Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 11, 2014

Cooling of Chinese inflation provides leeway for further stimulus

A cooling of inflation provides further leeway for policymakers to add more stimulus to the Chinese economy if growth continues to disappoint in coming months. However, the authorities are likely to hold off until the impact of past measures can be better assessed.

Consumer prices rose at an annual rate of 2.0% in August, according to the National Bureau of Statistics, down from 2.3% in July. The rate has fallen from just above 3% late last year.

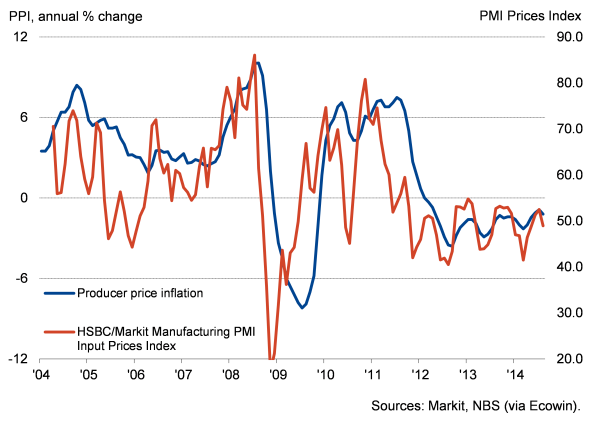

Factory input prices meanwhile continued to fall compared to a year ago in August, dropping 1.2% compared to a drop of 0.9% in July.

The weaker inflationary pressures in part reflect a softening of demand as economic growth waned from a 7.8% annual pace in the middle of last year. The opening quarter of the year saw China's growth rate slow to the weakest since 2009. Data subsequently available so far this year add to worries that the government may struggle to meet its 7.5% growth target for this year. HSBC PMI survey data compiled by Markit, which had forewarned of the slowdown earlier this year, have picked up in recent months but remain subdued, suggesting economic growth will remain disappointingly weak in the third quarter.

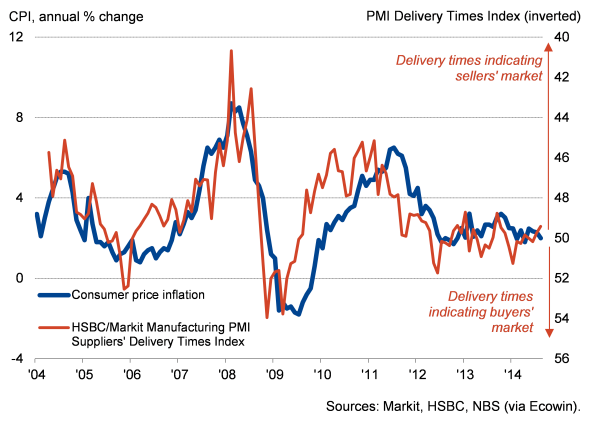

The impact of the pace of economic growth on prices is clearly illustrated by the PMI measure of suppliers' delivery times (see chart). When the economy is growing strongly, suppliers often struggle to provide enough raw materials to factories as demand exceeds supply, meaning suppliers are often able to raise their prices. Inflation therefore eventually picks up as factories pass these higher costs onto consumers. The reverse occurs when economic growth is weak, meaning quicker deliveries provide an advance indication that inflationary pressures will fall.

Inflation and capacity constraints

Factory prices

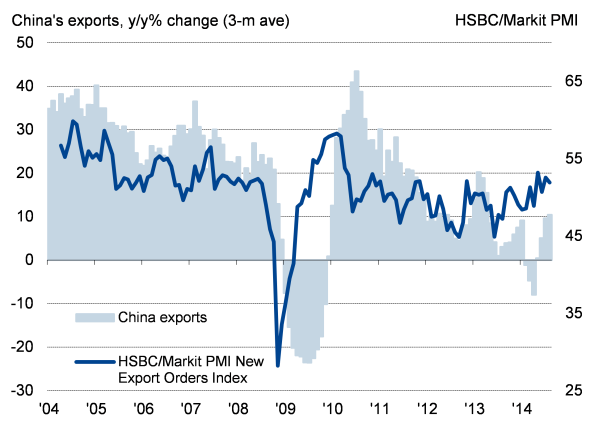

Chinese exports

In recent months, the PMI Suppliers' Delivery Times Index has signalled broadly stable lead-times for raw materials, pointing to weak price pressures. A slight lengthening of lead-times in August (note that the delivery times index is inverted in the chart) points to a mild upturn in inflationary pressures, but suggests consumer price inflation will remain subdued, and of little concern to policymakers.

The lack of inflationary pressures in the supply chain and current low level of consumer price inflation provide policymakers with scope to undertake more stimulus measures if needed, to help meet the 2014 7.5% growth target. The central bank seeks to keep inflation below 3.5%.

Mini stimulus impact to be assessed

A mini stimulus earlier this year included actions to boost bank lending, prop up the housing market and bring forward planned infrastructure spending. However, with some of these measures yet to impact on the economy, especially the infrastructure projects, the authorities may well choose to hold off with additional measures until the effectiveness of these past policy actions can be better gauged.

There are already some tentative signs of the economy picking up. PMI data on exports, for example, have signalled a relatively robust pace of increase so far this year, an upturn that is now being confirmed by official data which fell to a worrying extent earlier in the year but have since rebounded, confirming the upward trend in the PMI. Official exports rose 10.4% on a year ago in August, the largest rise since April of last year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092014-Cooling-of-Chinese-inflation-provides-leeway-for-further-stimulus.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092014-Cooling-of-Chinese-inflation-provides-leeway-for-further-stimulus.html&text=Cooling+of+Chinese+inflation+provides+leeway+for+further+stimulus","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092014-Cooling-of-Chinese-inflation-provides-leeway-for-further-stimulus.html","enabled":true},{"name":"email","url":"?subject=Cooling of Chinese inflation provides leeway for further stimulus&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092014-Cooling-of-Chinese-inflation-provides-leeway-for-further-stimulus.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Cooling+of+Chinese+inflation+provides+leeway+for+further+stimulus http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092014-Cooling-of-Chinese-inflation-provides-leeway-for-further-stimulus.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}