Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 13, 2016

Eurozone business optimism at lowest ebb since 2014 as political risks intensify

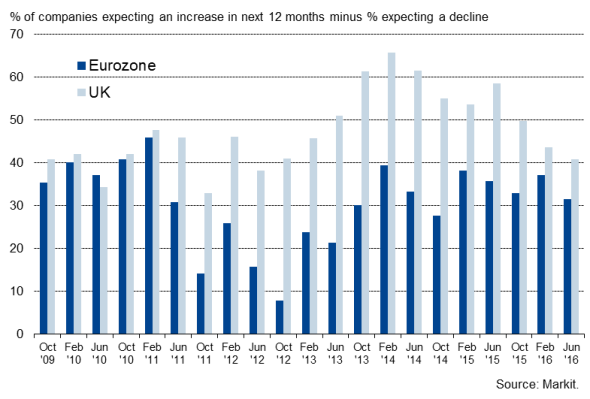

Eurozone business confidence has deteriorated to the lowest since late-2014, according to the latest Markit Business Outlook survey.

Conducted in June, with the majority of responses collected prior to the UK's referendum on EU membership, the survey showed the percentage of respondents expecting to see their business activity levels rise over the coming year outnumbered those expecting a decline by 31%, but that's down from a net balance of 37% earlier in the year and the lowest since October 2014.

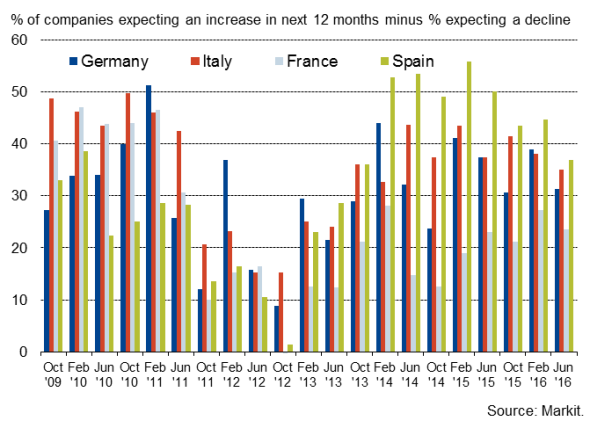

Optimism waned in all of the four largest euro member countries. France once again recording the lowest degree of confidence in the outlook while Spanish firms were the most upbeat.

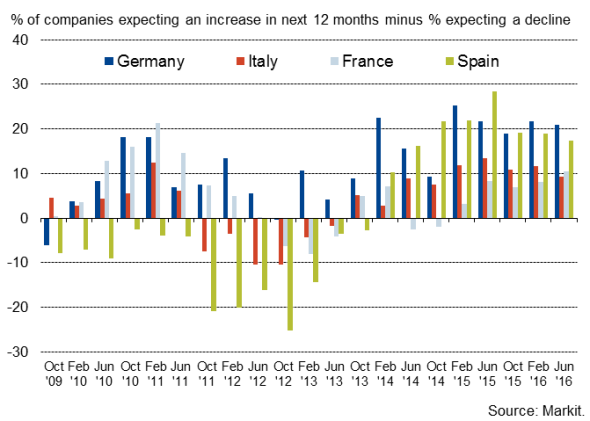

Encouragingly, expansion plans remained largely unchanged compared to earlier in the year. The number of companies expecting to raise their capital expenditures outnumbered those planning a decline by 11%, identical to the prior net balance seen in February. The percentage of companies planning to take on additional staff meanwhile outnumbered those projecting a decline by 16%, down only marginally from 18% in February.

With employment and capex intentions holding up while expectations of future activity fell, it was perhaps not surprising to see firms' optimism about future profits edge down to the lowest since October 2014.

Expectations of future business activity

Rising political risk

The expansion of capacity signalled by the resilient hiring and capex numbers augurs well for the sustainability of the eurozone's recovery. However, the surveys also highlighted widespread worries about rising political risks in the coming year, which pose a significant downside risk to the growth outlook.

By far the most widely cited threat to business growth in the coming year across all euro area countries surveyed was the departure of the UK from the European Union, a source of instability that also caused optimism to fall to a four-year low in the accompanying UK Business Outlook Survey. Outside of the UK, firms in Ireland were the most concerned, with some 45% of survey respondents citing 'Brexit' as a key threat to their future prospects.

However, political uncertainty extended beyond 'Brexit'. Widespread concerns about political stability in Italy, Germany, France and especially Spain were evident in the survey responses relating to key threats. Worries about the US presidential election outcome were also commonly recorded.

Big four Eurozone: business activity expectations

Big four Eurozone: employment intentions

Commenting on the survey, Chris Williamson, Markit Chief Economist, said:

"The promising brightening of the business mood seen earlier in the year has evaporated amid intensifying political uncertainty.

"The disruption of the UK's referendum on EU membership topped the list of corporate concerns across the euro area, but there's also widespread worry about political instability within the euro area itself.

"Companies are apprehensive about upcoming elections in France and Germany, as well as ongoing political stalemate in Spain and instability in Italy.

"There's clearly a strong risk that the UK's vote to leave the EU, and potential contagion, will fuel wider political uncertainty in coming months, and economic growth will inevitably suffer in consequence. Policymakers and governments will therefore have their work cut out to maintain business and consumer confidence in what could be a challenging year for Europe."

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Eurozone-business-optimism-at-lowest-ebb-since-2014-as-political-risks-intensify.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Eurozone-business-optimism-at-lowest-ebb-since-2014-as-political-risks-intensify.html&text=Eurozone+business+optimism+at+lowest+ebb+since+2014+as+political+risks+intensify","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Eurozone-business-optimism-at-lowest-ebb-since-2014-as-political-risks-intensify.html","enabled":true},{"name":"email","url":"?subject=Eurozone business optimism at lowest ebb since 2014 as political risks intensify&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Eurozone-business-optimism-at-lowest-ebb-since-2014-as-political-risks-intensify.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+business+optimism+at+lowest+ebb+since+2014+as+political+risks+intensify http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072016-Economics-Eurozone-business-optimism-at-lowest-ebb-since-2014-as-political-risks-intensify.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}