Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 12, 2016

US bank CDS spreads can't shake off Q1 woes

The credit risk divergence between tier one US banks and the rest of the investment grade bond universe has surged to new recent highs ahead of Q1 earnings season.

- Basis between the tier one US bank CDS spreads and CDX NA IG index hits yearly high

- Goldman Sachs has the widest CDS spreads among its peers

- Most recent divergence comes as treasury yields reach within 40bps off their all-time lows

The market is bracing for a tough earnings season for US banks, commencing on Wednesday when Wells Fargo announces its results for the opening three months of the year. Operational headwinds faced by the sector include exposure to loans made to oil firms, a downturn in trading and investment banking revenues and ever falling bond yields. With little relief to any of these struggles in sight, the investors have been actively reassessing the sector's credit risk and demanding more to insure its debts against default.

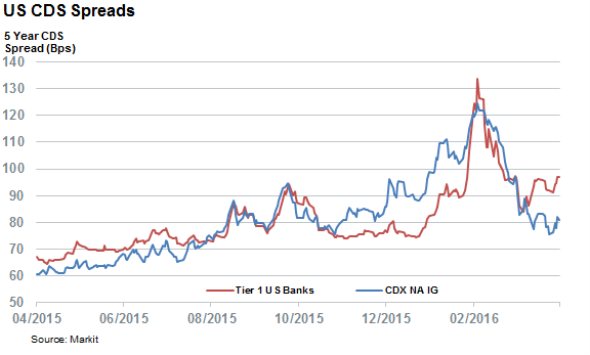

The average five year CDS spread for the six tier 1 global US banks (Bank of America, Citigroup, Goldman Sachs, J.P. Morgan, Morgan Stanley and Wells Fargo) now stands at stands 97bps; 22bps wider than at the start of the year.

While the current level of credit risk still far off the highs seen during the worst of February's volatility, the year to date rise in banks' CDS spreads has outpaced that seen in the rest of the market. The Markit CDX NA IG index, which tracks the latter, is now trading at five month lows. In fact the difference between the average CDS spread among tier one US banks and the Markit CDX NA IG index in now 16 bps, a 12 month high.

This marks a noteworthy reversal for the CDS market, given that banks' CDS spreads were tighter than the rest of the market for much of last year as traders were looking forward to a normalisation of US monetary policy, which would have lifted banks' profitability.

GS leads the way

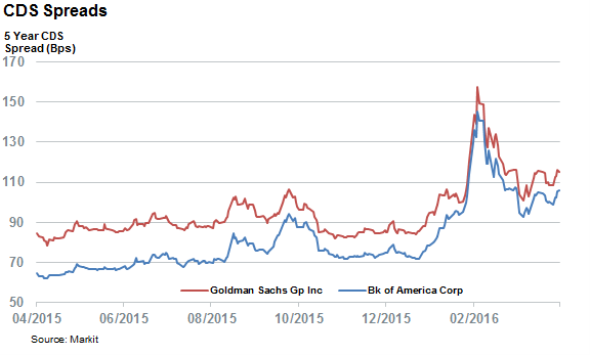

Goldman Sachs currently stands at the vanguard of the sector's credit risk with a five year CDS spread of 115bps, a third higher than the level seen at the start of the year. Goldman has led the sector's credit risk for much of the last 12 months, but it was briefly overtaken by Moran Stanley and Citigroup during the worst of the volatility.

Bank of America's CDS spread has been the most affected by the trend however as its CDS spread is up by nearly 50% since the start of the year to reach 106bps, the highest of its peer group.

Yields keep falling

The yield portion of the sector's headwind also shows no signs of slowing down, given that the Markit iBoxx $ Treasuries index has seen its yield fall to 1.8% in recent weeks - the lowest level in over a year. The index's yield is now over 50bps tighter on the year and within 40bps of the all-time lows registered in 2012. This will no doubt be a factor in the upcoming earnings season and beyond.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12042016-credit-us-bank-cds-spreads-can-t-shake-off-q1-woes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12042016-credit-us-bank-cds-spreads-can-t-shake-off-q1-woes.html&text=US+bank+CDS+spreads+can%27t+shake+off+Q1+woes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12042016-credit-us-bank-cds-spreads-can-t-shake-off-q1-woes.html","enabled":true},{"name":"email","url":"?subject=US bank CDS spreads can't shake off Q1 woes&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12042016-credit-us-bank-cds-spreads-can-t-shake-off-q1-woes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+bank+CDS+spreads+can%27t+shake+off+Q1+woes http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12042016-credit-us-bank-cds-spreads-can-t-shake-off-q1-woes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}