Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 13, 2015

China devaluation jolts Asian credit markets

China's currency devaluation pushed Asian credit markets wider earlier this week before the central bank intervened, stabilising the market.

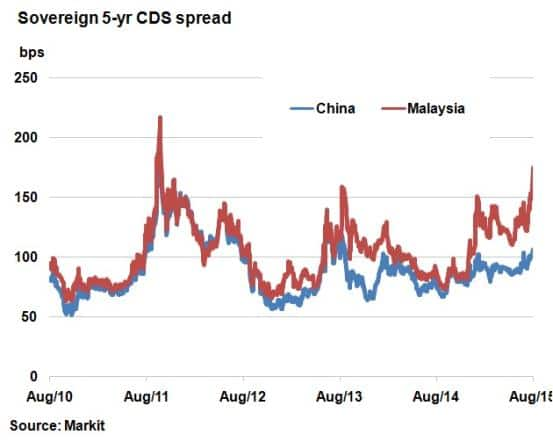

- China's sovereign 5-yr CDS spread widened to two year highs earlier this week

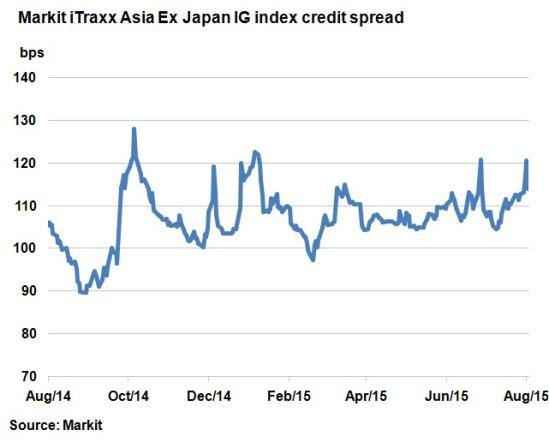

- Markit iTraxx Asia Ex Japan IG index widened to 121bps, touching 2015 highs

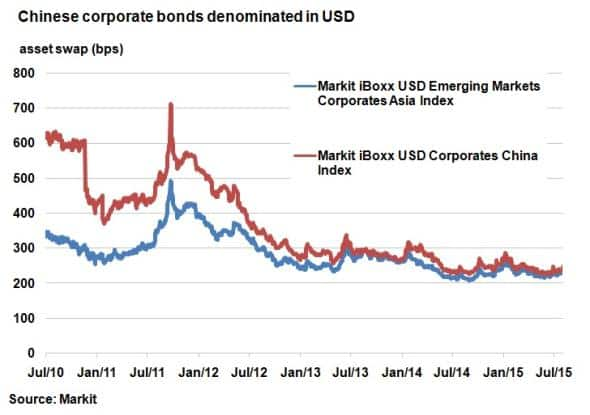

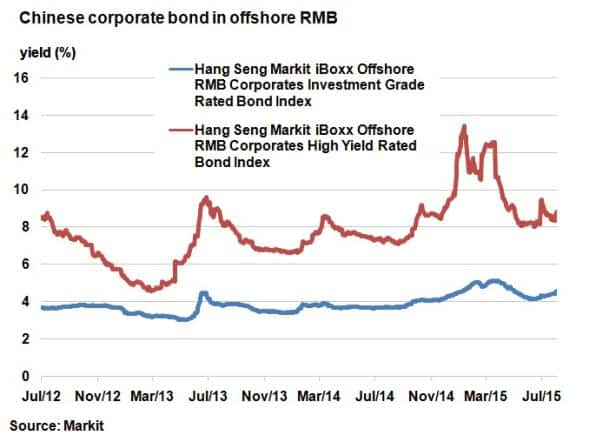

- Devaluation had little impact on the China's eurodollar and dim sum bond markets

The People Bank of China (PBC) calmed credit markets this morning with a rare press conference in which the bank stated there was no basis for any further depreciation of its currency, the renminbi. This followed a tumultuous couple of days which saw the PBC shock the market with a devaluation of the country's currency on Monday, prompting a further fall for two successive days. The drop accumulated to around 5% against the US dollar and initially sent credit markets sprawling before the PBC intervened to stabilize the market.

While the PBC's exact intentions remain unknown, fear in credit markets, suggests that the bank's decision was based on slowing economic growth for the world largest exporter. Concerns over slowing growth were exacerbated by recent data showing weak industrial production, investment, and retail sales; the effects of which would ripple across the Asian region.

China's sovereign 5-yr CDS spread widened 5bps from last Friday's close to 107bps earlier this week; the widest level since August 2013. Credit markets have been increasingly wary of the Chinese situation in the last few weeks, but the PBC's rhetoric calmed the market somewhat, sending China's CDS spread 7bps lower according to Markit CDS pricing's latest level.

China remains a highly leveraged nation, with total debt to GDP (which includes corporate and household debt) standing at 282%. Any slowdown would certainly strain that figure, increasing sovereign debt risk.

Elsewhere in Asia, Malaysia's CDS spread hit fresh four year highs as its currency took further beating. The ringgit had already lost over 10% over the last three months against the US dollar. Finally, despite the PBC's comments to stabilise the yuan, Australia's 5-yr CDS spread has remained at 52-week highs of 40bps. Both countries are major commodity exporters and their CDS spreads reflect China's slowing growth which has dented appetite for global commodities.

In corporate credit, the Markit iTraxx Asia Ex Japan IG index widened to 121bps as of yesterday's close, touching 2015 highs. This trend was also seen further afield, with the CDX.NA.IG index, compromising of 125 US investment grade single name credits, widening to a 52-week high while the European exposed Markit iTraxx Main index also widened to 68bps. The latter is still 13bps tighter than the level seen during the Grexit situation in July, suggesting that the Chinese devaluation impact on Europe was limited.

Eurodollar bonds also saw bond spreads widen in both China and the wider Asian region. The Markit iBoxx USD Corporates China Index has seen its asset swap spread widen 10bps this week, but the level is a far cry away from the figures that were more than double in 2011. With the depreciation now stemmed by the PBC, credit markets are suggesting China's USD corporate debt load had limited impact.

It was a similar story in In China's offshore renminbi market, where yields on dim sum bonds saw widening but not to any significant historical threshold. As of yesterday's close, The Hang Seng Markit iBoxx Offshore RMB Corporates Investment Grade Rated Bond Index yielded 4.57%, with its high yield peer yielding 8.8% at the latest EOD close.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-Credit-China-devaluation-jolts-Asian-credit-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-Credit-China-devaluation-jolts-Asian-credit-markets.html&text=China+devaluation+jolts+Asian+credit+markets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-Credit-China-devaluation-jolts-Asian-credit-markets.html","enabled":true},{"name":"email","url":"?subject=China devaluation jolts Asian credit markets&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-Credit-China-devaluation-jolts-Asian-credit-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+devaluation+jolts+Asian+credit+markets http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082015-Credit-China-devaluation-jolts-Asian-credit-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}