a joint-record high of 74.8%. Survey data such as the PMI and REC recruitment industry report have likewise indicated strong demand for staff, with robust hiring continuing into May.

However, the good news on employment is overshadowed by the weakness of pay growth. Official data showed employee regular earnings growing at an annual rate of just 1.7% in the three months to April, its weakest since January 2015 and down a full percentage point since last November.

Coming fast on the heels of data showing consumer prices rising at an annual rate of 2.9%, the fastest for nearly four years, such meagre wage growth indicates that pay is falling in real terms.

The drop in real pay adds to worries about the economic outlook. Recent official and survey data have already shown consumer spending coming under strain as households feel the pinch from rising prices and low pay. Today's data will add further to the likelihood of consumer spending acting as a drag on the economy in coming months, leaving growth largely dependent on exports, corporate services and business investment.

While the upturn in employment is further confirmation that businesses were preparing for stronger growth ahead by expanding capacity earlier in the year, the concern is that the uncertainty caused by the shock general election result will have undermined business confidence, leaving the economy devoid of any significant domestic growth drivers as both business and consumer spending come under pressure.

Corporate costs and inflation

Sources: IHS Markit, ONS.

On a brighter note, recent months have seen a moderation in the rate of increase of companies' input costs, which suggests that a peak for consumer price inflation is in sight. While inflation may still creep up to over 3% in the autumn, a drop in input cost inflation to an eight-month high in May, according to PMI survey data, suggests that consumer price inflation should start to cool later in the year, taking some pressure off the squeeze on household budgets.

In contrast, unfortunately there are scant signs that households will benefit from any significant improvement in wage growth. Higher employment has clearly not fed through to higher pay, and there's no sign that this is going to change any time soon. If anything, the labour market may well weaken in coming months, putting further downward pressure on wages.

In the light of the weak wage growth and uncertainty facing the economy as Brexit discussions get underway, it seems increasingly likely that Bank of England policymakers will keep interest rates on hold - looking through the temporary rise in inflation - until the economic outlook starts to clear and prospects improve.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14062017-Economics-Weak-pay-growth-adds-to-doubts-on-UK-economic-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14062017-Economics-Weak-pay-growth-adds-to-doubts-on-UK-economic-outlook.html&text=Weak+pay+growth+adds+to+doubts+on+UK+economic+outlook","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14062017-Economics-Weak-pay-growth-adds-to-doubts-on-UK-economic-outlook.html","enabled":true},{"name":"email","url":"?subject=Weak pay growth adds to doubts on UK economic outlook&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14062017-Economics-Weak-pay-growth-adds-to-doubts-on-UK-economic-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weak+pay+growth+adds+to+doubts+on+UK+economic+outlook http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14062017-Economics-Weak-pay-growth-adds-to-doubts-on-UK-economic-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}