Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 14, 2016

Week Ahead Economic Overview

China will remain in the spotlight as economic growth looks set to slide to the weakest since the global financial crisis. The week also sees monetary policy meetings in the eurozone, Canada and Brazil as well as flash PMI releases and a run of inflation data.

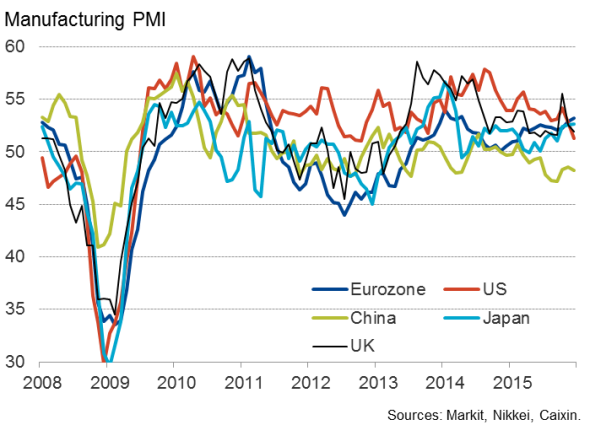

China is expected to report a further slowing of GDP growth in the fourth quarter. Economists are generally pencilling-in a 6.8% annual rise, down from 6.9% in the third quarter and the weakest since the start of 2009, after recent disappointing PMI survey data. The slowdown would mean China's growth of 6.9% in 2015 was the weakest for 25 years.

If monthly updates to China's industrial production and retail sales confirm that the slowdown showed no signs of letting up in December, then expectations will grow that the Chinese authorities will take further steps to boost growth, including cutting interest rates.

Markets will also be looking for appetite for more stimulus at the ECB. With PMI data showing only modest economic growth in the fourth quarter and an ultra-benign inflation outlook, many analysts are looking for Mario Draghi to announce more QE beyond the current March 2017 programme and further cuts to deposit rates, which are already negative. However, it's likely that the ECB will want more time before making further adjustments to its stimulus package.

Eurozone Flash PMI data for January will be updated on Friday, giving clues as to growth and inflation, and therefore future ECB policy.

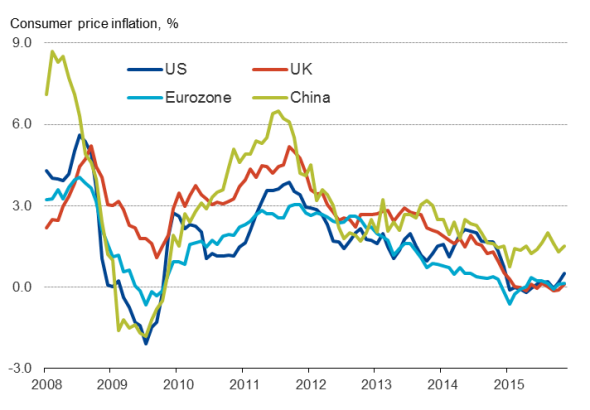

The Central Bank of Brazil and Bank of Canada will also be setting policy. With both facing struggling economies and currencies sliding in the face of the global commodity rout, markets will be looking for determined support from policymakers. A rate cut in Canada is widely touted, though such a move is precluded in Brazil by spiralling inflation.

Bets that the Bank of England will follow the US Fed in hiking rates have lengthened as PMI data showed the economy slowing late last year alongside signs of wage growth easing. Official labour market data, and pay growth in particular, will therefore be an important guide to policy, with weak numbers effectively set to kill off expectations of UK rates rising in the first half of 2016.

Inflation data are meanwhile published in the eurozone, UK and US, all of which are expected to show no surprises as low oil prices feed through to weak consumer inflation rates.

With markets also eager for insights in to the next policy moves at both the US Fed and Bank of Japan, flash PMI data will provide the first indications of the state of both economies at the start of 2016.

Manufacturing activity

Inflation rates

Monday 18 January

House price figures are out for China at the start of a relatively quiet day for data releases.

Japan issues its latest Tertiary Industry Index as well as industrial production numbers.

Trade data are released by Istat in Italy.

In Brazil, an update on net payroll jobs is made available.

Tuesday 19 January

Latest GDP figures are the highlight of a host of releases for China, which also includes industrial production, retail sales and urban investment spend.

Germany sees the release of consumer prices data, followed by the ZEW Sentiment indicator.

Inflation numbers are also out for the eurozone, alongside latest construction figures and the ECB's balance of payments data.

In the UK, producer and consumer price inflation figures are published.

NAHB housing data are released in the US.

Wednesday 20 January

'Hump' day sees the publication of producer prices data for Germany.

Latest employment figures are out in the UK, alongside an update on earnings growth.

Markit releases its latest UK Household Finances Index.

A packed day in the US starts with latest mortgage numbers, followed by building permits and housing starts. There is also inflation and real earnings data, and finally the Redbook index.

In Canada, BoC announce their interest rate decision and publish an accompanying statement.

The Central Bank of Brazil announces its interest rate decision, while foreign capital flows data are also out.

Thursday 21 January

In the early hours Japan publishes its latest foreign investment numbers, with the All Industry Activity Index released later in the day.

Inflation expectations and new home sales are out in Australia.

The UK sees the publication of the RICS Housing Survey.

Thursday's highlights are the ECB's monetary policy decisions and corresponding statement, with consumer confidence data also released for the currency zone.

Business confidence data are published in France.

In the US, jobless claims data are released alongside the Philadelphia Fed Manufacturing Survey, before the EIA's latest oil stock figures.

Friday 22 January

Friday begins with the publication of Markit's UK House Price Sentiment Index and the Nikkei Flash Japan Manufacturing PMI.

Flash PMI data are also issued for the eurozone and the US.

Retail sales and public sector borrowing figures are among the highlights in the UK.

Canada sees the release of latest retail sales numbers and an update on consumer price inflation.

Finally, existing home sales data are out in the US, along with the CB leading indicator.

Phil Smith | Economist, Markit

Tel: +44 149 1461009

phil.smith@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}