Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 13, 2015

Short sellers: half year review

Short sellers have profited handsomely in the first half the year in some names, however on average short sold firms have delivered mixed results, with energy stocks among the best performing shorts of 2015.

- Best performing stocks of year to date had negligible levels of short interest at start of 2015

- Energy sector has supplied the best performing short sales of the year so far

- Overall, the most shorted at the start of the year have underperformed those less short sold

Reviewing short sellers' bets

For US equities with a market cap of at least $250m and $500,000 in shares out on loan, the average returns for the 100 most shorted stocks have underperformed the least shorted by a spread of 2.2%. However on average, the absolute performance of the most shorted shares was positive at 1.7%, versus the least shorted average return of 3.9%.

Average short interest for the 100 most and least shorted stocks at the beginning of the year was 22% and 0.1% respectively. Short sellers have targeted smaller companies with the 100 most shorted averaging $1.9bn in market cap versus the 100 least shorted averaging $23.8bn.

Best performing short sales of the year

"Higher conviction" shorts at the start of the year, namely those with at least 10% of shares outstanding on loan, represent approximately 10% of the above universe. But these 300 high conviction names have in fact delivered mixed results with average total returns of 3.4%.

Short sellers targeting biotech and pharmaceuticals have arguably suffered the most, with these stocks making up the majority of the top 20 worst conviction shorts of year i.e. those delivering positive returns. This group has delivered returns of 99% on average over the past six months.

Conversely, the top 20 shorts averaged 42% in price declines for the first six months of 2015, with short sellers particularly rewarded for shorting energy firms.

The energy sector had the highest representation in the 100 most shorted stocks at the start of the year and retains this position as of the end of June 2015.

The best performing short so far this year, FXCM, actually suffered the bulk of its price decline in early January, declining over 80%.

Down 92% year to date the online retail forex broker FXCM and its clients were caught off guard by the Swiss National Bank removing the country's currency peg. This left leveraged clients and ultimately FXCM exposed to ultimately impossible to cover margin calls.

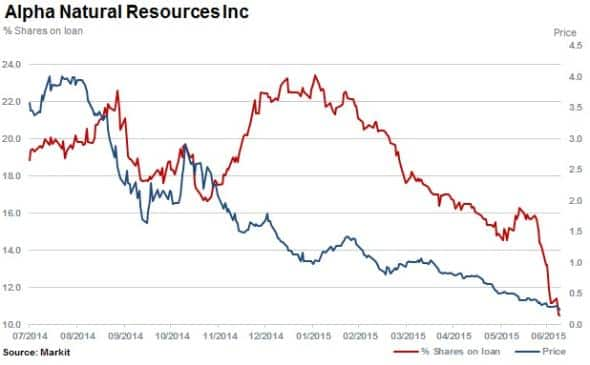

Alpha Natural Resources is down 86% year to date, from $1.7 to $0.2. The stock, which traded as high as $67.38 in 2011, has continued to fall as plummeting coal prices and a relatively high debt burden has seen the company post losses for the last three years.

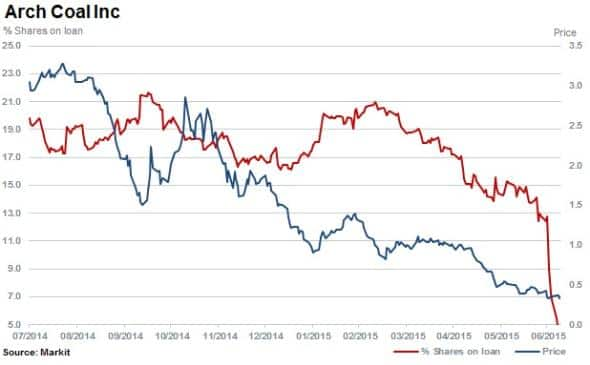

Another successful energy short of 2015 is Arch Coal, whose shares have fallen 82% year to date.

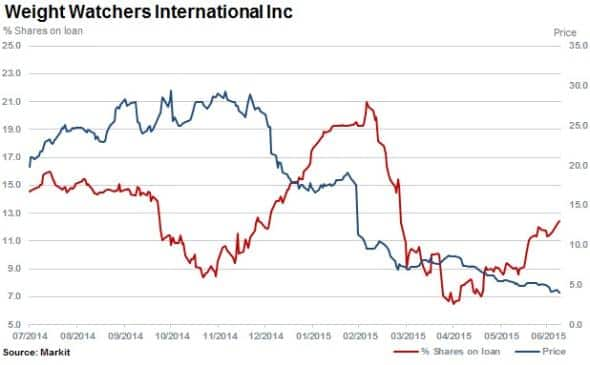

Other non-energy short performers include Weight Watchers and Lumber Liquidators, which have fallen 83% and 70% this year to date. Weight Watchers has seen earnings and its share price continue to fall as subscriptions decline and consumers migrate to digital calorie tracking devices.

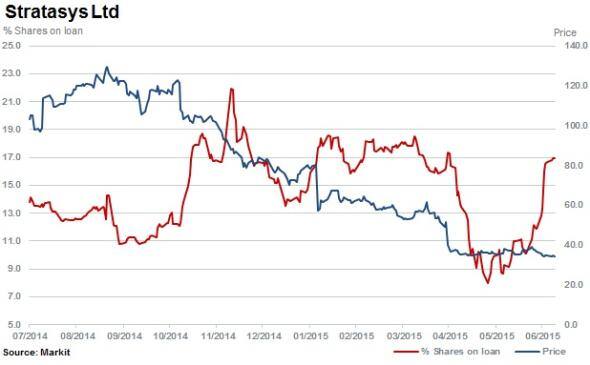

3D printer Stratasys has continued to come under pressure in 2015. While 3D printing may have begun to revolutionise manufacturing, it has yet to deliver investment returns with the stock down 60% year to date.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-equities-short-sellers-half-year-review.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-equities-short-sellers-half-year-review.html&text=Short+sellers%3a+half+year+review","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-equities-short-sellers-half-year-review.html","enabled":true},{"name":"email","url":"?subject=Short sellers: half year review&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-equities-short-sellers-half-year-review.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers%3a+half+year+review http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-equities-short-sellers-half-year-review.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}