Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 13, 2015

Faster than expected economic growth adds to improving eurozone outlook

The eurozone economy fared better than expected in the final quarter of last year, setting the scene for economic forecasts for 2015 to be ratcheted higher. Survey data are already signalling an upturn in growth in January, and investors are flooding into the region in response to the improved economic outlook and renewed stimulus from the European Central Bank - a torrent of investment flows which looks likely to continue in coming months barring any escalation of the Greek crisis.

Steady growth, led by Germany

According to Eurostat data, GDP rose 0.3% in the final three months of the year against expectations of a 0.2% rise. The rise pushed GDP 0.9% higher than a year ago.

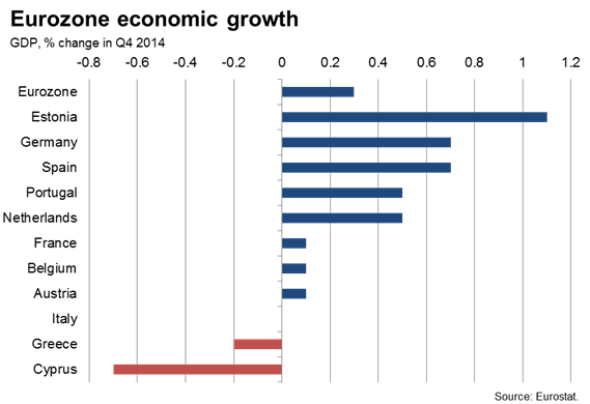

The region's expansion was led by a 0.7% rise in German GDP, alongside welcome signs of stronger growth in several so called 'periphery' countries. Spain and Portugal saw their economies grow by 0.7% and 0.5% respectively, and Ireland also looks to have notched-up a strong performance. The biggest disappointments were France and Italy. France mustered a meagre 0.1% expansion (and stagnated after rising government spend is excluded) while Italy stagnated. The dismal performances will put further pressure on the French and Italian governments to step up economic reform programmes. The worst performer was Cyprus, followed by Greece where the economy contracted 0.2% in the fourth quarter.

Some caution is warranted as the better than expected data most likely in part reflect a catch-up after technical factors had depressed the official numbers in the summer, especially in Germany, where the biggest GDP surprise was seen in the fourth quarter. Survey data had always indicated that the region did not stall over the summer months.

It's also encouraging that the surveys point to growth picking up again in January. The survey data furthermore indicate that, rather than falling into a deflationary slump, low prices are spurring economic growth. Detailed sector PMI data show consumer-focused industries have been driving economic growth in recent months.

Flash PMI data for February are published next Friday, which will give a better idea of how the region performed in the first quarter. It's possible that the announcement of quantitative easing by the ECB will have boosted the economy by lifting business and household confidence, but it's unclear how much any beneficial impact might be offset by risk aversion arising from uncertainty over Greece and Russia.

As far as Greece goes, at the moment worries about the debt crisis appear to be contained in that there is little sign of contagion to other countries. While the cost of insuring against Greek default has spiked higher, with a near-70% likelihood of default being implied by Markit's credit default swap data in recent sessions, credit markets in Spain, Italy, Portugal and Ireland have been largely unaffected by the escalating Greek crisis.

Bonds and equities lifted by improved investor sentiment

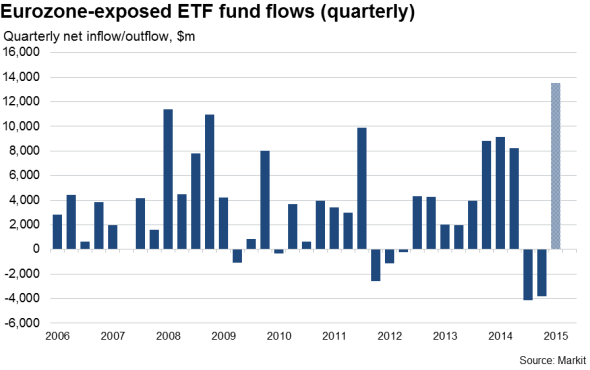

Investors have already latched on to the region's improving outlook. Markit's exchange traded fund data reveal that this year has so far seen investors move money out of US-exposed funds towards eurozone-focused investments, including both equity and fixed income ETFs. The region is set to see record inflows into ETFs exposed to the region in the first quarter.

