Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 12, 2016

Global manufacturing output growth slows, underpinned by weak consumer demand

Global economic growth picked up slightly at the start of the second quarter of 2016, but was still one of the weakest seen over the past three years. The JPMorgan Global PMITM sector data indicate that services firms were the main drivers of higher global output, as manufacturers reported the second-slowest expansion seen in nearly three-and-a-half years.

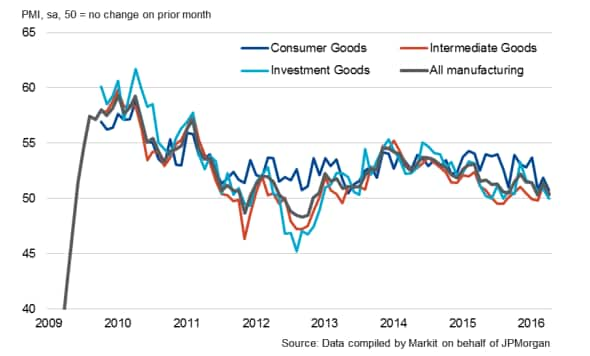

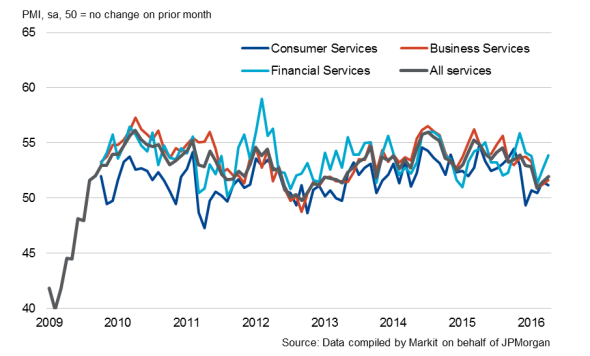

The launch of new economic indices allows deeper macro insights, with the creation of three sub-sectors for both the manufacturing and service sectors. The three new manufacturing indices include consumer goods, investment goods and intermediate goods. Business services, consumer services and financial services make up the overall services economy.

Five of the six monitored sub-sectors indicated output growth in April, with the exception being a stagnation at investment goods producers.

Also contributing to the weakness in the manufacturing sector was consumer goods, which saw the joint slowest expansion in nearly three years. In contrast, global services activity increased at a quicker pace, with growth in the financial services sub-sector boosting overall activity. Despite this, the services expansion was softer than those seen over 2015.

Global manufacturing: output

Global services: output

Consumer goods output growth slows

After having signalled a slight upturn at the end of the first quarter, PMI data showed that manufacturing production had eased in April to the second-weakest since November 2012.

This reflected growth easing at both consumer and intermediate goods, with the former sub-sector in particular indicating the joint-slowest expansion in 35 months. This suggests weak customer demand and subdued confidence in the sub-sector, as new orders rose at the softest rate since October 2013 and employment levels dropped.

Moreover, a stagnation in output at capital goods producers raised further doubts about confidence at global manufacturers. With new orders for investment goods falling for the second time in three months, companies appear uncertain about the long-term outlook.

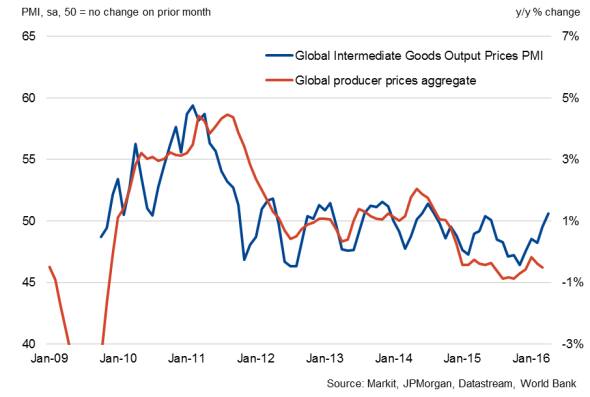

Manufacturing costs pressures re-emerge

Cost inflationary pressures re-emerged at global manufacturers for the first time in eight months during April. All three sub-sectors signalled higher input prices, with intermediate goods producers indicating the first increase since July last year. Greater cost burdens at intermediate goods can be linked to the recent improvement in oil prices.

As a result of higher cost burdens, global manufacturing charges rose for the first time since June last year, with both the consumer and intermediate sub-sectors signalling increases. In fact, intermediate goods producers noted greater selling prices for the first time in ten months, suggesting that the trend towards higher producer prices may pick up in coming months.

Intermediate goods: input prices

Intermediate goods: output charges

Financial services activity growth accelerates

Output at financial services (one of the three sub-sectors of services) increased at the sharpest rate in 2016 so far, outstripping growth in the other two sub-sectors. Consequently, overall global services activity rose at a slightly quicker rate, although remained below the long-run series average. Financial services firms, however, hired workers at the slowest rate since July 2014, suggesting confidence within the sector remains relatively subdued.

Amy Brownbill | Economist, Markit

Tel: +44 149 146 1063

amy.brownbill@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-Economics-Global-manufacturing-output-growth-slows-underpinned-by-weak-consumer-demand.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-Economics-Global-manufacturing-output-growth-slows-underpinned-by-weak-consumer-demand.html&text=Global+manufacturing+output+growth+slows%2c+underpinned+by+weak+consumer+demand","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-Economics-Global-manufacturing-output-growth-slows-underpinned-by-weak-consumer-demand.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing output growth slows, underpinned by weak consumer demand&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-Economics-Global-manufacturing-output-growth-slows-underpinned-by-weak-consumer-demand.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+output+growth+slows%2c+underpinned+by+weak+consumer+demand http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-Economics-Global-manufacturing-output-growth-slows-underpinned-by-weak-consumer-demand.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}