Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 12, 2015

Eurozone industrial output up 1.7% on a year ago despite September drop

Industrial production in the euro area fell 0.3% in September, according to official data, piling additional pressure on policymakers to inject more stimulus to tackle the region's economic malaise.

The weakness was greater than economists had been expecting, and contrasted with a more positive picture painted by recent survey data. The weakness was also something of a surprise given that it was led by a sharp drop in production of consumer goods, a sector which has, in theory at least, been buoyed this year by slumping oil prices and low inflation boosting consumers' spending power.

However, the data are volatile on a monthly basis, and production over the third quarter as a whole was 0.1% higher than the second quarter. Further consolation can be gleaned from the fact that production remains 1.7% higher than a year ago, with 2.6% and 2.1% growth seen for consumer durable and non-durable goods respectively, reflecting the improvement in spending power from low prices. Production of capital goods, such as plant and machinery, is also running 2.2% higher than a year ago, suggesting business investment is slowly recovering.

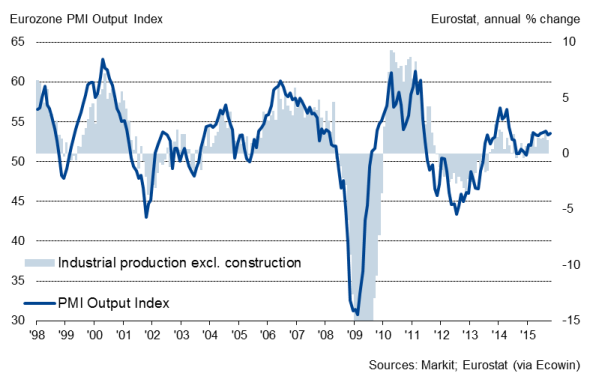

September's weakness also looks likely to be short-lived. The eurozone PMI suggests that factory output rose at an increased rate at the start of the fourth quarter on the back of improved order books. Inflows of new orders rose at the quickest rate for a year-and-a-half in October, helped in turn by faster growth of export sales. The survey data are indicating annual production growth of approximately 2%, painting a slightly brighter picture than the official data.

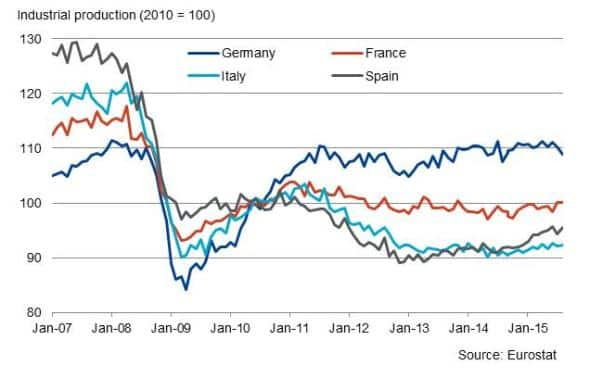

However, even the rate of increase signalled by the brighter survey data remains only modest, and the task faced by policymakers is further highlighted by the extent to which the eurozone's industrial sector remains decimated by the global financial crisis and the region's debt crisis. Production across the euro area is still more than 10% smaller than its pre-crisis peak, with only Germany having shown good progress in closing the gap, though even here output remains 2% below its prior peak. Factory output in both Spain and Italy remains around 25% below pre-recession highs, while a 15% deficit persists in France.

Eurozone industrial production

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112015-Economics-Eurozone-industrial-output-up-1-7-on-a-year-ago-despite-September-drop.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112015-Economics-Eurozone-industrial-output-up-1-7-on-a-year-ago-despite-September-drop.html&text=Eurozone+industrial+output+up+1.7%25+on+a+year+ago+despite+September+drop","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112015-Economics-Eurozone-industrial-output-up-1-7-on-a-year-ago-despite-September-drop.html","enabled":true},{"name":"email","url":"?subject=Eurozone industrial output up 1.7% on a year ago despite September drop&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112015-Economics-Eurozone-industrial-output-up-1-7-on-a-year-ago-despite-September-drop.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+industrial+output+up+1.7%25+on+a+year+ago+despite+September+drop http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12112015-Economics-Eurozone-industrial-output-up-1-7-on-a-year-ago-despite-September-drop.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}