Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 14, 2017

UK inflation at highest since June 2014

UK inflation rose less than expected in January, but continued to climb closer to the Bank of England's 2.0% target, which looks likely to be breached in the coming months.

While the further upturn in price pressures will fuel speculation that interest rates may start to rise later in 2017, the most likely scenario remains one of policy staying on hold over the next two years as the economy navigates through Brexit.

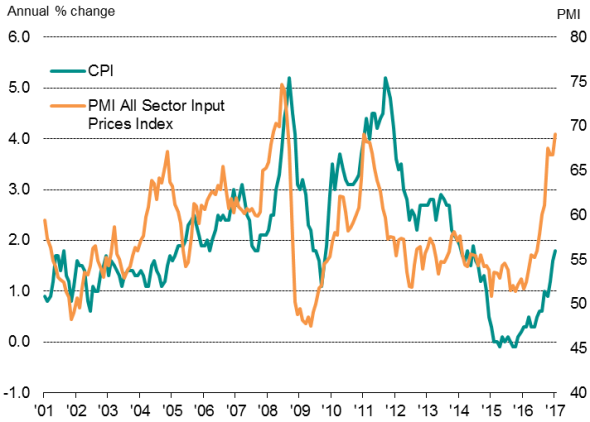

Consumer prices rose 1.8% on a year ago, according to the Office for National Statistics, the steepest annual rate of increase since June 2014. The latest rise was below analysts' expectations of a 1.9% rise, but is up from 1.6% in December and was just 0.3% this time last year.

Further upward pressure on prices looks inevitable in coming months as energy costs continue to climb and firms pass rising costs on to customers, pushing inflation up towards 3.0% in the second half of the year.

Bank of England Governor Mark Carney has outlined how policymakers are prepared to look through this increase in inflation, keeping policy on hold amid the heightened uncertainty that the UK economy faces during the process of withdrawing from the EU. However, coming months will likely see some itchy trigger fingers among some of the hawkish members of the Monetary Policy Committee, as price pressures mount and inflation spikes higher.

The key drivers of the increase in inflation are higher global commodity prices, notably oil, and the weaker pound. Globally, goods producers are seeing their costs rise at the fastest rate for five-and-a-half years as prices for a wide variety of raw materials such as oil, chemicals, timber, rubber and metals have jumped higher in recent months.

In the UK, the depreciation of sterling has exacerbated this global upturn in price pressures by significantly lifting the cost of imports. Survey data show UK manufacturers' costs rising in January at the steepest rate in 25 years' of data collection. Average prices charged for goods and services meanwhile increased at the fastest rate since April 2011. These price hikes look set to feed through to consumers in coming months.

Wage growth has meanwhile crept up to 2.8%, stoking worries of so-called 'second round' inflationary pressures. Clearly there's a risk that any further significant increase in earnings alongside rising inflation expectations will test the Bank's tolerance of high inflation, prompting rate hikes later in 2017.

However, our expectation is that wage growth will slow, or at least remain muted, in 2017 as the labour market cools, providing the Bank of England with leeway to keep policy on hold. Not only is there a likelihood of rising prices curbing consumer spending as the year proceeds, but uncertainty caused by the triggering of Article 50 will also likely lead to weaker spending and hiring by employers.

Inflation and producer prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14022017-economics-uk-inflation-at-highest-since-june-2014.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14022017-economics-uk-inflation-at-highest-since-june-2014.html&text=UK+inflation+at+highest+since+June+2014","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14022017-economics-uk-inflation-at-highest-since-june-2014.html","enabled":true},{"name":"email","url":"?subject=UK inflation at highest since June 2014&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14022017-economics-uk-inflation-at-highest-since-june-2014.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+inflation+at+highest+since+June+2014 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14022017-economics-uk-inflation-at-highest-since-june-2014.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}