Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 13, 2014

Bond ETFs in a post-Gross world

Two weeks on from Bill Gross's departure from the world's largest bond fund, we see record appetite for bond ETFs.

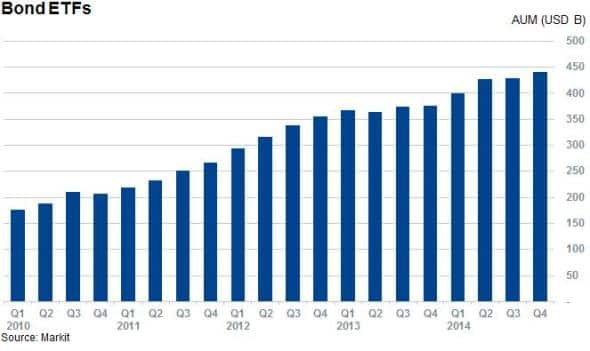

- Assets managed by global bond ETFs stand at an all-time high of $441bn

- Record highs in AUM are led by strong inflows across the world

- PIMCO's Total Return Bond ETF has led outflows out of actively managed bond funds

Bill Gross' surprise departure from his highly visible role at the helm of the world's largest bond mutual fund and its cousin ETF has sent ripples throughout the fixed income investment world.

While the impact of Gross' departure from his long time employer on the bond markets was relatively short lived, the consequential influence over the way investors gain exposure to the bond world may be felt for years to come as they switch out of legacy, relatively costly active products into cheaper index tracking funds.

While still early days, the last couple of weeks have seen investors pile money into bond ETFs in the wake of Gross' departure to take assets to a record high.

AUM at all-time high

The two weeks since Gross' departure have seen the aggregate AUM of the 914 bond ETFs jump to new highs. These funds now control $441bn, which is $64bn higher than the aggregate managed at the start of the year.

Perhaps most pertinently to the present situation, the AUM base for Bond ETFs has grown during the first ten calendar days of the current quarter and now stands over $12bn higher than at the end of September.

Most of the AUM growth in the asset class was driven by the largest funds, as the ten largest bond funds have seen over just under $6.2bn of inflows in the last ten days, with nine of the ten funds seeing net inflows.

This includes the iShares 1-3 Year Treasury Bond ETF and the Vanguard Total Bond Market ETF which have both seen over $1bn of inflows in the post Gross market.

Inflows driving the surge in global AUM

These strong inflows into the largest bond funds, combined with strong inflows across the rest of the bond universe take the aggregate inflows to $10.7bn. The current quarter is now on track beat last quarter's total just over a week into the trading period.

While flows into US funds, which manage the lion's share of assets, are the driving force behind the latest surge in AUM, bond ETFs listed in Europe and Asia have also seen strong inflows with $1.23bn and $200m of inflows respectively since the start of the quarter. Both regions also see AUM sit at record high.

Active funds fall out of favour

On the opposite end of the picture, actively managed funds seem to have fallen out of favour with investors, with several funds in the category experiencing outflows. The 70 actively managed funds in the index have experienced over $470m of outflows in the last week.

Leading the outflows are two PIMCO funds, led by the US Dollar Short Maturity Source UCITS ETF which has seen investors pull $287m in the last week. The Total Return ETF, which was formerly managed by Gross, has continued to see strong outflows in the last week, adding to the over $540m pulled from the fund in the last days of September immediately following Gross's departure announcement.

These outflows are not isolated to the PIMCO family, as the Guggenheim Enhanced Short Duration ETF has also seen over $185m of redemption in the last week.

Whether this marks a change of hearts by bond investors away from relatively more expensive active funds remains to be seen, but the funds which have fallen out of favour in the last couple of weeks are on the expensive end of the bond ETF scale. The funds which have seen strong inflows stand on the opposite end of the same scale.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102014-Equities-Bond-ETFs-in-a-post-Gross-world.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102014-Equities-Bond-ETFs-in-a-post-Gross-world.html&text=Bond+ETFs+in+a+post-Gross+world","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102014-Equities-Bond-ETFs-in-a-post-Gross-world.html","enabled":true},{"name":"email","url":"?subject=Bond ETFs in a post-Gross world&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102014-Equities-Bond-ETFs-in-a-post-Gross-world.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bond+ETFs+in+a+post-Gross+world http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13102014-Equities-Bond-ETFs-in-a-post-Gross-world.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}