The ECB's quantitative easing in particular has helped boost sentiment towards both bonds and equities exposed to the region. Share prices have risen almost 12% since the lows seen in early January and Markit's iBoxx data show a 1.7% uplift to euro area bonds in January, with improved returns seen across all major euro member states sovereign debt as well as investment grade corporates.

German economy enjoys reasonable year

The Eurozone was lifted in particular by the German economy expanding 0.7% in the fourth quarter, far exceeding expectations. The strong reading dispels worries, fuelled by weak GDP data over the summer months, that the eurozone's main engine was stalling.

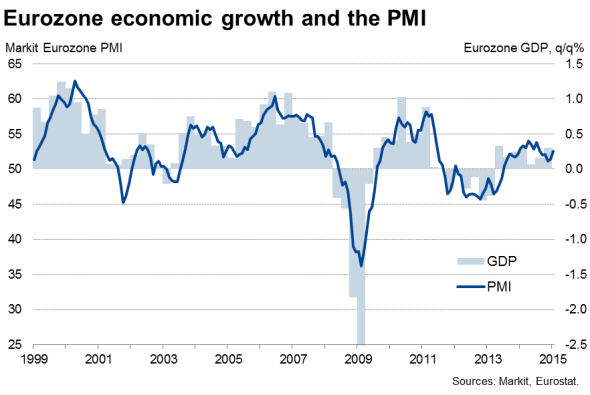

The weak German GDP numbers in the second and third quarters (-0.1% in the second quarter and 0.1% in the third quarter) always sat uncomfortably with stronger signals from the PMI surveys (see our note from the summer here). Like the surveys, the GDP data now indicate that Germany in fact had a reasonably good year over 2014 as a whole, growing 1.6% (note that the composite PMI averaged 54.4 in 2014, consistent with quarterly GDP growth of 0.4%, 1.6% annualised - see chart). The GDP data for Germany have simply been more volatile than the PMI, most likely reflecting special factors such as bridging holidays in the summer and unusual weather affecting construction).

On the basis that the strong fourth quarter GDP data probably represent some payback after the weak German data over the summer, it's likely that the 0.7% expansion overstates growth, the underlying pace being closer to 0.3%, according to the surveys. However, it's encouraging to also see the survey data signalling an upturn in growth in January.

French economy close to stagnation

The French economy meanwhile eked out a mere 0.1% expansion in the fourth quarter. Once government spending is stripped out, the economy in fact stagnated, which is very much in line with the signal from the PMI business surveys. The surveys suggest this trend of stagnation persisted into January.

Italian stagnation contrasts with Spanish revival

Italy stagnated in the fourth quarter, as its GDP was unchanged after falling 0.1% in the third quarter, contrasting markedly with Spain, which enjoyed a 0.7% growth revival, and Portugal, where GDP rose 0.5%. No details were given of the Italian GDP release, but we suspect that, like France, the situation is worse if rising government spend is excluded. PMI data pointed to a mild contraction of the private sector (and therefore tax generating) economy late last year, a downturn which continued into January. Spain, on the other hand, continued to grow at a robust pace at the start of the year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-Economics-Faster-than-expected-economic-growth-adds-to-improving-eurozone-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-Economics-Faster-than-expected-economic-growth-adds-to-improving-eurozone-outlook.html&text=Faster+than+expected+economic+growth+adds+to+improving+eurozone+outlook","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-Economics-Faster-than-expected-economic-growth-adds-to-improving-eurozone-outlook.html","enabled":true},{"name":"email","url":"?subject=Faster than expected economic growth adds to improving eurozone outlook&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-Economics-Faster-than-expected-economic-growth-adds-to-improving-eurozone-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Faster+than+expected+economic+growth+adds+to+improving+eurozone+outlook http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-Economics-Faster-than-expected-economic-growth-adds-to-improving-eurozone-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}