Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 13, 2015

Irish firms most optimistic globally

According to Markit's latest Business Outlook survey, Irish companies remain strongly optimistic that growth of activity will be recorded over the coming year. Sentiment in the service sector is particularly buoyant, leading Irish firms to signal the strongest optimism of all the countries covered by the survey.

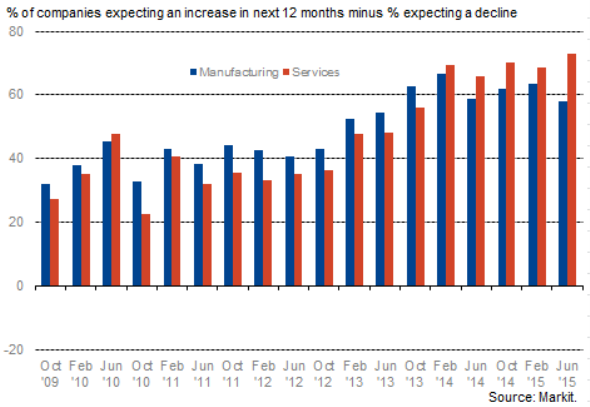

At +67 percent, the net balance of companies across the manufacturing and service sectors forecasting activity to increase is unchanged from the February survey. While strong optimism is recorded across both sectors, services is the standout performer with sentiment improving to its highest in the history of the survey which was first conducted in April 2006.

Business Activity outlook

The latest outlook data add to the upbeat messages from the sister PMI surveys for Ireland, which pointed to a substantial monthly increase in output during June. Moreover, the rate of expansion was the fastest in 2015 so far amid strong growth of new work.

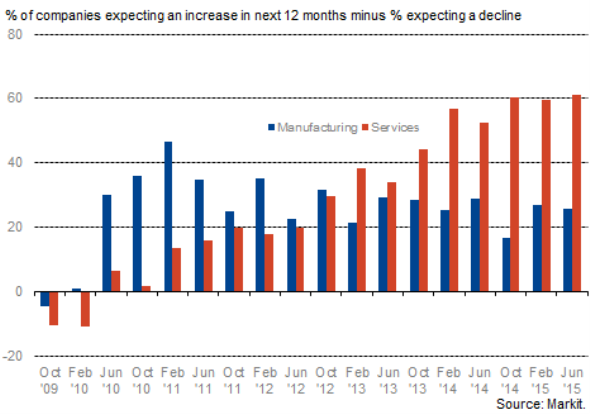

The outlook in June also saw companies expecting record growth of new business over the coming year, with the net balance posting a new survey high. Survey respondents highlight improving demand as the main opportunity for growth going forward, helped by improving economic conditions.

Opportunities over next 12 months

Positive expectations regarding activity led firms to predict further job creation over the coming year. The net balance is at +47 percent, again the highest of all the countries monitored, with the service sector seeing particular strength. That said, one of the potential threats to the outlook is seen as being the difficulty in sourcing suitable staff as companies look to expand operations. A number of firms also express concerns about potential wage cost increases over the coming year as the labour market looks set to tighten.

Threats to the outlook

Service providers are much more likely to experience higher input prices than their manufacturing counterparts over the coming year, with the net balance for staff costs far above that for non-staff costs. This is despite some manufacturing firms indicating that the weakness of the euro will likely result in higher costs for imported items.

Input Prices outlook

Improving demand is set to increase the pricing power of Irish companies over the next 12 months and the net balance for output prices has risen from the previous survey, suggesting that firms will up the rate at which they pass on higher cost burdens to their clients.

The latest outlook data therefore suggest that the impressive rate of recovery of the Irish economy will continue in the near-term at least, with the pace of growth undimmed from that seen in the first half of the year. Companies see little in the way of major headwinds to knock the recovery off course, although the recent escalation of the Greek crisis clearly has the potential to do this.

For more information on global business outlook data please contact economics@markit.com.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-Economics-Irish-firms-most-optimistic-globally.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-Economics-Irish-firms-most-optimistic-globally.html&text=Irish+firms+most+optimistic+globally","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-Economics-Irish-firms-most-optimistic-globally.html","enabled":true},{"name":"email","url":"?subject=Irish firms most optimistic globally&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-Economics-Irish-firms-most-optimistic-globally.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Irish+firms+most+optimistic+globally http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-Economics-Irish-firms-most-optimistic-globally.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}