Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 14, 2016

Bond investors flock to US amid global yield drought

US exposed bond ETFs listed overseas have been the hot trade in the global quest for yield with these assets set to smash last year's inflow total.

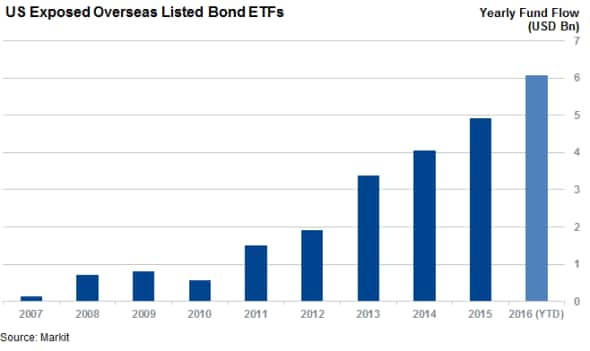

- Overseas US exposed bond ETFs attract $6.1bn of inflows ytd, surpassing last year's $4.9bn

- European investors make up the near totality of overseas flows heading into US

- Yields difference between USD and EUR denominated debt surges to new highs

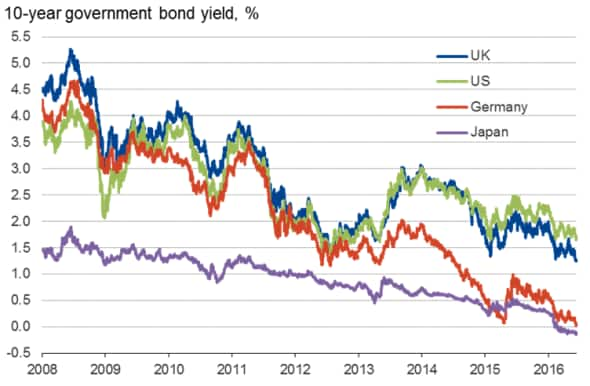

The US fed, the sole major rate setting body to have tightened monetary policy in the last 12 months, has pushed dollar denominated yields to the top of the global pile. Yield starved overseas investors are now clamouring to gain exposure to relatively high yielding dollar denominated debt.

US exposed overseas listed ETFs have seen over $6bn of inflows year to date which has already overhauled last year's $4.9bn haul. Investor appetite for US exposed bonds shows no signs of slowing down heading into the June Fed meeting given that these ETFS recorded just under $300m of inflows yesterday, the largest one day tally since early February.

European investors in the driving seat

European investors are the ones driving that trend as all but $42m of the inflows into US overseas listed bond ETFs have come from European listed funds. This trend speaks more to the relatively less developed nature of the Asian and Middle Eastern ETF market, which contains a lot less cross border products.

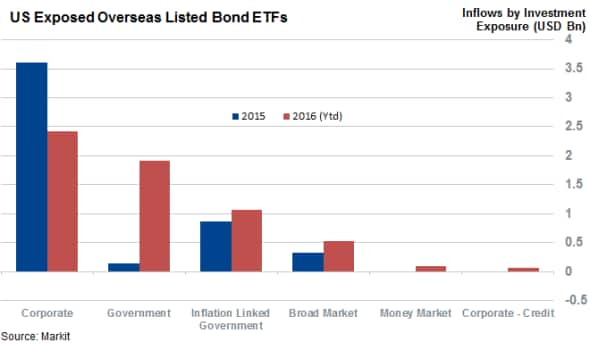

Government bonds are slightly ahead of corporate bonds in terms of inflows with treasuries and their inflation hedged TIPS cousins attracting $1.9 and $1.1bn of inflows ytd respectively. This haul is nearly three times the entire 2015 tally for the asset class and highlights the demand for decent yielding safe assets.

This trend is also played out in the relatively higher yielding corporate bonds which have seen $2.4bn of inflows ytd. Last year's record $3.6bn inflow tally into overseas listed US corporate bond funds was driven by high yield funds, which attracted $2.9 bn of inflows but investors have opted for relatively safer investment grade products in the year so far. To this end, investment grade products have attracted $2.3bn of inflows ytd, while the net inflows gathered by their investment grade peers has come in at $110m over the same period of time.

Yield difference drives trends

This strong appetite for US exposed assets has been driven by the recent plunging bonds rates in Europe which has forced income seeking investors to become ever more pragmatic in the search for yield. This trend is reflected in the yields difference of the dollar denominated iBoxx indices relative to their euro denominated peers. That yield difference starts at 1% for sovereign bonds and jumps to over 2% for both high yield and investment grade bonds.

The fear of an interest rate hike is also less relevant for overseas investors as this move could see the US dollar rebound from its recent slide which would boost value of funds held by investors in overseas currencies

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14062016-Credit-Bond-investors-flock-to-US-amid-global-yield-drought.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14062016-Credit-Bond-investors-flock-to-US-amid-global-yield-drought.html&text=Bond+investors+flock+to+US+amid+global+yield+drought","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14062016-Credit-Bond-investors-flock-to-US-amid-global-yield-drought.html","enabled":true},{"name":"email","url":"?subject=Bond investors flock to US amid global yield drought&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14062016-Credit-Bond-investors-flock-to-US-amid-global-yield-drought.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bond+investors+flock+to+US+amid+global+yield+drought http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14062016-Credit-Bond-investors-flock-to-US-amid-global-yield-drought.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}