Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 12, 2014

Most Expensive US Corporate Bonds

- Bonds of troubled companies with liquidity and solvency problems are the most expensive to borrow in the US corporate bond universe

- Bonds issued by Cliff’s Natural Resources, Nii Holdings, and Walter Energy top the list of the most expensive US corporate bonds to borrow.

- There is significant demand to borrow the equity shares of the listed companies of the top 20 most expensive bonds.

When investors want to hedge a position or speculate that the price of a security will decline they use a short position. While equity shorts sales are well known, they can also occur in a company’s corporate debt.

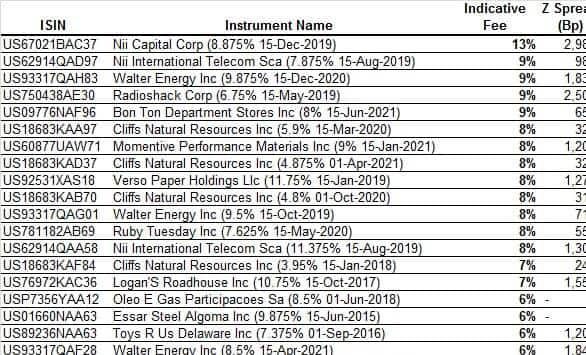

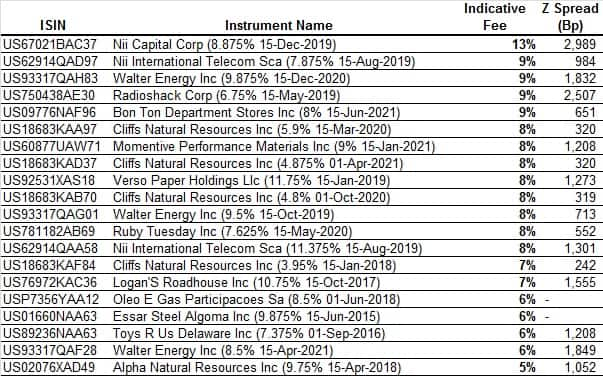

Much like in the equities world, the list of most expensive bonds in the securities lending world is replete with natural resource companies, distressed tech firms, and companies with insolvency concerns. The table below details the 20 most expensive US corporate bonds by indicative fee. A high sec lending fee also goes hand in hand with high yield, as the most expensive list has an average assets swap spread of over 700bps.

On the equities leg of these trades, we found that there was significant demand to borrow and negative sentiment surrounding the equity shares of these companies as well.

Top of the Cliff

Four of the top twenty most expensive US corporate bonds to borrow were issued by the international mining and natural resource company, Cliffs Natural Resources. The four listings have an average indicative fee of 7.75%, indicating investors are willing to pay generously in order to borrow these listings. The indicative fee does not include coupon payments which the borrower would also be responsible for paying upon selling the bond short.

CLF stock is down over 44% year to date and has been struggling since 2011. They recently announced cuts to capital expenditures of $100m in 2014 after failing to meet already depressed Q1 expected revenues due to an unrelenting fall in iron ore prices.

According to RBC, Cliffs is also at risk of breaching its debt covenants. They must maintain a total funded debt/EBITDA ratio of less than 3.5 and an EBITDA to interest expense ratio for the trailing four quarters of at least 2.5. RBC estimates that if the average spot price for 2014 falls below 114.3/tonne CFR China, it will likely trigger the funded debt/EBITDA covenant.

CLF was delisted from the S&P 500 index effective April 1st and has since fallen 28%. Short interest as a % of shares outstanding has decreased from the February high but is still above 25%, compared to the average S&P 500 short interest of 2.2%.

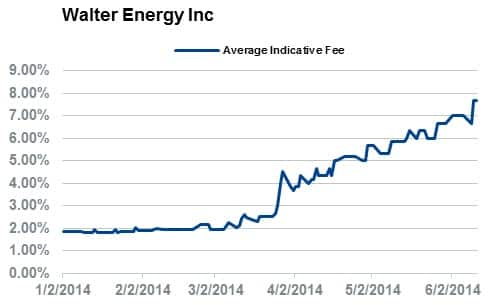

Also feeling the same pressure as Cliffs is Walter Energy which produces and exports met coal used by the global steel industry. The firm holds three spots on the list of top 20 most expensive US bonds to borrow. The chart below displays the average indicative fee for these three listings, which has roughly quadrupled since the beginning of January.

Walter Energy also struggles with a debt to equity ratio of 438% as of March 31st. This leverage will make it difficult to become profitable especially if met coal prices do not stabilize. WLT is down over 70% year to date and equity short interest has surged to over 37% of shares outstanding.

While these firms have prominent negative sentiment in their bonds, top honours go to Nii holdings whose bonds make up the two most expensive to borrow bonds currently. Nii is a holding company of Nextel that provides service to Latin American countries and recently has been struggling to stay solvent. The nominal value on loan spiked in February and March but has since decreased as investors likely took profits after large declines in the price of these bonds. Nominal lendable value steadily fell throughout 2014 indicating institutions have been selling their positions.

On the equities side, NIHD is down over 72% year to date with first quarter loss of $2.19 per share. Revenue decreased 37% from a year earlier to $970m and subscribers fell by 4%. Similar to CLF, Nii Holdings has seen a decrease in the % of shares outstanding on loan from earlier this year however at 25% it is still remains comparatively high.

Andrew Laird, Analyst, IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062014120000Most-Expensive-US-Corporate-Bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062014120000Most-Expensive-US-Corporate-Bonds.html&text=Most+Expensive+US+Corporate+Bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062014120000Most-Expensive-US-Corporate-Bonds.html","enabled":true},{"name":"email","url":"?subject=Most Expensive US Corporate Bonds&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062014120000Most-Expensive-US-Corporate-Bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+Expensive+US+Corporate+Bonds http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062014120000Most-Expensive-US-Corporate-Bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}