Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 12, 2016

Noble downgrade turns spotlight onto who may be next

After Noble's credit rating was pushed to junk status last week, Markit reveals the names which may be next in line for a potential downgrade to junk.

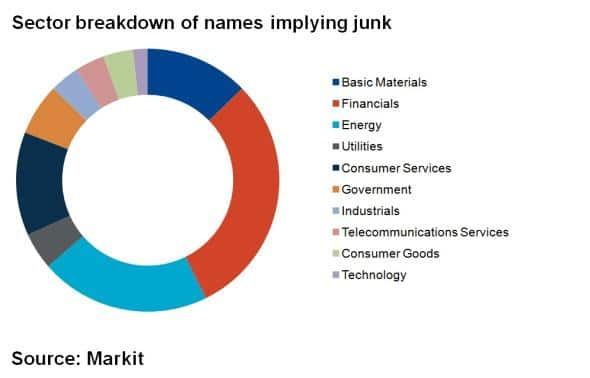

- 110 investment grade names credit spreads imply junk status; up from 21 last November

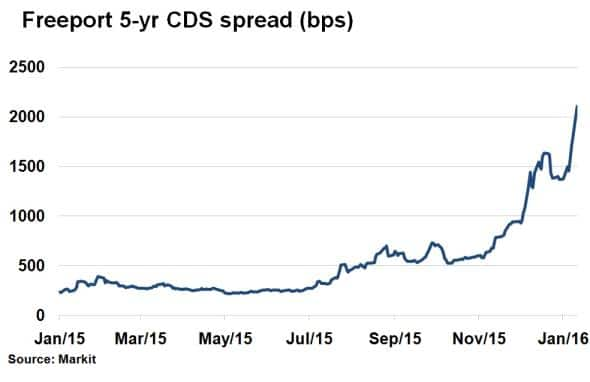

- Investment grade Freeport's 5-yr CDS is currently at distressed levels

- There are 18 US energy names whose current CDS spread implies junk status

Credit markets had long been pricing in Hong Kong based commodity trader Noble Group's recent demise to the depths of junk grade status. Its 5-yr credit default swap (CDS) spread, a measure of perceived credit risk, had been floating above 1,000bps for months before S&P decided to downgrade the name to junk last week.

Back in November, 21 investment grade credits were trading at 5-yr CDS levels that implied junk status, which included Noble Group. As of January 11th, that number has risen to 110, highlighting a significant shift in risk perception over this short space of time.

With global markets fretting about the potential impact of a weaker Chinese economy and commodity prices continuously hitting fresh multi-year lows, the next downgrade appears something of inevitability.

Using Markit's CDS pricing service, implied ratings can be derived based on single name 5-yr CDS spreads and associated CDS sector curve spreads.

Freeport-McMoRan Inc

(1739bps; Av BBB; Imp CCC)

The US copper and gold producer has seen its 5-yr CDS spread trading at implied junk levels for the last six months. Troubles have intensified over the past month and credit spreads now imply a 79% chance of default within the next five years. Moody's placed the $6bn company on review for a possible downgrade just last week.

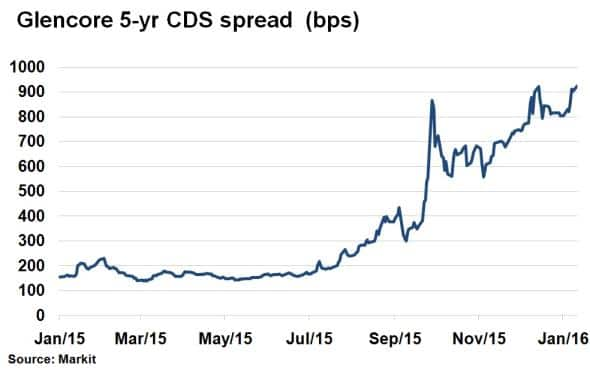

Glencore Intl AG

(915bps; Av BBB; Imp CCC)

The beleaguered European commodities trader continues to see its 5-yr CDS spread widen to new highs, surpassing the levels seen during last September's risk escalation. Restructuring and asset sales have done little to cancel out the effects of tumbling commodity prices.

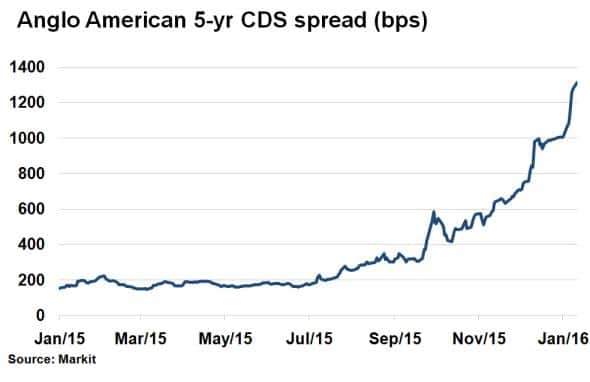

Anglo American Cap PLC

(1283bps; Av BBB; Imp CCC)

Just like Glencore, the international mining giant is frantically trying to rebuild its balance sheet through strategic portfolio restructuring. Shares have plummeted 80% over the past year and 5-yr CDS spreads have surpassed 1,000bps.

Vale SA

(890bps; Av BBB; Imp CCC)

The Brazilian miner known for its iron ore production has seen its 5-yr CDS spread widen to 890bps as of January 11th, implying a CCC rating. As well as dealing with iron ore prices which have fallen from $190 in 2011 to $45 today, the company also faces liabilities arising from the environmental damage done by subsidiary Samarco last November.

Noble Corp

(745bps; Av BBB; Imp CCC)

Not to be confused with Noble Group, Noble Corp, the US offshore driller has continued to see its credit deteriorate over the past year. While it remains on the cusp of investment grade for now, CDS spreads are currently at all-time highs as the price of WTI oil approaches a $20 handle.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-credit-noble-downgrade-turns-spotlight-onto-who-may-be-next.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-credit-noble-downgrade-turns-spotlight-onto-who-may-be-next.html&text=Noble+downgrade+turns+spotlight+onto+who+may+be+next","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-credit-noble-downgrade-turns-spotlight-onto-who-may-be-next.html","enabled":true},{"name":"email","url":"?subject=Noble downgrade turns spotlight onto who may be next&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-credit-noble-downgrade-turns-spotlight-onto-who-may-be-next.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Noble+downgrade+turns+spotlight+onto+who+may+be+next http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-credit-noble-downgrade-turns-spotlight-onto-who-may-be-next.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}