Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 13, 2015

Weak official UK construction data contrast with upbeat business surveys

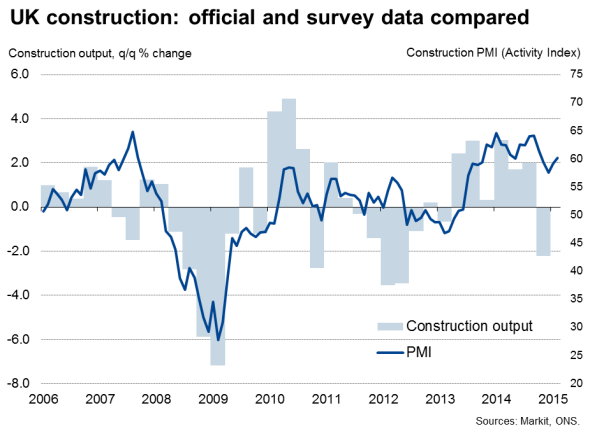

Official data indicated a steep downturn in UK construction activity at the start of the year, following a worryingly sharp decline in the fourth quarter of last year. However, while there are signs that the sector is set to see a tougher year in 2015 compared to 2014, survey data and corporate earnings suggest growth is merely slowing rather than collapsing.

How worried should we be?

Data from the Office for National Statistics showed the output of the construction industry slumping 2.6% in January. That took output 3.1% below the level of a year ago, which is the first time that a year-on-year decline has been registered since May 2013.

The data suggest the sector is undergoing a steep downturn, with the decline in January building on a 2.2% drop in output in the fourth quarter of last year. The decline included a 5.0% collapse in house building during the month.

However, the data need to be treated with caution as they have been downgraded to be no longer considered official national statistics due to concerns over data quality.

The weakness in the ONS data also contrast with Markit/CIPS PMI survey data, which have signalled an ongoing impressive recovery of the sector. The survey data showed activity in the sector picking up in February. While down on the peaks seen last year, the rate of growth remained elevated, suggesting the sector is helping drive yet another robust expansion of the economy in the first quarter.

Survey data on commercial property development also rose higher in February, though, like the signal from the PMI, the pace of expansion is notably weaker than last year.

The ongoing impressive upturn in the construction sector so far this year, alongside solid service sector growth and signs of a revival in manufacturing, puts the economy on course to grow by 0.6% in the first quarter.

Slowing not collapsing

It seems like activity in the sector is set to slow this year, led down by a cooling housing market. Companies also look to be reining in their investment spending, hitting growth of commercial construction. However, there are few signs that the sector is really facing another downturn, as these official statistics suggest. After all, dividend distributions to shareholders among homebuilders in the FTSE 350 are set to rise by around 50% this financial year, according to Markit's dividend analysis, reflecting strong corporate earnings. Alongside the buoyant PMI survey data, healthy dividend pay-outs indicate that the sector is still in rude health and faring really rather well.

Despite concerns over data quality, in the absence of alternatives the ONS construction data are still used in the calculation of GDP. The weakness of the data in January therefore suggest that the official first estimate of GDP could undershoot the signal of 0.6% growth from the PMI. The strength of the survey data therefore also raise the possibility that construction output could eventually be revised higher for the closing months of last year, eventually boosting GDP slightly compared to the current reading of 0.5% growth.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-Economics-Weak-official-UK-construction-data-contrast-with-upbeat-business-surveys.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-Economics-Weak-official-UK-construction-data-contrast-with-upbeat-business-surveys.html&text=Weak+official+UK+construction+data+contrast+with+upbeat+business+surveys","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-Economics-Weak-official-UK-construction-data-contrast-with-upbeat-business-surveys.html","enabled":true},{"name":"email","url":"?subject=Weak official UK construction data contrast with upbeat business surveys&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-Economics-Weak-official-UK-construction-data-contrast-with-upbeat-business-surveys.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weak+official+UK+construction+data+contrast+with+upbeat+business+surveys http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032015-Economics-Weak-official-UK-construction-data-contrast-with-upbeat-business-surveys.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}