Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 13, 2014

Week Ahead Economic Overview

Flash PMI" data from Markit will provide the first insights into the health of the world's largest economies in November. Other standouts in a busy week for data watchers are third quarter GDP data for Japan and inflation numbers in the UK and the US. The Bank of England and the FOMC also release minutes from their latest interest rate meetings.

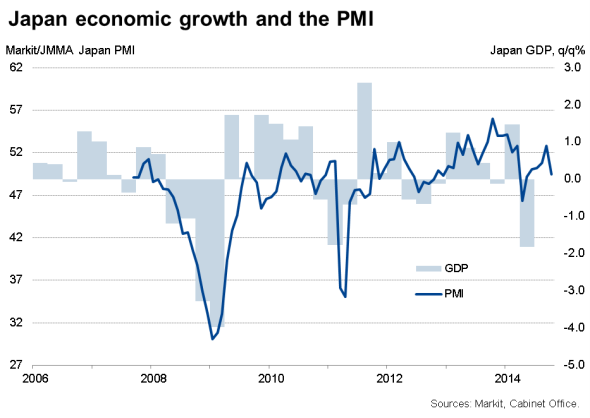

Amid speculation that a snap election could be called in Japan, more detail of the impact of the sales tax hike earlier this year will be provided by the release of third quarter GDP data. There has been mixed news on the recent performance of the Japanese economy. Weak industrial production data for August left Japan struggling to avoid recession, but signs of a rebound in September add to hopes that gross domestic product rose in the three months to September, following a decline in the second quarter. Strong service sector data support the likelihood of GDP rising by approximately 0.5% in the third quarter.

Markit meanwhile releases flash manufacturing PMI data for November, which will give further insight into fourth quarter trends after October's data showed Japan's factories enjoying the strongest upturn for seven months.

The Bank of England meanwhile issues minutes from its October monetary policy meeting. The minutes are likely to show that two MPC members again voted for higher interest rates. However, while the recent downward revisions to the Bank's inflation projections paint an even more dovish picture for interest rates, the possibility of increasing numbers of the Monetary Policy Committee voting for higher interest rates in coming months cannot be ruled out, especially given recent labour market trends.

Consumer price numbers are also out in the UK, and are likely to show the inflation rate falling further from the five-year low of 1.2% seen in September. The Bank estimates that inflation is likely to remain close to 1% over the course of the next year, dipping below 1% in coming months.

First signs of how the US economy has performed in November are provided by flash manufacturing PMI data. October's survey data signalled the weakest growth for six months, suggesting that US economic growth may slow in the fourth quarter, especially if PMI data continue to drop in November and December.

The US also sees an update on consumer prices. Inflation held steady at a five-month low of 1.7% in September, providing policymakers with greater leeway to keep interest rates on hold for longer. The FOMC meanwhile publishes minutes from its November meeting. The statement that followed the meeting was seen as pointing to June as still being the most likely time when rates will rise, but the language was generally considered to have been more hawkish than previous statements.

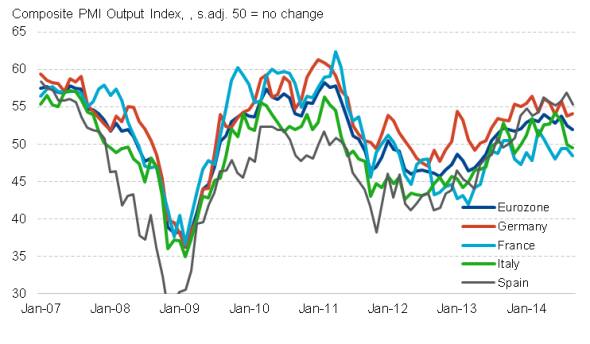

In the eurozone, the flash PMI for November will give insights into whether recent ECB actions have provided a lift to growth in the region or whether discussions about further stimulus such as full-scale quantitative easing will intensify in the coming months. The Markit Eurozone Composite PMI" was little-changed from September's 10-month low in October, with Ireland and Spain remaining at the head of the PMI output growth table, while France remained stuck in contraction territory.

The release of flash PMI data for China will also provide a timely update on whether manufacturing growth picked up again in November. Official data showed factory output rising at the second-weakest rate since 2009 in October.

US manufacturing output and the PMI

Eurozone Composite PMI Output Index

Monday 17 November

The week kicks off with the release of third quarter GDP numbers for Japan.

In New Zealand, retail sales figures and vehicle sales numbers are out.

Rightmove issues its House Price Index for November.

Russia sees the release of unemployment numbers.

In the euro area, trade balance data are released.

Industrial production numbers for October and the NY Empire State Manufacturing Index are out in the US.

Tuesday 18 November

The Reserve Bank of Australia issues minutes from its latest monetary policy meeting.

In China, house price information are released.

Inflation numbers are meanwhile published in the UK.

ZEW issues its latest economic sentiment results for Germany and the eurozone.

Producer price numbers and the NAHB Housing Market Index are released in the US.

Wednesday 19 November

The Bank of Japan announces its latest interest rate decision.

Industrial output data are out in Russia.

Current account numbers and construction production data are meanwhile released in the eurozone.

The Office for National Statistics publishes data on public and private sector earnings for the UK, while Markit publishes the latest UK Household Finance Index.

The European Central Bank's Governing Council and General Council meet, but no interest rate announcement is scheduled.

The Bank of England and the FOMC issue minutes from their latest monetary policy meetings.

In Brazil, unemployment data are published.

Building permits numbers and housing starts data are released in the US.

Thursday 20 November

Trade data and the Bank of Japan Monthly Report of Recent Economic and Financial Developments are issued in Japan.

Monthly GDP data are released in Russia.

Producer price data are meanwhile out in Germany.

Flash PMI results are published worldwide by Markit.

In Italy, industrial orders numbers are issued, while retail sales figures and CBI orders data are out in the UK.

Current account numbers are published in Greece.

The European Commission releases consumer confidence data for the currency union.

Inflation numbers, initial jobless claims, the CB leading indicator and existing home sales numbers are all out in the US.

The OECD publishes a statistics release on third quarter GDP and also launches an updated economic outlook.

Friday 21 November

Wage inflation numbers are released in Italy, while producer price figures are issued in Russia.

In the UK, public sector finances data are out.

Meanwhile, inflation figures are out in Canada.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13112014-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}