Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 13, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to the companies due to announce earnings in the week to come.

- Restaurant firms Darden and Bob Evans see high short interest

- In Europe, airline SAS sees the highest short interest in the lead up to earnings

- Retailers Sa Sa and Asahi are the only two firms seeing any significant short interest in the run up to earnings

North American earnings

This week sees first quarter earnings announcements start to tail off with only 134 firms announcing results this week. On the short interest side, there are only 14 companies with 3% or more of their shares out on loan ahead of earnings.

Perennial short Itt Educational Services tops the list as the most shorted firm announcing results this week with more than a third of its shares out on loan. Note that the upcoming results are only the delayed first quarter results which were put on hold pending clarification with the SEC’s office of the chief accountant regarding its treatment of Itt’s student loans. Preliminary results announced at the end of May showed that the company has so far been unable to improve its falling enrolment which has resulted in a 10% dip in year on year revenue. Short sellers have taken some profits off the table after the company’s shares fell heavily on the announcement, but short interest is still 50% higher than at the start of the year.

Second most shorted on the list is gun maker Smith & Wesson with just over a quarter of shares out on loan. Short sellers, which had been betting on tighter regulation and falling sales following a bumper 2013 seem to have capitulated somewhat in that name as shot interest has trailed off from the recent highs seen in March. Despite the recent spate of high profile shootings, the US has so far been unable to gather the political capital needed to pass gun regulation which has seen SWHC shares edge to new recent highs.

On a sector basis, restaurants Darden and Bob Evans make the most shored list. Both firms have seen their earnings fall consistently over the last couple of years as Americans fall out of favour with full service chain dining. This has seen both firms come under increased scrutiny from short sellers.

Darden, which recently elected to sell its Red Lobster chain sees the highest short interest of the two firms with 7.7% of shares out on loan, a number that has climbed since the recent deal.

European earnings

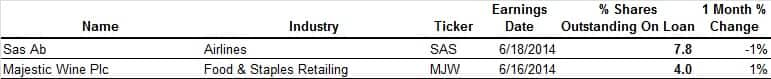

Europe also low earnings activity with just two firms seeing over 3% of shares out on loan ahead of imminent results.

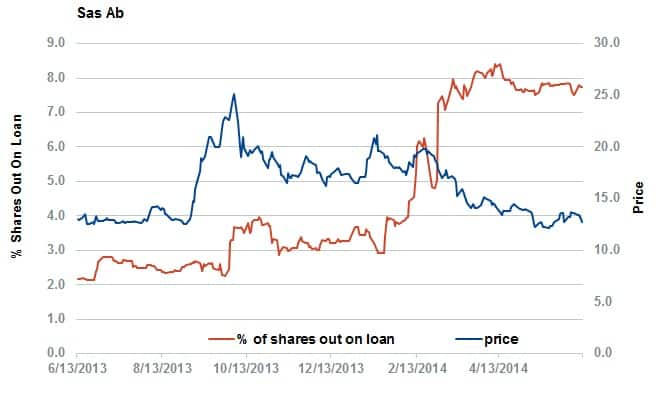

The only company to see any significant demand to borrow is Scandinavian airline SAS which has 7.8% of its shares out on loan. The Airline which is locked in a protracted struggle with recent upstart Norwegian Air Shuttle is expected to post a loss in the coming quarter after its competitor forced it to lower prices. Short seller have been drawn to the fight as the current demand to borrow SAS shares is three times higher than at the same point a year ago.

UK wine warehouse firm Majestic Wine rounds out the most shorted list with 4% of the company’s shares out on loan. Shorts flocked to this name in the wake of a March profits warning which the firm revised its growth expectations down after its post-Christmas business tailed off. Current demand to borrow stands at an all-time high.

Asian earnings

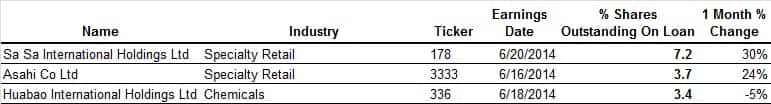

Asia also sees light reporting flow, with two firms with more than 3% of shares out on loan ahead of earnings.

Retailers make up two of the most shorted names as short sellers bet on lower customer spending growth in China and Japan. In China, cosmetics firm Sa Sa has seen demand to borrow jump by 30% to 7% of shares outstanding after analysts trimmed their growth forecasts.

Japanese firm Asahi is the other shorted retailer after the country’s customers reeled from the increased sales tax which took effect a couple of months ago. Demand to borrow Asahi shares is up by 24% in the last four weeks.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13062014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13062014120000most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13062014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13062014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13062014120000most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}