Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 13, 2015

Market volatility boosts securities lending industry

The North American market's recent slump has seen short sellers return to the market in levels not seen in several years; this in turn has translated into better revenue figures for the securities lending industry.

- Value of short positions in the Americas has climbed to $594bn, the highest since 2008

- Daily revenues generated so far in October are up by 20% from last year

- 7% North American shares now trading special, twice as much as in 2011

American short sellers have returned to the market after years of bull market hibernation. Average short interest in the S&P 500 index has passed the 3% mark for the first time in over three years, which is over 50% higher than the levels seen a year ago.

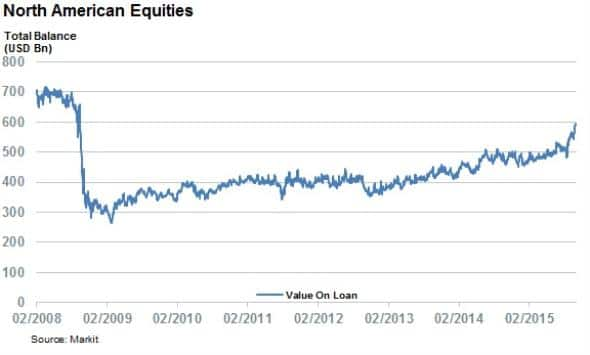

This increased desire to sell shares short means that the aggregate value of all short positions as tracked by securities lending volumes has surged from the $500bn mark seen at the start of the year to $594bn as of the latest count. This surge puts the value of all short positions in North America at its highest level since 2008, when short positions were worth more than $700bn.

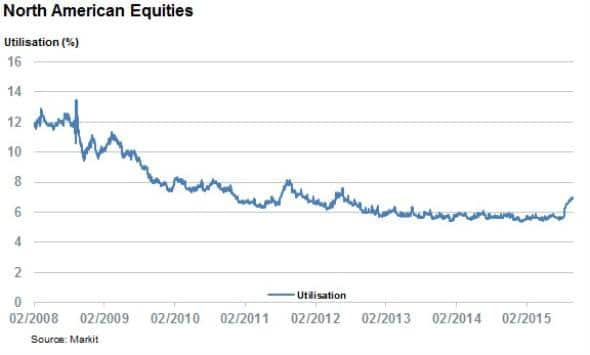

The anaemic demand to sell shares short over the last few years is also represented by securities lending program utilisation, the proportion of inventories sitting in lending programs out on loan at any given time. That metric has flat lined in the 5.5%-6% range over the last two years of tepid shorting activity. The recent surge in borrow activity, combined with the fact that market volatility has seen the value of assets in lending programs fall by 7% from the highs, has led utilisation to jump past the 7% mark for the first time in over three years.

Fees hold up

While the fees commanded by lenders for North American equities to keep a short position open has not seen the multi-year highs seen in other borrow metrics, the recent weighted average of 60bps-70bps required to borrow North American assets over the recent period of volatility is above the 58bps average of the last five years.

This has helped the industry post some of its healthiest revenues in years as lenders have been able to get 6bps of annualised total returns for North American assets over the last two weeks, the longest such streak since the "taper tantrum" volatility in 2013.

In dollar terms, the revenues generated by North American assets since the start of October are up by 18% from the same period last year. While it's still very early days for the fourth quarter, should the trend hold up, we could see the best quarter for the industry in revenue terms since the financial crisis.

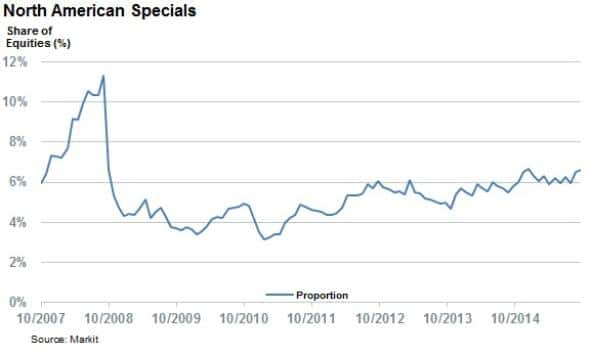

Specials jump

A large part of the revenue story will be driven by the proportion of shares trading "special". The proportion of shares which command a high fee of more than 100bps a year to borrow now stands at 6.6% of shares, the highest proportion since the financial crisis.

Not surprisingly, energy names have been the shares which short sellers are the most willing to pay up for. There are now 43 energy names trading special, 50% more than at the start of the year. The other sector to see a large jump in specials is materials, which has seen its number of specials surge year to date 17.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102015-Equities-Market-volatility-boosts-securities-lending-industry.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102015-Equities-Market-volatility-boosts-securities-lending-industry.html&text=Market+volatility+boosts+securities+lending+industry","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102015-Equities-Market-volatility-boosts-securities-lending-industry.html","enabled":true},{"name":"email","url":"?subject=Market volatility boosts securities lending industry&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102015-Equities-Market-volatility-boosts-securities-lending-industry.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Market+volatility+boosts+securities+lending+industry http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102015-Equities-Market-volatility-boosts-securities-lending-industry.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}