Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 14, 2015

Investors still betting on oil ETFs

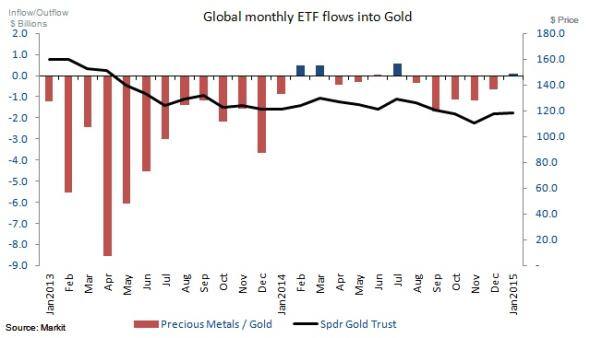

Collapsing oil prices and the free falling Russian market have so far not tested the patience of ETF investors, who continued to double down on these lossmaking trades in 2014; a stark contrast to 2013's gold slump when ETF investors rushed to the door.

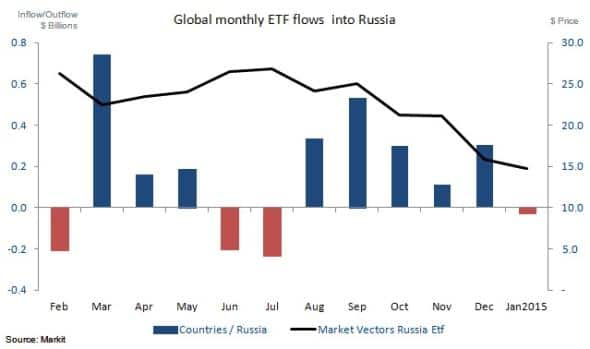

- Russian ETF inflows continued to add exposure to the country in 2014, but first signs of outflows in 2015

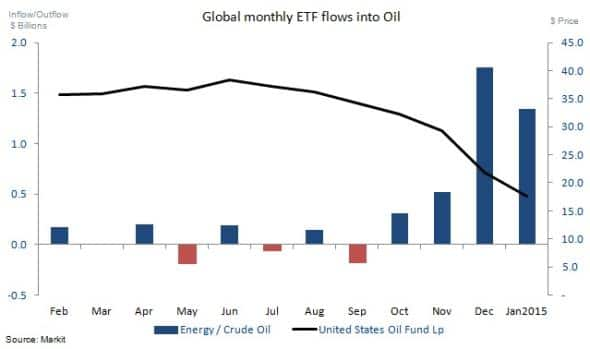

- Oil ETFs have seen net inflows of $1.3bn so far this year

- Investors have pulled $80bn from gold ETFs since 2012

ETF investor's Russian affair

Russian exposed ETFs saw consistent inflows of $1.5bn in the last five months of 2014 as the Russian market continued to decline with sanctions, declining oil prices and the devaluing rouble hitting the market.

However, while these inflows were occurring, the largest Russian exposed ETF, the Market Vectors Russian ETF, saw its price decrease by over a third from August to December 2014.

This trend looks to be reversing somewhat in the New Year, as Russian exposed ETFs are on track for their first monthly outflows in six months, as investor's resilience and staying power may have begun to wane.

Chasing oil's bottom

Oil prices have slid by 50% since mid-June 2014 and the largest Oil ETF, the United States Oil Fund with AUM of $1.7bn, isdown by a parallel 54% over the same time period.

ETF investors are continuing to 'double down' after catching knives over the past four months while oil prices continued to decline. Prices are currently hovering at $46 per barrel (Brent).

Investor's faith in an oil price recovery seems to have increased, as fund flows into oil exposed ETFs look set to beat December's total inflows of $1.7bn, with inflows so far this month already standing at $1.3bn.

Interestingly oil was at similar price level back in 2009, when we also saw strong inflows into oil ETFs after a dramatic collapse in global oil prices.

ETF investors could see more red in the short term though, as news out today reveals record oil imports for China hitting highs of 7m barrels per day. These have been cited as being destined for strategic and commercial reserves.

Turning against gold

Gold has not been so precious in the eyes of ETF investors, as ETFs exposed to the metal's price movements have continued to see sustained outflows over the last two years.

The last two years has seen only four months of net inflows. This comes as the commodity declined from 2011 highs of ~$1800, stabilising at $1259 currently.

The end of quantitative easing in the US and an expectation of strengthening dollar and weaker global demand has seen the precious metal fall out of favour with investors.

The largest gold ETF, the SPDR Gold shares ETF has $28bn AUM which represents 44% of total AUM exposed to the metal. This AUM figure has fallen by over 60% from the $72bn it managed at start of January 2013.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-equities-investors-still-betting-on-oil-etfs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-equities-investors-still-betting-on-oil-etfs.html&text=Investors+still+betting+on+oil+ETFs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-equities-investors-still-betting-on-oil-etfs.html","enabled":true},{"name":"email","url":"?subject=Investors still betting on oil ETFs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-equities-investors-still-betting-on-oil-etfs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+still+betting+on+oil+ETFs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-equities-investors-still-betting-on-oil-etfs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}