Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 14, 2016

Spanish banks slowly remove the Band-Aid

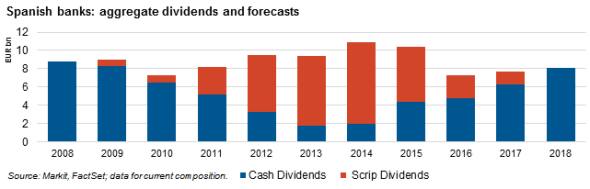

After several years of offering investors the option of a scrip dividend to preserve cash, Spanish banks are returning to cash payments as earnings and balance sheets slowly recover.

- Spanish bank scrip dividends expected to decline 60% in 2016, falling to "2.5bn

- Forecasted banks' cash dividend payments set to increase 8.6%, reaching "4.8bn

- European Banks cautiously achieve pre-crisis dividend payment levels of "44.3bn

To access the full dividend report highlighting Spanish banking dividends, please contact us

Using scrip dividends* as a temporary Band-Aid for the last five years, Spanish banks are expected to continue the gradual transition into cash based payments in 2016.

Cash dividends of Spanish banks are expected to increase for the third consecutive year rising to "4.8bn, according to Markit Dividend Forecasting. Investors however, have to face a 30% cut to aggregate banking dividends due to a 60% reduction in scrip dividends, declining to "2.5bn.

Post the financial crisis Spanish banks were faced with faltering earnings and battered balance sheets. Squeezed into a corner by dividend hungry investors, creditors and depositors, Spanish banks pioneered the scrip dividend.

Scrip dividends preserve and raise yields at face value but more importantly they protect the capital required to restore balance sheets in times of crisis. They do represent somewhat of an investor illusion however. Assuming widespread acceptance of scrip shares on a cash basis, investors accepting a scrip to avoid dilution would be no worse or better off. However, banks achieve the avoidance of sending the dreaded message of weakness to the market, a dividend cut.

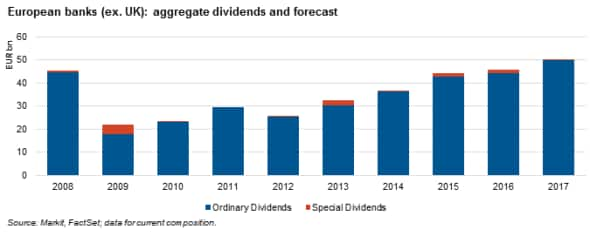

The resumption in cash payments has been modest and conservative in Spain and is a trend seen with peers in Europe. Overall European banks are struggling, with less than a third posting positive returns thus far this year. Markit is forecasting European banks dividends to reach pre-crisis levels of "44.3bn. However, this represents growth of only 4% compared to 2015.

Stricter capital requirements have put extra pressure on European banks with regulations in place to avoid a crisis impacting profitability. Coupled with low to negative interest rates - banks profit margins are facing further compression.

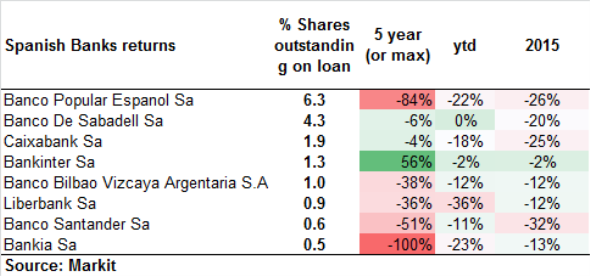

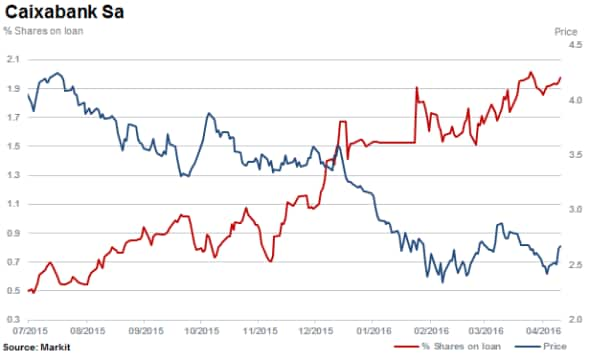

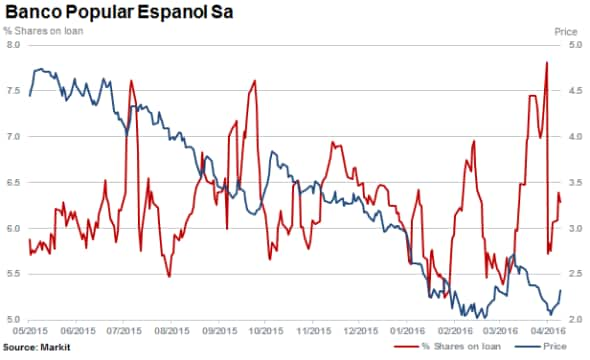

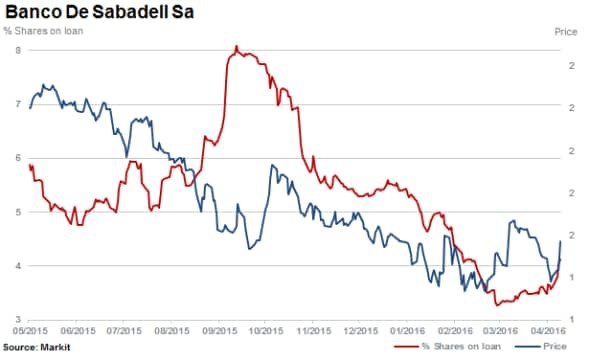

Caixabank, Popular and Sabadell have all seen their shares fall over 30% in the past 12 months. The three currently lead Spanish banks in terms of short interest levels. Caixabank has seen a two fold increase in shares outstanding on loan, rising to 1.9% currently.

Short sellers in Banco have been relatively volatile oscillating between 5% and 8% of shares outstanding on loan with 6.3% at present.

Since September 2015 shorts have covered almost half of positions in Sabadell, while shares have fallen some 30%.

Scrip dividends have been the window dressing or even curtain over an effective five year stretch of dividend cuts in Spain which do not seem to have had the desired impact.

The majority of Spanish banks' shares are still trading under water on a year to date and five year basis. However, an alternative view is that perhaps scrip dividends have prevented equity prices from cratering even further, reducing volatility and providing Spanish banks with a smoother recapitalisation path.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042016-Equities-Spanish-banks-slowly-remove-the-Band-Aid.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042016-Equities-Spanish-banks-slowly-remove-the-Band-Aid.html&text=Spanish+banks+slowly+remove+the+Band-Aid","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042016-Equities-Spanish-banks-slowly-remove-the-Band-Aid.html","enabled":true},{"name":"email","url":"?subject=Spanish banks slowly remove the Band-Aid&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042016-Equities-Spanish-banks-slowly-remove-the-Band-Aid.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Spanish+banks+slowly+remove+the+Band-Aid http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14042016-Equities-Spanish-banks-slowly-remove-the-Band-Aid.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}